- 2 -

Enlarge image

|

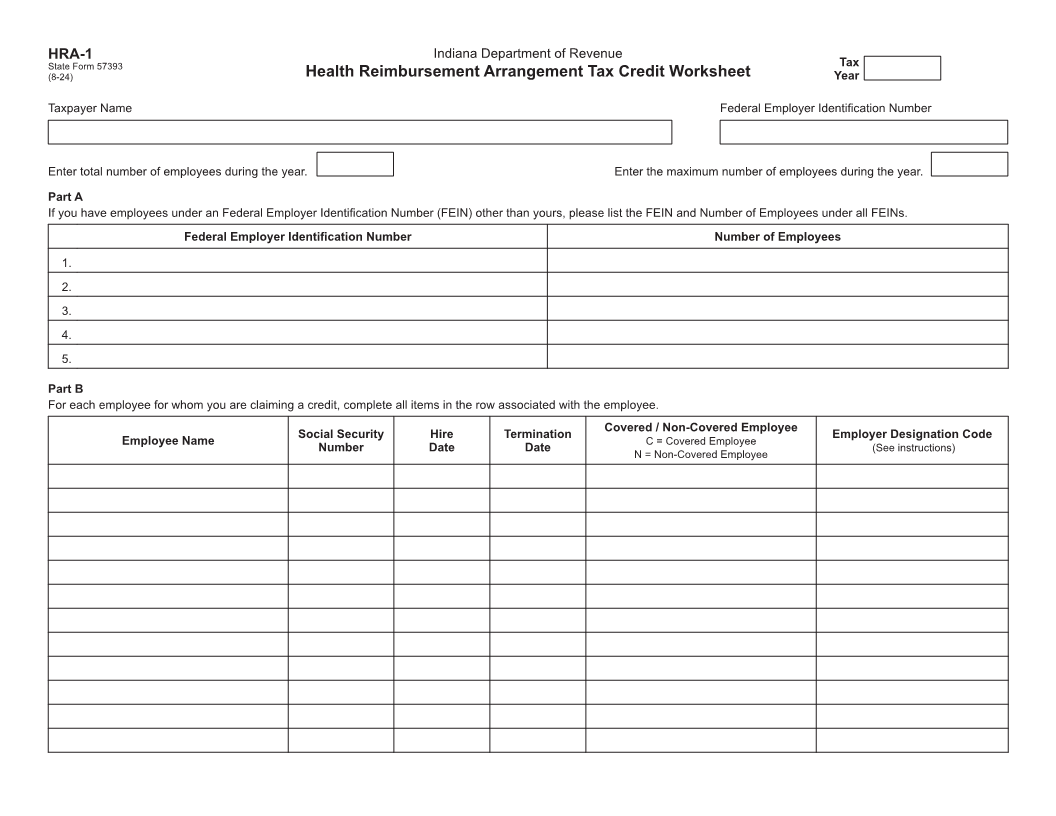

Instructions for HRA-1, Health Reimbursement Arrangement Tax Credit Worksheet

This worksheet should be completed if you are claiming a Health Part B Instructions

Reimbursement Arrangement tax credit. You are not required to

provide the worksheet with your return when it is filed. However, Enter the employee’s name and social security number for each of

you may be asked to provide or complete this worksheet upon your employees. List each employee only one time. Failure to list

review of your return. an employee will result in the employee not being considered a

covered employee for purposes of this credit.

If you are a pass through entity (partnership, S corporation,

estate, or trust), this credit does not flow through. In addition, if a Hire Date. Enter the date the employee was hired as MM/DD/

partnership or S corporation has a liability for pass through entity YYYY. If an employee was hired multiple times during the taxable

tax or composite withholding tax, this credit cannot be applied to year, enter the last date on which the employee was hired.

reduce the tax due.

Termination Date.

If additional sheets are necessary for Part A and Part B, include • If the employee listed was no longer employed by you at

additional copies of this worksheet the end of the year, enter the date on which the employee

resigned or otherwise terminated from employment. Enter the

Tax Year. Enter the year in which your tax year begins. For date as MM/DD/YYYY.

instance, if you have a fiscal year from July 1, 2024, to June 30, • If an employee resigned or otherwise terminated multiple

2025, enter “2024”. times during the year, enter the last termination date.

• If an employee was still employed by you as of the end of the

For the employee information, there are two boxes listed. taxable year, enter “12/31/9999”.

Both boxes must be completed. In the first box, enter the total

number of employees that you had during the taxable year. In Covered/Non-Covered Employees. Enter “C” if the employee

the second box, enter the maximum number of employees that was covered by a health reimbursement arrangement during the

you had at any point during the taxable year. For instance, if you tax year. Enter “N” if the employee was not covered by a health

had 60 employees during the year but never had more than 45 reimbursement arrangement at any time during the tax year.

employees at any time during the year, enter “60” in the first box

and “45” in the second box. Employer Designation Code. If the employee was issued a W-2

by you and a copy of the W-2 was supplied to the department,

Part A Instructions

enter “00” in this column on the row listing the employee.

Complete this section only if you have employees that were

If the employee was issued a W-2 under a different FEIN than

issued W-2s for wages paid by you as an employer and the W-2s

your FEIN, and that W-2 was supplied to the department, use the

were issued by an entity with a federal employer identification

row for the employer in Part A. Include only the row for which the

number (FEIN) other than your own FEIN.

employee was included in the “Number of Employees” column in

Enter the FEIN of any other entities that issued a W-2 to Part A. If using rows 1 through 9, include a leading zero (e.g., row

your employees for your wages. In the box for the number of 1 is employer designation code “01”, etc.).

employees, enter the number of employees that were issued

If an employee was issued a W-2 and the W-2 was not supplied to

W-2s for your wages under that FEIN. However, if an employee

the department, enter “99” in this column.

had W-2s issued under two different FEINs, include the employee

only once: Note. If you are a fiscal year filer, enter the employer designation

• If you issued a W-2 to the employee and the W-2 issued by code for which you expect the W-2s ultimately will be issued.

you was supplied, or will be supplied, to the department, do

not count the employee under the “Number of Employees” for

any employer in Part A.

• If you did not issue a W-2 to the employee and two or more

employers listed in Part A issued W-2s to an employee,

include them in the “number of employees” only for the first

employer that:

ο is listed, and

ο supplied or will supply a W-2 to the department.

|