Enlarge image

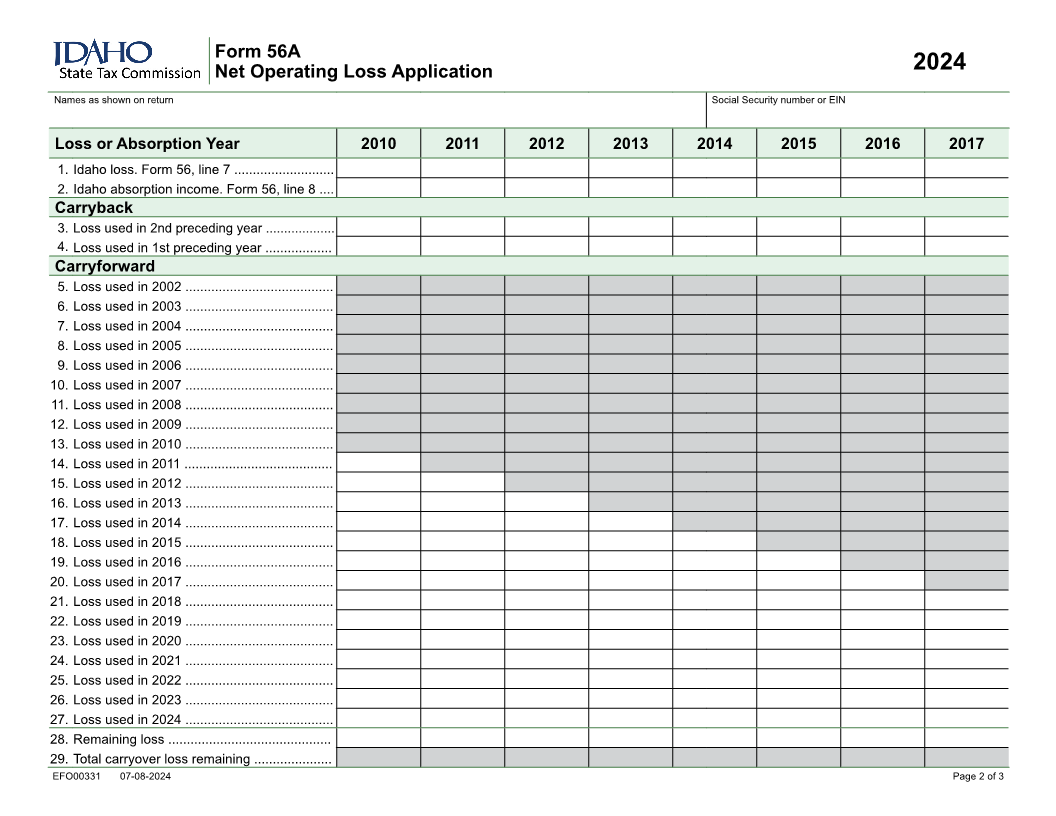

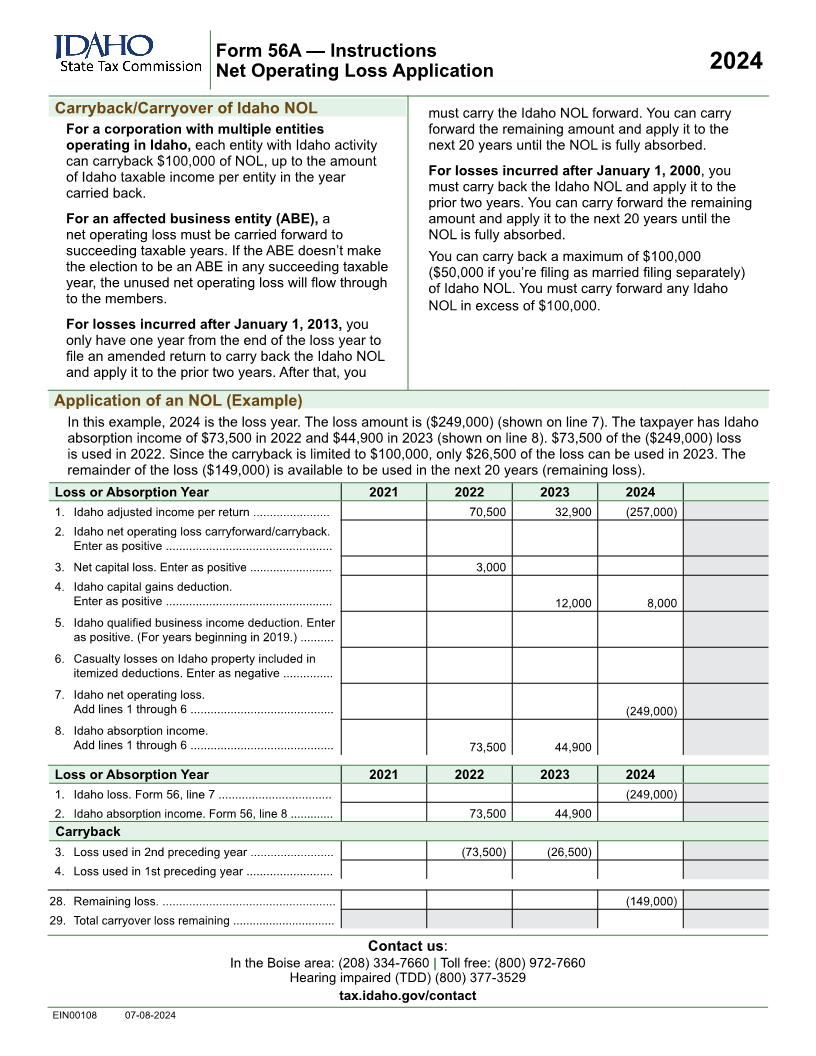

Form 56A

Net Operating Loss Application 2024

Names as shown on return Social Security number or EIN

Loss or Absorption Year 2002 2003 2004 2005 2006 2007 2008 2009

1. Idaho loss. Form 56, line 7 ..........................

2. Idaho absorption income. Form 56, line 8 ...

Carryback

3. Loss used in 2nd preceding year ..................

4. Loss used in 1st preceding year ..................

Carryforward

5. Loss used in 2002 ........................................

6. Loss used in 2003 ........................................

7. Loss used in 2004 ........................................

8. Loss used in 2005 ........................................

9. Loss used in 2006 ........................................

10. Loss used in 2007 ........................................

11. Loss used in 2008 ........................................

12. Loss used in 2009 ........................................

13. Loss used in 2010 ........................................

14. Loss used in 2011 ........................................

15. Loss used in 2012 ........................................

16. Loss used in 2013 ........................................

17. Loss used in 2014 ........................................

18. Loss used in 2015 ........................................

19. Loss used in 2016 ........................................

20. Loss used in 2017 ........................................

21. Loss used in 2018 ........................................

22. Loss used in 2019 ........................................

23. Loss used in 2020 ........................................

24. Loss used in 2021 ........................................

25. Loss used in 2022 ........................................

26. Loss used in 2023 ........................................

27. Loss used in 2024 ........................................

28. Remaining loss ............................................

29. Total carryover loss remaining .....................

EFO00331 07-08-2024 Page 1 of 3