Enlarge image

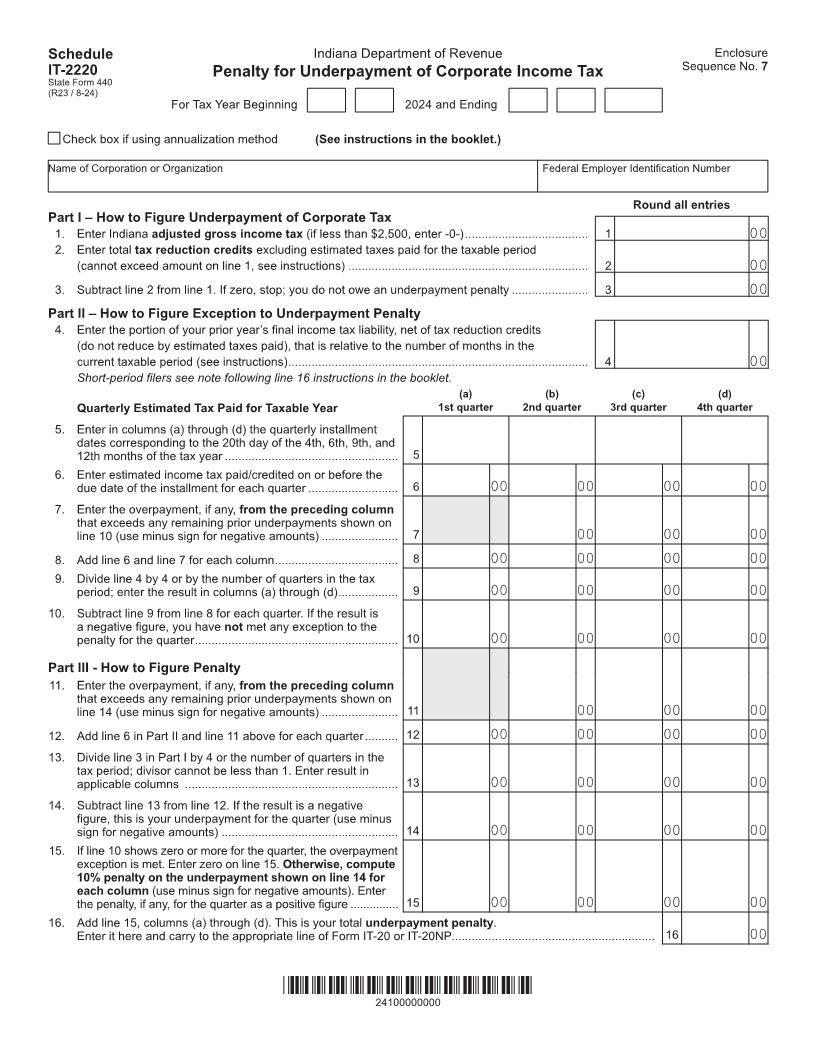

Schedule Indiana Department of Revenue Enclosure

IT-2220 Penalty for Underpayment of Corporate Income Tax Sequence No. 7

State Form 440

(R23 / 8-24)

For Tax Year Beginning 2024 and Ending

Check box if using annualization method (See instructions in the booklet.)

Name of Corporation or Organization Federal Employer Identification Number

Round all entries

Part I – How to Figure Underpayment of Corporate Tax

1. Enter Indiana adjusted gross income tax (if less than $2,500, enter -0-) ..................................... 1 00

2. Enter total tax reduction credits excluding estimated taxes paid for the taxable period

(cannot exceed amount on line 1, see instructions) ........................................................................ 2 00

3. Subtract line 2 from line 1. If zero, stop; you do not owe an underpayment penalty ....................... 3 00

Part II – How to Figure Exception to Underpayment Penalty

4. Enter the portion of your prior year’s final income tax liability, net of tax reduction credits

(do not reduce by estimated taxes paid), that is relative to the number of months in the

current taxable period (see instructions) .......................................................................................... 4 00

Short-period filers see note following line 16 instructions in the booklet.

(a) (b) (c) (d)

Quarterly Estimated Tax Paid for Taxable Year 1st quarter 2nd quarter 3rd quarter 4th quarter

5. Enter in columns (a) through (d) the quarterly installment

dates corresponding to the 20th day of the 4th, 6th, 9th, and

12th months of the tax year .................................................... 5

6. Enter estimated income tax paid/credited on or before the

due date of the installment for each quarter ........................... 6 00 00 00 00

7. Enter the overpayment, if any, from the preceding column

that exceeds any remaining prior underpayments shown on

line 10 (use minus sign for negative amounts) ....................... 7 00 00 00

8. Add line 6 and line 7 for each column ..................................... 8 00 00 00 00

9. Divide line 4 by 4 or by the number of quarters in the tax

period; enter the result in columns (a) through (d) .................. 9 00 00 00 00

10. Subtract line 9 from line 8 for each quarter. If the result is

a negative figure, you have not met any exception to the

penalty for the quarter ............................................................. 10 00 00 00 00

Part III - How to Figure Penalty

11. Enter the overpayment, if any, from the preceding column

that exceeds any remaining prior underpayments shown on

line 14 (use minus sign for negative amounts) ....................... 11 00 00 00

12. Add line 6 in Part II and line 11 above for each quarter .......... 12 00 00 00 00

13. Divide line 3 in Part I by 4 or the number of quarters in the

tax period; divisor cannot be less than 1. Enter result in

applicable columns ................................................................ 13 00 00 00 00

14. Subtract line 13 from line 12. If the result is a negative

figure, this is your underpayment for the quarter (use minus

sign for negative amounts) ..................................................... 14 00 00 00 00

15. If line 10 shows zero or more for the quarter, the overpayment

exception is met. Enter zero on line 15. Otherwise, compute

10% penalty on the underpayment shown on line 14 for

each column (use minus sign for negative amounts). Enter

the penalty, if any, for the quarter as a positive figure ............... 15 00 00 00 00

16. Add line 15, columns (a) through (d). This is your total underpayment penalty.

Enter it here and carry to the appropriate line of Form IT-20 or IT-20NP............................................................. 16 00

*24100000000*

24100000000