Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

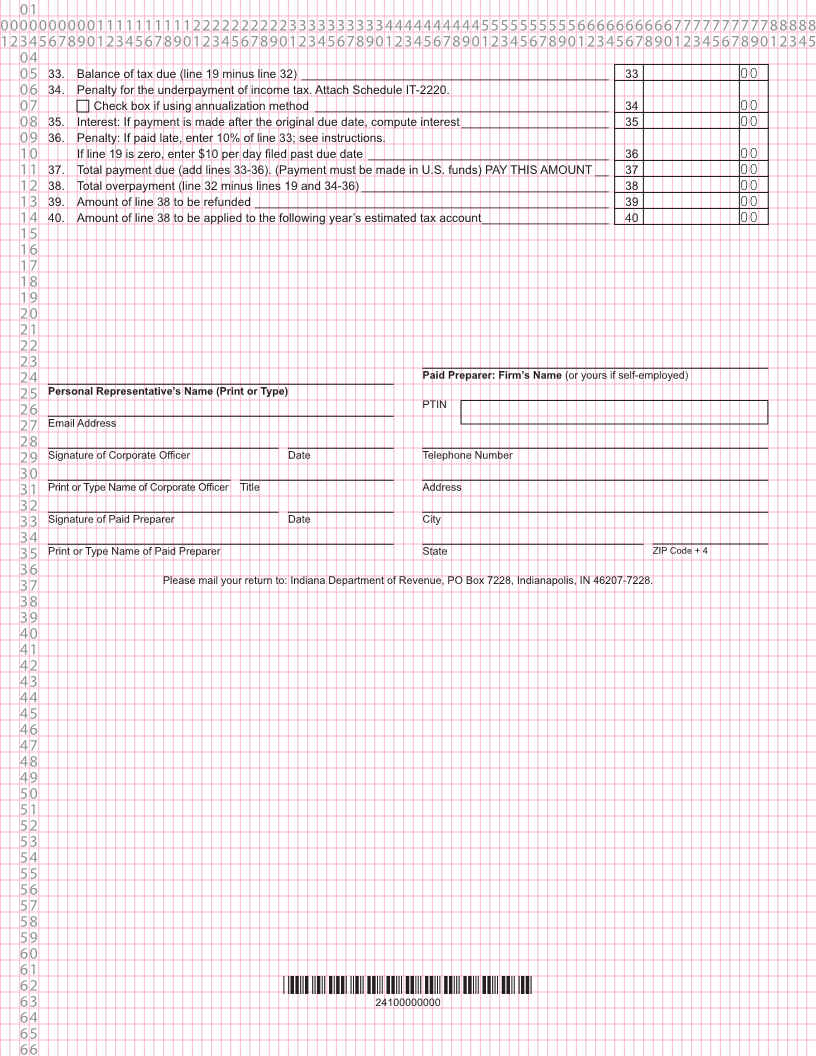

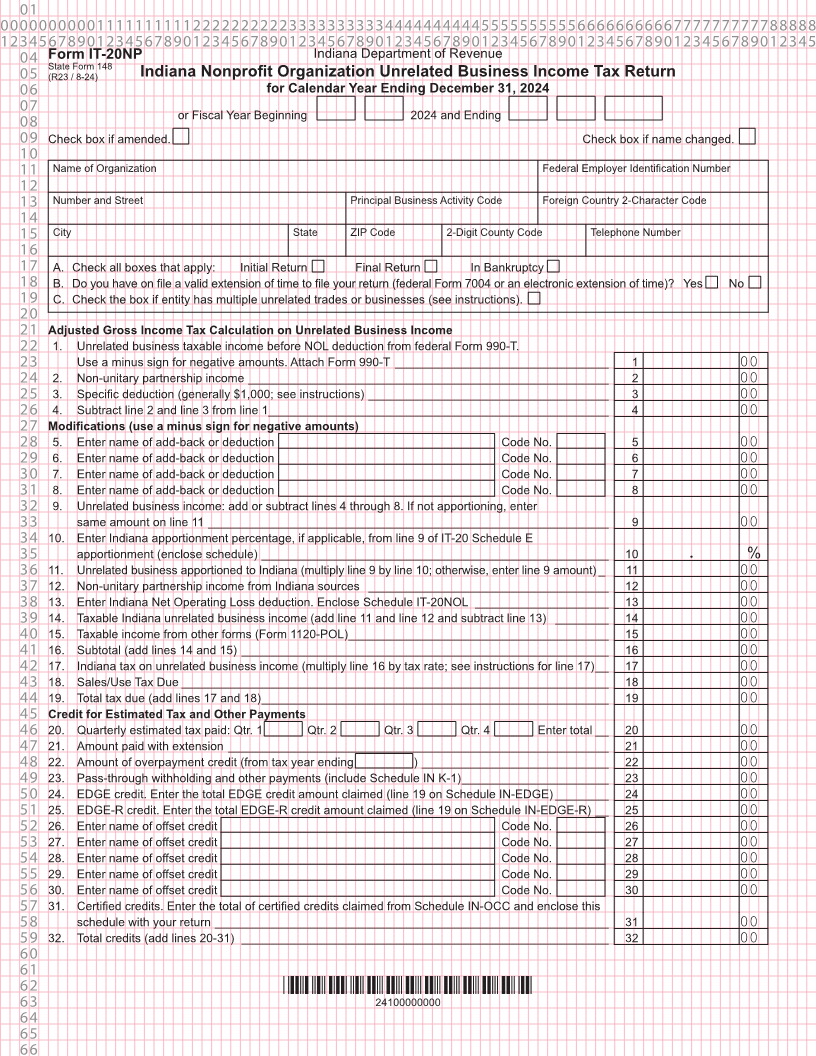

04 Form IT-20NP Indiana Department of Revenue

State Form 148

05 (R23 / 8-24) Indiana Nonprofit Organization Unrelated Business Income Tax Return

06 for Calendar Year Ending December 31, 2024

07

or Fiscal Year Beginning 2024 and Ending

08

09 Check box if amended. Check box if name changed.

10

11 Name of Organization Federal Employer Identification Number

12

13 Number and Street Principal Business Activity Code Foreign Country 2-Character Code

14

15 City State ZIP Code 2-Digit County Code Telephone Number

16

17 A. Check all boxes that apply: Initial Return Final Return In Bankruptcy

18 B. Do you have on file a valid extension of time to file your return (federal Form 7004 or an electronic extension of time)? Yes No

19 C. Check the box if entity has multiple unrelated trades or businesses (see instructions).

20

21 Adjusted Gross Income Tax Calculation on Unrelated Business Income

22 1. Unrelated business taxable income before NOL deduction from federal Form 990-T.

23 Use a minus sign for negative amounts. Attach Form 990-T ________________________________ 1 00

24 2. Non-unitary partnership income ______________________________________________________ 2 00

25 3. Specific deduction (generally $1,000; see instructions) ____________________________________ 3 00

26 4. Subtract line 2 and line 3 from line 1___________________________________________________ 4 00

27 Modifications (use a minus sign for negative amounts)

28 5. Enter name of add-back or deduction Code No. 5 00

29 6. Enter name of add-back or deduction Code No. 6 00

30 7. Enter name of add-back or deduction Code No. 7 00

31 8. Enter name of add-back or deduction Code No. 8 00

32 9. Unrelated business income: add or subtract lines 4 through 8. If not apportioning, enter

33 same amount on line 11 ____________________________________________________________ 9 00

34 10. Enter Indiana apportionment percentage, if applicable, from line 9 of IT-20 Schedule E

35 apportionment (enclose schedule) ____________________________________________________ 10 . %

