Enlarge image

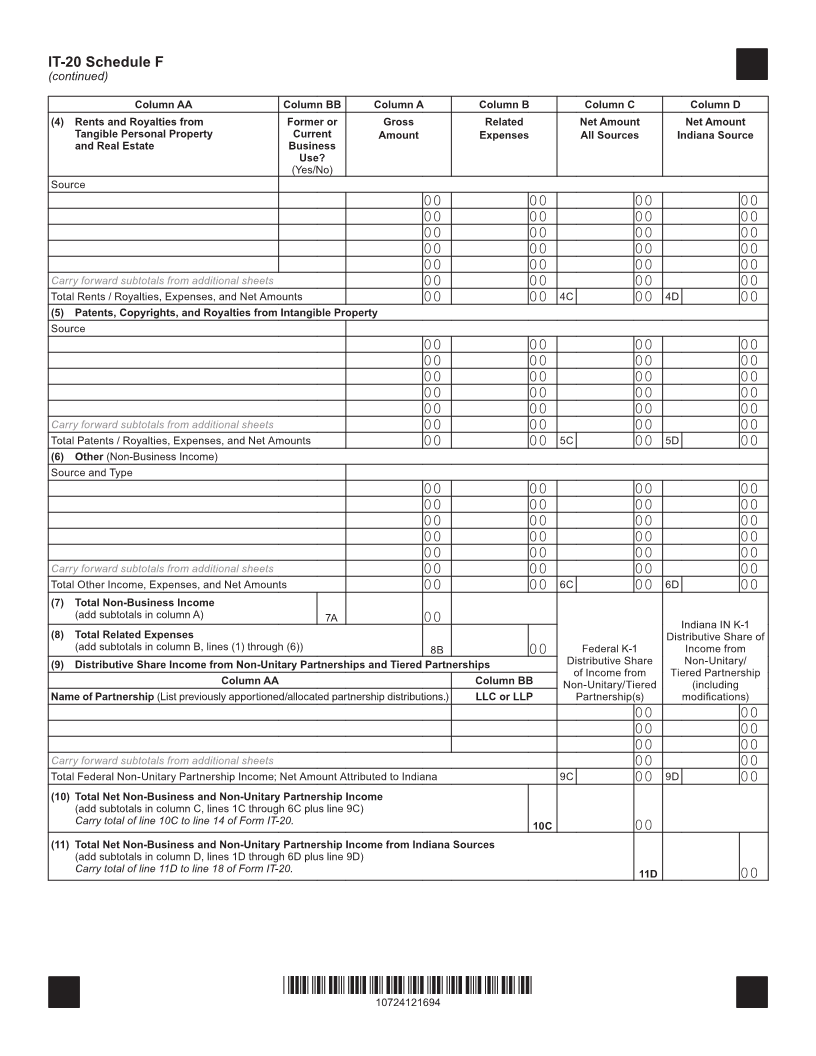

IT-20 Schedule F Indiana Department of Revenue

State Form 49104

(R23 / 8-24) Allocation of Non-Business Income and

Indiana Non-Unitary Partnership Income

For Tax Year Beginning 2024 and Ending

Name as shown on return Federal Employer Identification Number

Complete all applicable sections. See separate instructions for IT-20 Schedule F in income tax booklet. Attach additional sheets if

necessary. Identify each item of income. Indicate the amount of related non-business expenses (other than state income taxes) for

each income source. For every line with an entry, subtract column B from column A and enter the net amount in column C. Also enter

the net amount in column D if the income is attributable to Indiana. Use a minus sign to denote negative amounts. Round all entries.

Column AA Column BB Column A Column B Column C Column D

(1) Dividends (not from DISC or FSCs) Percent Total Related Net Amount Net Amount

Excess after federal and state foreign Owned Amount Expenses All Sources Indiana Source

source dividends deduction: (if foreign)

Source

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

Carry forward subtotals from additional sheets 00 00 00 00

Total Dividends, Expenses, and Net Amounts 00 00 1C 00 1D 00

(2) Interest (Do not include interest from U.S. government obligations.)

Source and Type Short / Long

Term

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

00 00 00 00

Carry forward subtotals from additional sheets 00 00 00 00

Total Interest, Expenses, and Net Amounts 00 00 2C 00 2D 00

(3) Net Capital Gains or Losses from Sale or Exchange of Personal Property and Real Estate (Indicate if tangible or intangible property.)

Source and Type Gross Proceeds

00 00 00 00 00

00 00 00 00 00

00 00 00 00 00

00 00 00 00 00

00 00 00 00 00

00 00 00 00 00

00 00 00 00 00

Carry forward subtotals from additional sheets 00 00 00 00

Total Net Gains, Expenses, and Net Amounts 00 00 3C 00 3D 00

*10724111694*

10724111694