Enlarge image

Form ID-VP — Instructions

Income Tax Voucher Payment 2024

Only use this voucher when sending a payment without a return.

Choose one of the following:

• Pay securely online through our Taxpayer Access Point (TAP) at tax.idaho.gov/quickpay.

Visit tax.idaho.gov/epay for more information about other electronic payment options.

• Pay by mail

Complete the voucher below by entering:

Your name, address, and Social Security number (SSN) or EIN

Spouse’s name and SSN, if joint individual return

The tax type of your return

The filing period of your return

o Individuals: Enter 1224

o Businesses: Enter your fiscal year ending date using the two-digit

abbreviations for month and year

Example: September 2024 is entered as 0924

The amount you’re paying by check or money order

Make your check or money order payable to the Idaho State Tax Commission. Don’t staple

your check to your voucher or send a check stub.

Mail your voucher and payment to the address on the voucher.

If the full amount of your tax due isn’t received or postmarked on or before the due date of your

return, we’ll charge you penalty and interest on the balance of the tax due.

Contact us:

In the Boise area: (208) 334-7660 |Toll free: (800) 972-7660

Hearing impaired (TDD) (800) 377-3529

tax.idaho.gov/contact

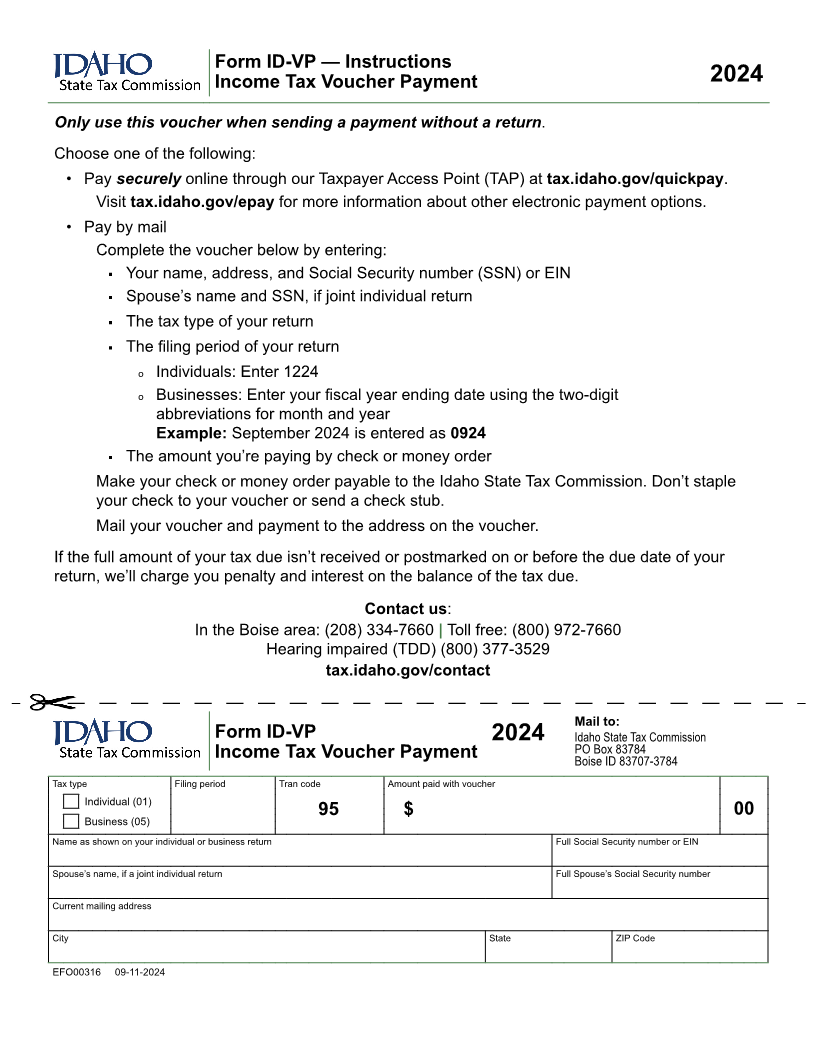

Mail to:

Form ID-VP 2024 Idaho State Tax Commission

PO Box 83784

Income Tax Voucher Payment Boise ID 83707-3784

Tax type Filing period Tran code Amount paid with voucher

Individual (01)

95 $ 00

Business (05)

Name as shown on your individual or business return Full Social Security number or EIN

Spouse’s name, if a joint individual return Full Spouse’s Social Security number

Current mailing address

City State ZIP Code

EFO00316 09-11-2024