36 11. Unrelated business apportioned to Indiana (multiply line 9 by line 10; otherwise, enter line 9 amount) _ 11 00

37 12. Non-unitary partnership income from Indiana sources ____________________________________ 12 00

38 13. Enter Indiana Net Operating Loss deduction. Enclose Schedule IT-20NOL ____________________ 13 00

39 14. Taxable Indiana unrelated business income (add line 11 and line 12 and subtract line 13) ________ 14 00

40 15. Taxable income from other forms (Form 1120-POL) _______________________________________ 15 00

41 16. Subtotal (add lines 14 and 15) _______________________________________________________ 16 00

42 17. Indiana tax on unrelated business income (multiply line 16 by tax rate; see instructions for line 17) __ 17 00

43 18. Sales/Use Tax Due ________________________________________________________________ 18 00

44 19. Total tax due (add lines 17 and 18) ____________________________________________________ 19 00

45 Credit for Estimated Tax and Other Payments

46 20. Quarterly estimated tax paid: Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Enter total __ 20 00

47 21. Amount paid with extension _________________________________________________________ 21 00

48 22. Amount of overpayment credit (from tax year ending ) ____________________________ 22 00

49 23. Pass-through withholding and other payments (include Schedule IN K-1) ______________________ 23 00

50 24. EDGE credit. Enter the total EDGE credit amount claimed (line 19 on Schedule IN-EDGE) ________ 24 00

51 25. EDGE-R credit. Enter the total EDGE-R credit amount claimed (line 19 on Schedule IN-EDGE-R) __ 25 00

52 26. Enter name of offset credit Code No. 26 00

53 27. Enter name of offset credit Code No. 27 00

54 28. Enter name of offset credit Code No. 28 00

55 29. Enter name of offset credit Code No. 29 00

56 30. Enter name of offset credit Code No. 30 00

57 31. Certified credits. Enter the total of certified credits claimed from Schedule IN-OCC and enclose this

58 schedule with your return ___________________________________________________________ 31 00

59 32. Total credits (add lines 20-31) _______________________________________________________ 32 00

60

61

62 *24100000000*

63 24100000000

64

65

66