Enlarge image

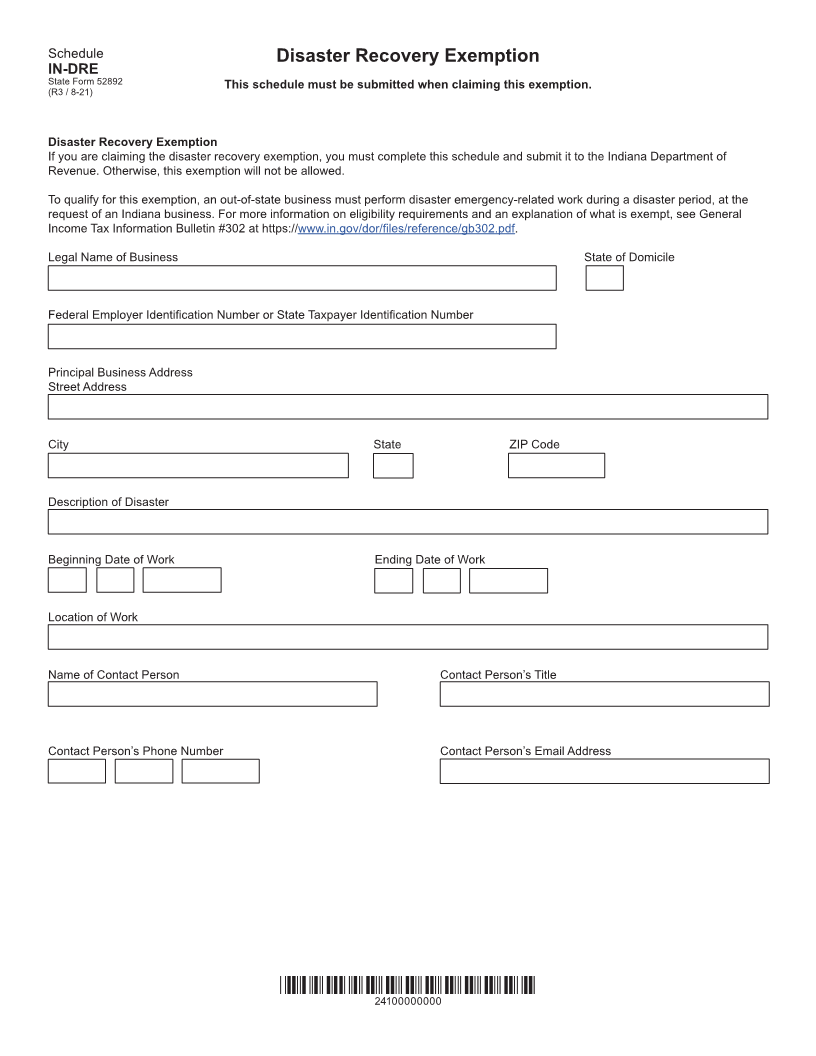

Schedule Disaster Recovery Exemption

IN-DRE

State Form 52892 This schedule must be submitted when claiming this exemption.

(R3 / 8-21)

Disaster Recovery Exemption

If you are claiming the disaster recovery exemption, you must complete this schedule and submit it to the Indiana Department of

Revenue. Otherwise, this exemption will not be allowed.

To qualify for this exemption, an out-of-state business must perform disaster emergency-related work during a disaster period, at the

request of an Indiana business. For more information on eligibility requirements and an explanation of what is exempt, see General

Income Tax Information Bulletin #302 at https://www.in.gov/dor/files/reference/gb302.pdf.

Legal Name of Business State of Domicile

Federal Employer Identification Number or State Taxpayer Identification Number

Principal Business Address

Street Address

City State ZIP Code

Description of Disaster

Beginning Date of Work Ending Date of Work

Location of Work

Name of Contact Person Contact Person’s Title

Contact Person’s Phone Number Contact Person’s Email Address

*24100000000*

24100000000