- 3 -

Enlarge image

|

Instructions for Completing the Request for Indiana Corporate Estimated Quarterly

Income Tax Returns

Purpose of Form E-6 Estimated Quarterly Income Tax Return Packets

The E-6 can be used during the current calendar or fiscal year to: Corporate taxpayers that have an Indiana income tax return on file for

1. Open a new estimated account and receive preprinted Corporate the previous year will automatically be issued a current preprinted Form

Estimated Quarterly Income Tax Returns, Form IT-6; IT-6 packet. Taxpayers that are required to pay corporate estimated

2. Make an initial corporate estimate income tax payment; income tax and do not have an established estimated tax account must

3. Make an income tax payment to an already established estimated

account for a corporation or nonprofit organization; and to submit a completed Form E-6.

4. Make a timely (fifth quarter) payment by the original due date

when an extension of time to file the annual return is requested. The Form IT-6 packet contains four preprinted estimated quarterly

income tax returns with envelopes, an extension payment form, a record-

View Estimated Tax Payments and Make Payments Online keeping envelope with instructions, and a change of address/name form.

Corporate taxpayers may verify their state estimated tax payments and

balances online. To access your estimated tax information, visit If there is a change of address, name, or federal employer identification

www.in.gov/dor/4340.htm. number (FEIN) for your estimated account, use the proper form included

in your Form IT-6 packet. Do not use Form E-6 or Form IT-6 to request

View by clicking on “Get Started” To make. an estimated tax such changes to your estimated account.

installment payment or to view payment history, you will need to know

the following information: taxpayer name, federal tax ID, or federal

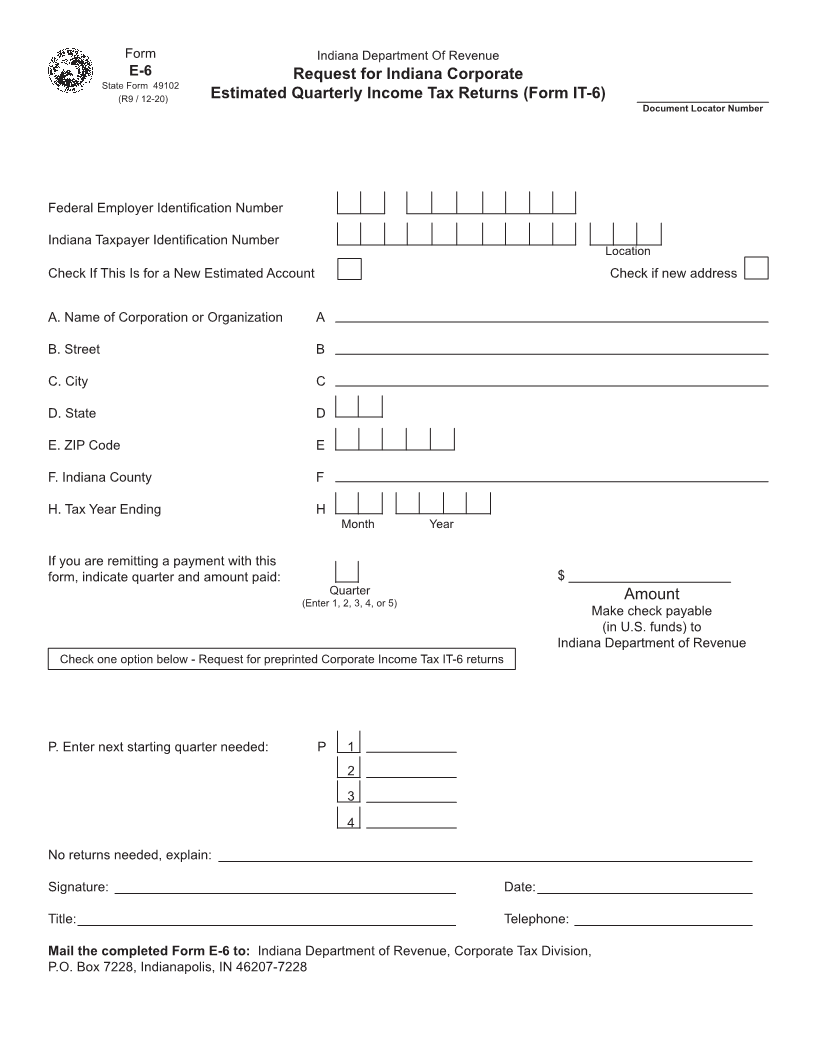

employer identification number (FEIN); current street address; and Instructions for Completing Form E-6

your last payment amount. If you have any questions, please call the Complete the spaces provided for the FEIN, Indiana taxpayer

department at (317) 232-0129. identification number, name, current mailing address (including city,

state, and ZIP code), county, and tax year ending date.

NOTE: Form IT-6 is to be used by taxpayers required to file corporate

estimated quarterly income tax returns unless the remittance is made via A corporation filing an annual return on a consolidated basis must

electronic funds transfer (EFT). When your average quarterly liability file this form under the reporting corporation’s name and FEIN.

for any tax type exceeds $5,000, you must use one of the alternative EFT

methods of payment. The space provided for a new estimated income tax account should be

checked if the taxpayer is required to pay estimated quarterly tax but has

If you determine that you meet the statutory requirements for EFT never paid estimated tax and/or filed an annual Indiana corporate income

payment, contact the department’s EFT Section at (317) 232-5500 to tax return. Also check if showing a new corporate mailing address.

obtain instructions for remitting quarterly payments.

If a payment is being submitted with this form, make the check payable

Form E-6 may be used in lieu of Form IT-6 whenever the quarterly (in U.S. funds) to the Indiana Department of Revenue. Also indicate to

return with the preprinted estimated account information is not available. which quarter it applies and the amount of payment.

Due Dates and Penalties Be sure to check the space corresponding to the number of remaining

The estimated income tax payment and Form E-6 (and IT-6) are due estimated quarterly returns (Form IT-6) needed. NOTE: Include

on April 20, June 20, Sept. 20, and Dec. 20 of the tax year if filing payment if Form E-6 is submitted within 30 days of the due date of your

on a calendar-year basis. If filing on a fiscal-year basis, the estimated quarterly return.

quarterly income tax return is due on the 20th day of the fourth, sixth,

ninth, and 12th months of the tax year. Nonprofit organizations and If preprinted returns are not needed for the current year, please briefly

farmer’s cooperatives have different annual filing dates. See IT-20 explain on the dotted line. Additional information and instructions for

Corporate Income Tax booklet for details at www.in.gov/dor/3489.htm.

calculating the amount of corporate estimated tax due are detailed in

The fifth quarter extension form is to be used when a payment is due and Income Tax Information Bulletin #11 at www.in.gov/dor/3650.htm.

additional time is necessary for filing the annual income tax return. A Further assistance may be obtained from the department by calling (317)

penalty for late payment will not be assessed if at least 90% of the tax is 232-0129.

paid by the original due date and the remaining balance plus interest is

paid in full within the extended due date.

An additional penalty of 10% may be assessed for the underpayment of

estimated quarterly tax due. The quarterly estimated payment must be

equal to the lesser of 25% of the adjusted gross income tax liability for

the taxable year or the annualized income installment calculated in the

manner provided by IRC Section 6655(e) as applied to the corporation’s

liability for adjusted gross income tax. A taxpayer failing to make

adequate payments is assessed this penalty when the annual return is

due. Refer to Schedule IT-2220 and its instructions for information

concerning the underpayment penalty. Also see Income Tax Information

Bulletin #11 at www.in.gov/dor/3650.htm.

|