Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

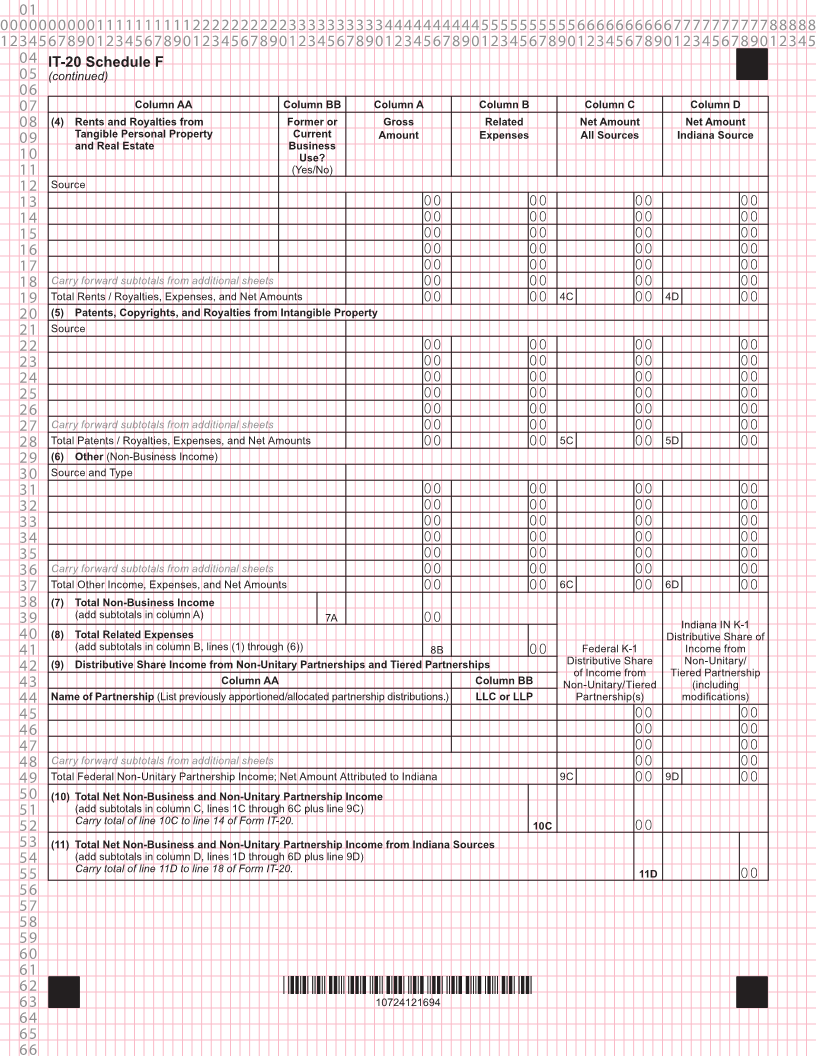

04 IT-20 Schedule F Indiana Department of Revenue

State Form 49104

05 (R23 / 8-24) Allocation of Non-Business Income and

06 Indiana Non-Unitary Partnership Income

07

08

For Tax Year Beginning 2024 and Ending

09

10

11 Name as shown on return Federal Employer Identification Number

12

13

14 Complete all applicable sections. See separate instructions for IT-20 Schedule F in income tax booklet. Attach additional sheets if

necessary. Identify each item of income. Indicate the amount of related non-business expenses (other than state income taxes) for

15 each income source. For every line with an entry, subtract column B from column A and enter the net amount in column C. Also enter

16 the net amount in column D if the income is attributable to Indiana. Use a minus sign to denote negative amounts. Round all entries.

17

18 Column AA Column BB Column A Column B Column C Column D

19 (1) Dividends (not from DISC or FSCs) Percent Total Related Net Amount Net Amount

20 Excess after federal and state foreign Owned Amount Expenses All Sources Indiana Source

source dividends deduction: (if foreign)

21

22 Source

23 00 00 00 00

24 00 00 00 00

25 00 00 00 00

26 00 00 00 00

27 00 00 00 00

28 00 00 00 00

29 00 00 00 00

30 00 00 00 00

31 Carry forward subtotals from additional sheets 00 00 00 00

32 Total Dividends, Expenses, and Net Amounts 00 00 1C 00 1D 00

33 (2) Interest (Do not include interest from U.S. government obligations.)

34 Source and Type Short / Long

35 Term

36 00 00 00 00

37 00 00 00 00

38 00 00 00 00

39 00 00 00 00

40 00 00 00 00

41 00 00 00 00

42 Carry forward subtotals from additional sheets 00 00 00 00

43 Total Interest, Expenses, and Net Amounts 00 00 2C 00 2D 00

44 (3) Net Capital Gains or Losses from Sale or Exchange of Personal Property and Real Estate (Indicate if tangible or intangible property.)

45 Source and Type Gross Proceeds

46 00 00 00 00 00

47 00 00 00 00 00

48 00 00 00 00 00

49 00 00 00 00 00

50 00 00 00 00 00

51 00 00 00 00 00

52 00 00 00 00 00

53 Carry forward subtotals from additional sheets 00 00 00 00

54 Total Net Gains, Expenses, and Net Amounts 00 00 3C 00 3D 00

55

56

57

58

59

60

61

62 *10724111694*

63 10724111694

64

65

66