Enlarge image

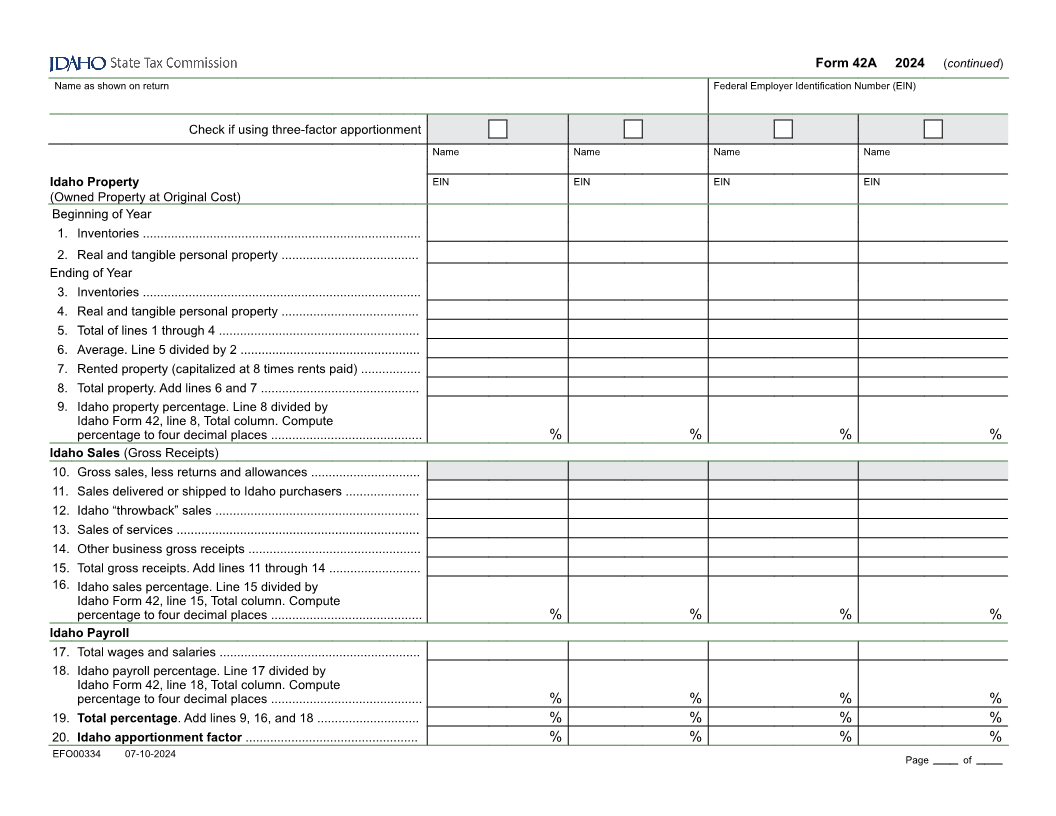

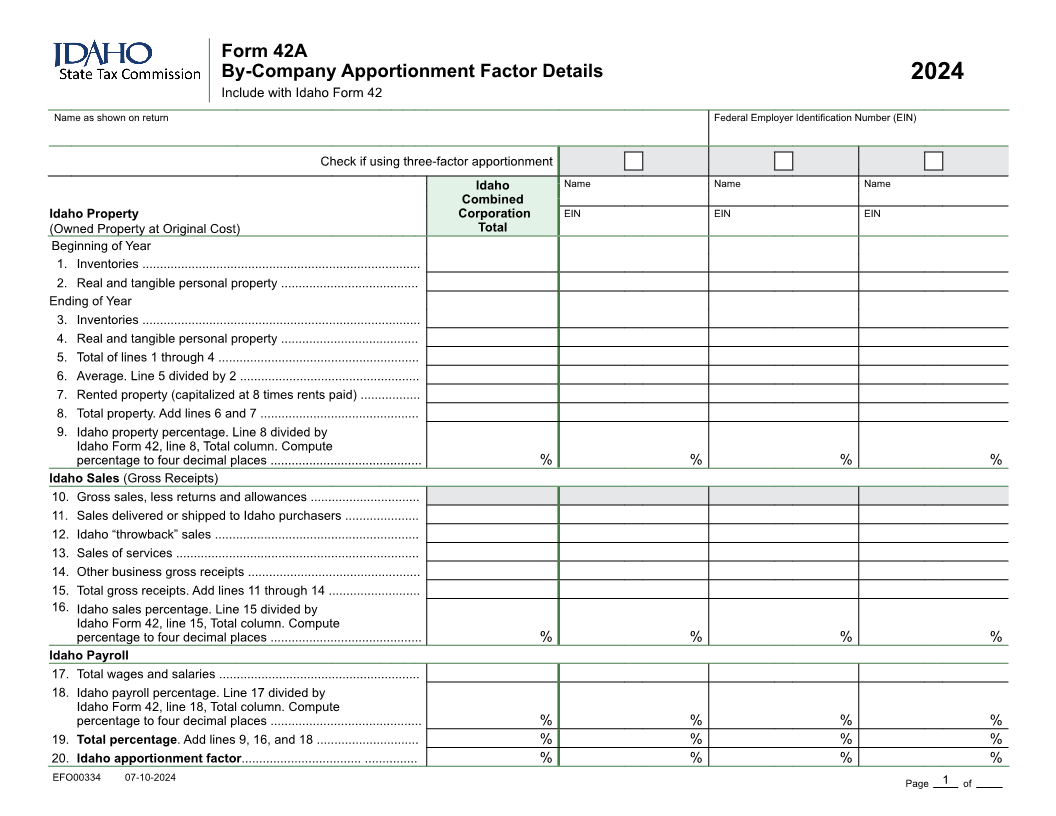

Form 42A

By-Company Apportionment Factor Details 2024

Include with Idaho Form 42

Name as shown on return Federal Employer Identification Number (EIN)

Check if using three-factor apportionment

Idaho Name Name Name

Combined

Idaho Property Corporation EIN EIN EIN

(Owned Property at Original Cost) Total

Beginning of Year

1. Inventories ...............................................................................

2. Real and tangible personal property .......................................

Ending of Year

3. Inventories ...............................................................................

4. Real and tangible personal property .......................................

5. Total of lines 1 through 4 .........................................................

6. Average. Line 5 divided by 2 ...................................................

7. Rented property (capitalized at 8 times rents paid) .................

8. Total property. Add lines 6 and 7 .............................................

9. Idaho property percentage. Line 8 divided by

Idaho Form 42, line 8, Total column. Compute

percentage to four decimal places ........................................... % % % %

Idaho Sales (Gross Receipts)

10. Gross sales, less returns and allowances ...............................

11. Sales delivered or shipped to Idaho purchasers .....................

12. Idaho “throwback” sales ..........................................................

13. Sales of services .....................................................................

14. Other business gross receipts .................................................

15. Total gross receipts. Add lines 11 through 14 ..........................

16. Idaho sales percentage. Line 15 divided by

Idaho Form 42, line 15, Total column. Compute

percentage to four decimal places ........................................... % % % %

Idaho Payroll

17. Total wages and salaries .........................................................

18. Idaho payroll percentage. Line 17 divided by

Idaho Form 42, line 18, Total column. Compute

percentage to four decimal places ........................................... % % % %

19. Total percentage. Add lines 9, 16, and 18 ............................. % % % %

20. Idaho apportionment factor.................................. ............... % % % %

EFO00334 07-10-2024 Page 1 of