Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

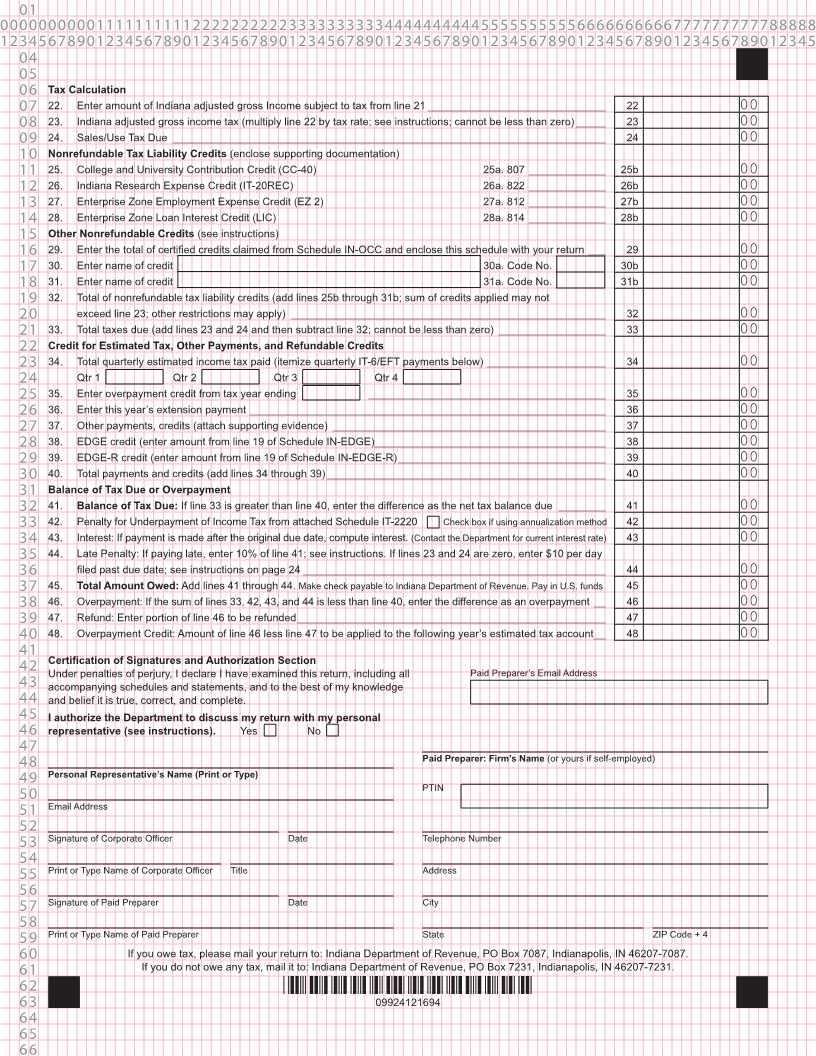

04 Form IT-20 Indiana Department of Revenue

State Form 44275

05 (R22 / 8-24) Indiana Corporate Adjusted Gross Income Tax Return 2024

06 for Calendar Year Ending December 31, 2024

07

or Other Tax Year Beginning 2024 and Ending

08

09 Check box if amended. Check box if amendment is due to a federal audit. Check box if name changed.

Name of Corporation Federal Employer Identification Number

10

11 Number and Street Principal Business Activity Code Foreign Country 2-Character Code

12

City State ZIP Code 2-Digit County Code Telephone Number

13

14

15 A. Check all boxes that apply: Initial Return Final Return In Bankruptcy Insurance Co. Cooperative/IC-DISC REMIC

16 B. Date of incorporation in the state of I. 80% or more of gross income is derived from making, acquiring,

17 C. State of commercial domicile selling, or servicing loans or extensions of credit.

18 D. Year of initial Indiana return J. This is a consolidated return for adjusted gross income tax.

19 E. Location of records if different from above address: K. This return is filed on a combined basis.

20 L. In determining taxable income, I deducted any intangible expenses

21 F. Check box if the corporation paid any quarterly estimated tax using or directly related intangible interest expenses paid to ≥ 50% owned

22 different federal employer identification numbers. affiliates.

23 G. Check box if you file federal Form 1120 on a consolidated basis. M. I have on file a valid extension of time (federal Form 7004 or an

24 H. I am filing on a combined basis, and there are material changes in electronic extension of time) to file my return.

25 circumstances since the last petition was filed. N. This entity reports income from disregarded entities.

26

27 Computation of Adjusted Gross Income Tax Round all entries

28 1. Federal taxable income (before federal NOL and special deductions); use a minus sign for negative amounts __ 1 00

29 2. Net qualifying dividends deduction from federal Schedule C, Form 1120 ________________________________ 2 00

30 3. Subtract line 2 from line 1 ____________________________________________________________________ 3 00

31 Modifications for Adjusted Gross Income (see instructions)

32 4. Enter name of addback or deduction Code No. 4 00

33 5. Enter name of addback or deduction Code No. 5 00

34 6. Enter name of addback or deduction Code No. 6 00

35 7. Enter name of addback or deduction Code No. 7 00

36 8. Enter name of addback or deduction Code No. 8 00

37 9. Enter name of addback or deduction Code No. 9 00

38 10. Enter name of addback or deduction Code No. 10 00

39 11. Subtotal (add/subtract lines 3 through 10; use a minus sign for negative amounts) ________________________ 11 00

40 Other Adjustments

41 12. Foreign source dividends (enclose Schedule IT-20FSD; enter as a positive amount) ______________________ 12 00

42 13. Subtotal of income with adjustments (subtract line 12 from line 11) ____________________________________ 13 00

43 14. Deduct: All source nonbusiness income or (loss) and non-unitary partnership distributions from

44 IT-20 Schedule F, column C, line 10 ____________________________________________________________ 14 00

45 15. Taxable business income (subtract line 14 from line 13) _____________________________________________ 15 00

46 Apportionment of Income for Entity with Multistate Activities

47 16. Check one of the following apportionment methods used, attach completed schedule, and enter percentage on line 16d.

48 16a. Schedule E, from line 9.

49 16b. Schedule E-7, from line 10 (for interstate transportation).

50 16c. Other approved method.

51 16d. Enter Indiana apportionment percentage, if applicable (round percent to two decimals) ____________________ 16d . %

52 17. Indiana apportioned business income (multiply line 15 by percent on line 16d) ___________________________ 17 00

53 If apportionment of income is not applicable, enter the total amount from line 15.

54 Add Allocated and Previously Apportioned Income to Indiana

55 18. Enter Indiana nonbusiness income or loss and Indiana non-unitary partnership income or loss from

56 IT-20 Schedule F, column D, line 11 ____________________________________________________________ 18 00

57 19. Indiana adjusted gross income before net operating loss deduction (add lines 17 and 18) __________________ 19 00

58 Deduct from Indiana Adjusted Gross Income

59 20. Indiana NOL deduction. Enter as positive amount from column B of Schedule IT-20NOL(s) for each loss year __ 20 00

60 21. Taxable adjusted gross income (subtract line 20 from line 19 and carry positive result to line 22 on page 2 of return) __ 21 00

61

62 *09924111694*

63 09924111694

64

65

66