Enlarge image

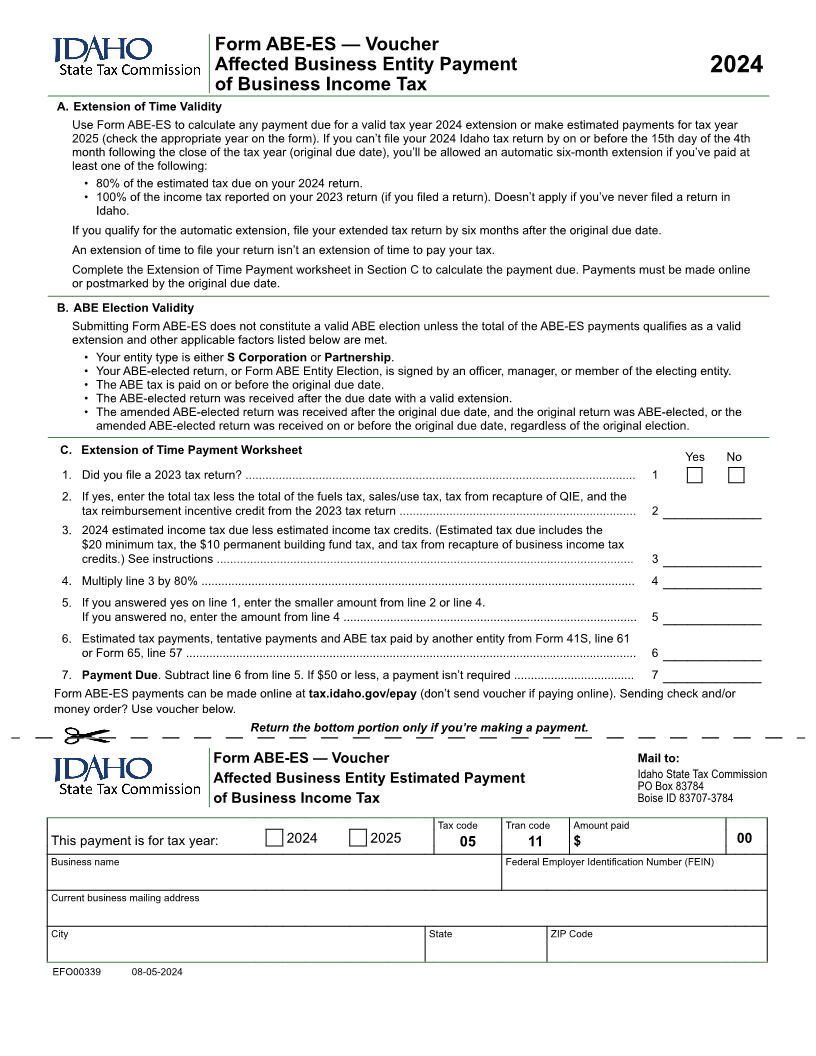

Form ABE-ES — Voucher

Affected Business Entity Payment 2024

of Business Income Tax

A. Extension of Time Validity

Use Form ABE-ES to calculate any payment due for a valid tax year 2024 extension or make estimated payments for tax year

2025 (check the appropriate year on the form). If you can’t file your 2024 Idaho tax return by on or before the 15th day of the 4th

month following the close of the tax year (original due date), you’ll be allowed an automatic six-month extension if you’ve paid at

least one of the following:

• 80% of the estimated tax due on your 2024 return.

• 100% of the income tax reported on your 2023 return (if you filed a return). Doesn’t apply if you’ve never filed a return in

Idaho.

If you qualify for the automatic extension, file your extended tax return by six months after the original due date.

An extension of time to file your return isn’t an extension of time to pay your tax.

Complete the Extension of Time Payment worksheet in Section C to calculate the payment due. Payments must be made online

or postmarked by the original due date.

B. ABE Election Validity

Submitting Form ABE-ES does not constitute a valid ABE election unless the total of the ABE-ES payments qualifies as a valid

extension and other applicable factors listed below are met.

• Your entity type is either S Corporation or Partnership.

• Your ABE-elected return, or Form ABE Entity Election, is signed by an officer, manager, or member of the electing entity.

• The ABE tax is paid on or before the original due date.

• The ABE-elected return was received after the due date with a valid extension.

• The amended ABE-elected return was received after the original due date, and the original return was ABE-elected, or the

amended ABE-elected return was received on or before the original due date, regardless of the original election.

C. Extension of Time Payment Worksheet Yes No

1. Did you file a 2023 tax return? ..................................................................................................................... 1

2. If yes, enter the total tax less the total of the fuels tax, sales/use tax, tax from recapture of QIE, and the

tax reimbursement incentive credit from the 2023 tax return ....................................................................... 2

3. 2024 estimated income tax due less estimated income tax credits. (Estimated tax due includes the

$20 minimum tax, the $10 permanent building fund tax, and tax from recapture of business income tax

credits.) See instructions ............................................................................................................................. 3

4. Multiply line 3 by 80% .................................................................................................................................. 4

5. If you answered yes on line 1, enter the smaller amount from line 2 or line 4.

If you answered no, enter the amount from line 4 ........................................................................................ 5

6. Estimated tax payments, tentative payments and ABE tax paid by another entity from Form 41S, line 61

or Form 65, line 57 ....................................................................................................................................... 6

7. Payment Due. Subtract line 6 from line 5. If $50 or less, a payment isn’t required .................................... 7

Form ABE-ES payments can be made online at tax.idaho.gov/epay (don’t send voucher if paying online). Sending check and/or

money order? Use voucher below.

Return the bottom portion only if you’re making a payment.

Form ABE-ES — Voucher Mail to:

Affected Business Entity Estimated Payment Idaho State Tax Commission

PO Box 83784

of Business Income Tax Boise ID 83707-3784

Tax code Tran code Amount paid

This payment is for tax year: 2024 2025 05 11 $ 00

Business name Federal Employer Identification Number (FEIN)

Current business mailing address

City State ZIP Code

EFO00339 08-05-2024