Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

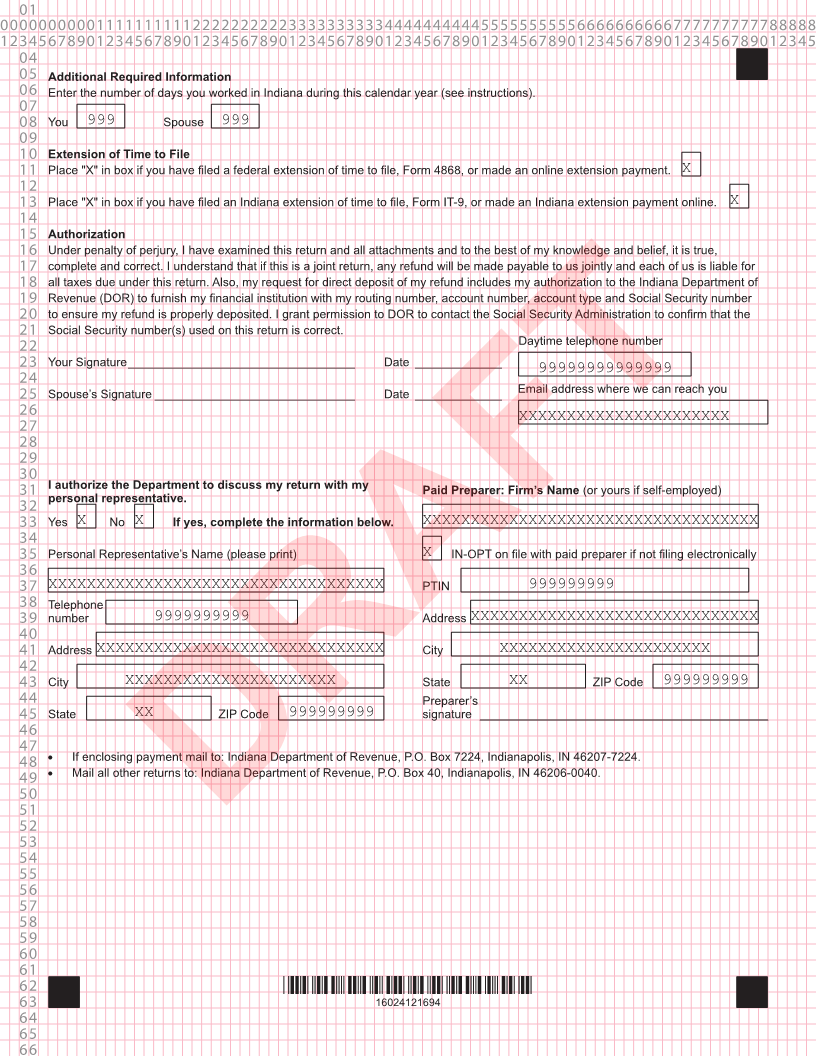

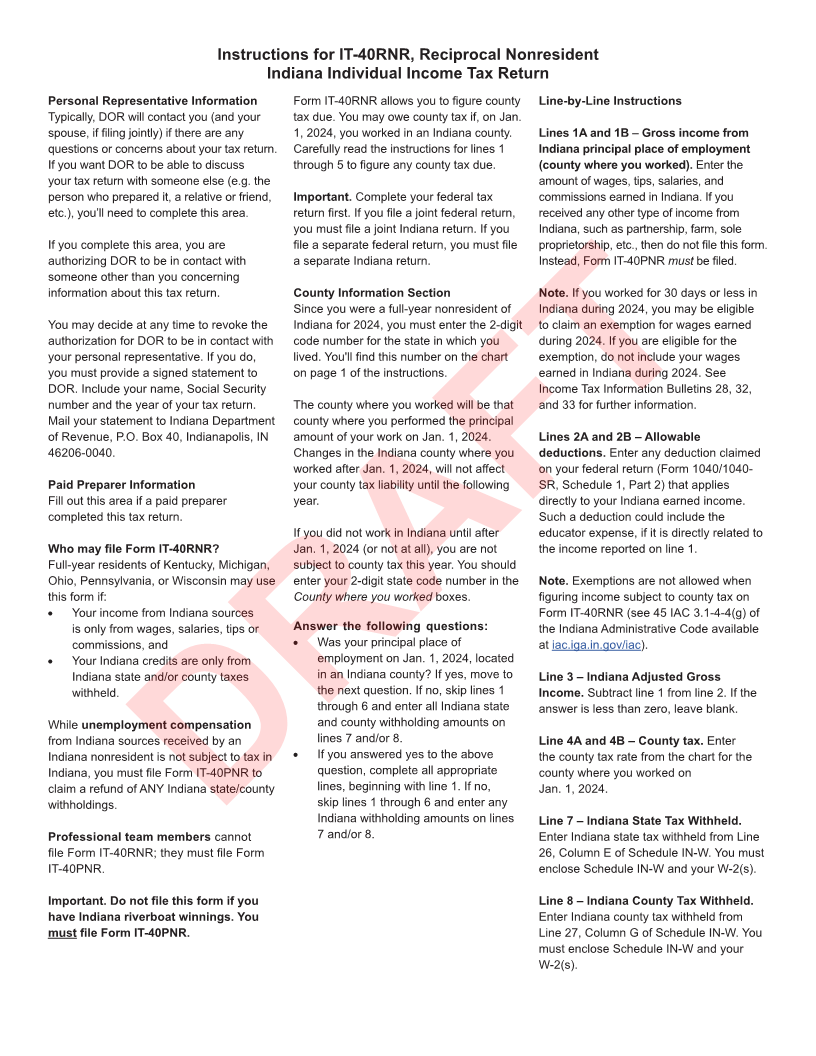

04 Form IT-40RNR Indiana Department of Revenue

State Form 44406

05 (R23 / 9-24) Reciprocal Nonresident Indiana

06 Individual Income Tax Return 2024 Place "X" in box

07 Due April 15, 2025 if amending. X

08

09 Your Social Spouse’s Social Place “X” in box if you are

10 Security Number 999 99 9999 Security Number 999 99 9999 married filing separately. X

11 Your first name Initial Last name Suffix

12

13 XXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXX

14 If filing a joint return, spouse’s first name Initial Last name Suffix

15

16 XXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXX

17 Present address (number and street or rural route)

18

19 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX Foreign country

20 City State ZIP/Postal code 2-character code

21

22 XXXXXXXXXXXXXXXXXXXX XX 9999999999 XX

23

24 Enter the 2-digit code numbers (see instructions) for the county and/or state where you lived and worked on Jan. 1, 2024.

25 State where County where State where County where

you lived you worked spouse lived spouse worked

26 99 99 99 99

27 If any individual listed above died during 2024, enter date of death below (MM/DD).

28

29 Taxpayer’s date of death 99 99 2024 Spouse’s date of death 99 99 2024

30

31 Your State of Residence

32 Place "X" in the appropriate box to indicate your state of residence for 2024.

33

Kentucky Michigan Ohio Pennsylvania Wisconsin

34 X X X X X

35 Note. You must file Form IT-40PNR, Part-Year Resident or Nonresident Indiana Individual Income Tax Return, if you were a resident

36 of a state other than those listed; had Indiana income other than wages, salaries, tips or commissions; or were a part-year resident of

37 Indiana during 2024. Important: You must file Form IT-40PNR if you have Indiana riverboat winnings.

38

39 Read Instructions First Column A – Yours Column B – Spouse’s

