Enlarge image

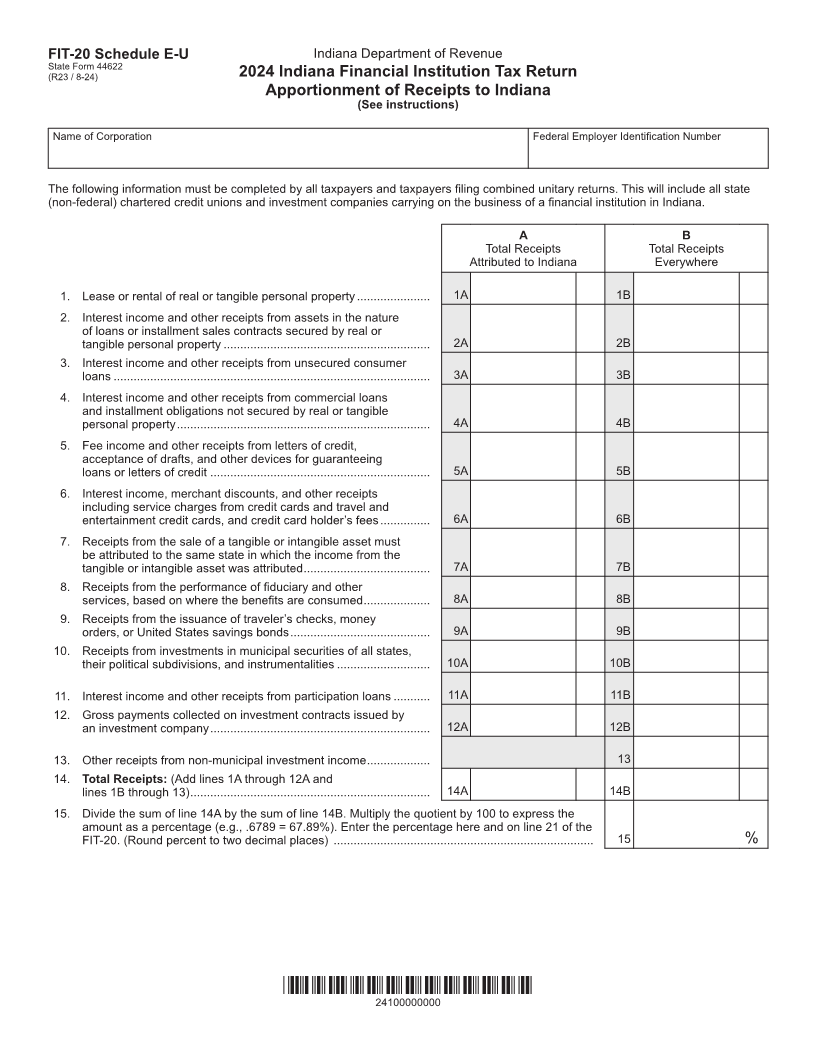

FIT-20 Schedule E-U Indiana Department of Revenue

State Form 44622

(R23 / 8-24) 2024 Indiana Financial Institution Tax Return

Apportionment of Receipts to Indiana

(See instructions)

Name of Corporation Federal Employer Identification Number

The following information must be completed by all taxpayers and taxpayers filing combined unitary returns. This will include all state

(non-federal) chartered credit unions and investment companies carrying on the business of a financial institution in Indiana.

A B

Total Receipts Total Receipts

Attributed to Indiana Everywhere

1. Lease or rental of real or tangible personal property ...................... 1A 1B

2. Interest income and other receipts from assets in the nature

of loans or installment sales contracts secured by real or

tangible personal property .............................................................. 2A 2B

3. Interest income and other receipts from unsecured consumer

loans ............................................................................................... 3A 3B

4. Interest income and other receipts from commercial loans

and installment obligations not secured by real or tangible

personal property ............................................................................ 4A 4B

5. Fee income and other receipts from letters of credit,

acceptance of drafts, and other devices for guaranteeing

loans or letters of credit .................................................................. 5A 5B

6. Interest income, merchant discounts, and other receipts

including service charges from credit cards and travel and

entertainment credit cards, and credit card holder’s fees ............... 6A 6B

7. Receipts from the sale of a tangible or intangible asset must

be attributed to the same state in which the income from the

tangible or intangible asset was attributed ...................................... 7A 7B

8. Receipts from the performance of fiduciary and other

services, based on where the benefits are consumed .................... 8A 8B

9. Receipts from the issuance of traveler’s checks, money

orders, or United States savings bonds .......................................... 9A 9B

10. Receipts from investments in municipal securities of all states,

their political subdivisions, and instrumentalities ............................ 10A 10B

11. Interest income and other receipts from participation loans ........... 11A 11B

12. Gross payments collected on investment contracts issued by

an investment company .................................................................. 12A 12B

13. Other receipts from non-municipal investment income ................... 13

14. Total Receipts: (Add lines 1A through 12A and

lines 1B through 13) ........................................................................ 14A 14B

15. Divide the sum of line 14A by the sum of line 14B. Multiply the quotient by 100 to express the

amount as a percentage (e.g., .6789 = 67.89%). Enter the percentage here and on line 21 of the

FIT-20. (Round percent to two decimal places) .............................................................................. 15 %

*24100000000*

24100000000