40 1. Enter gross income from your Indiana employment _____________ 1A 999999999 00 1B 99999999900

41 2. Allowable deductions: attach federal Schedule 1 ________________ 2A 999999999 00 2B 99999999900

42 3. Indiana adjusted gross income: line 1 minus line 2 ______________ 3A 999999999 00 3B 99999999900

43 4. County tax rate from chart (see instructions) ___________________ 4A .999999999 4B .999999999

44 5. County tax due: multiply line 3 x line 4 ________________________ 5A 999999999 00 5B 99999999900

45 6. Total county tax due: add lines 5A and 5B ______________________________________ Total Tax 6 99999999900

46 7. Indiana state tax withheld: See Instructions _____________________________________________ 7 99999999900

47 8. Indiana county tax withheld: See Instructions ____________________________________________ 8 99999999900

48 9. Add lines 7 and 8 ______________________________________________________ Total Credits 9 99999999900

49 10. Overpayment: if line 9 is more than line 6, subtract line 6 from line 9 and enter

50 amount to be refunded to you _____________________________________________ Your Refund 10 99999999900

51 11. a. Routing Number 999999999 c. Type: X Checking X Savings Direct

52 Deposit

53 b. Account Number 99999999999999999

(see instructions)

54 d. Place an “X” in the box if refund willDRAFTgo to an account outside the United States.X

55 12. Subtract line 9 from line 6 if line 6 is greater than line 9 ____________________________________ 12 99999999900

56 13. Penalty if filed after the due date (see instructions) _______________________________________ 13 99999999900

57 14. Interest if filed after the due date (see instructions) _______________________________________ 14 99999999900

58 15. Total amount you owe: add lines 12, 13 and 14 ___________________________ Amount You Owe 15 99999999900

59 Do not send cash. Please make your check or money order payable to:

60 Indiana Department of Revenue. See instructions if paying by credit card or electronic check.

61

62 *16024111694*

63 16024111694

64

65

66