Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

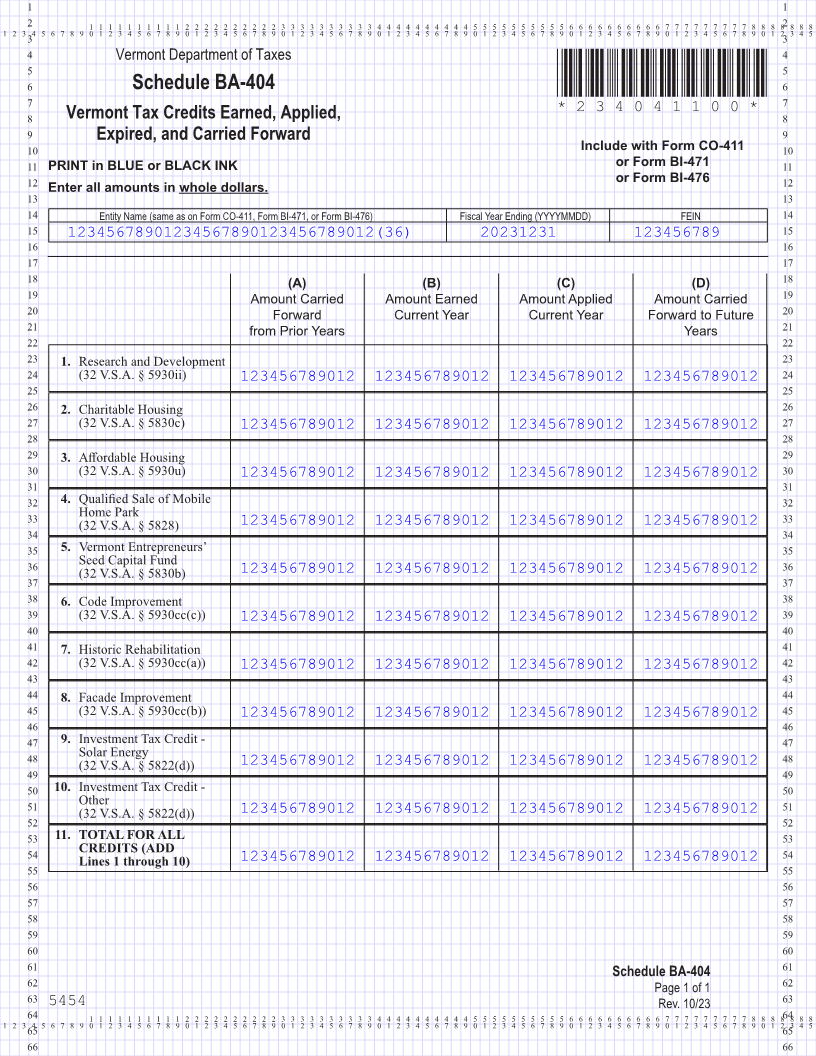

4 Vermont Department of Taxes 4

5 5

6 Schedule BA-404 *234041100* 6

7 7

Vermont Tax Credits Earned, Applied, *234041100*

8 8 Page 5

9 Expired, and Carried Forward 9

10 Include with Form CO-411 10

11 PRINT in BLUE or BLACK INK or Form BI-471 11

12 or Form BI-476 12

Enter all amounts in whole dollars.

13 13

14 Entity Name (same as on Form CO-411, Form BI-471, or Form BI-476) Fiscal Year Ending (YYYYMMDD) FEIN 14

15 15

12345678901234567890123456789012(36) 20231231 123456789

16 16

17 17

18 18

(A) (B) (C) (D)

19 Amount Carried Amount Earned Amount Applied Amount Carried 19

20 Forward Current Year Current Year Forward to Future 20

21 from Prior Years Years 21

22 22

23 1. Research and Development 23

24 (32 V.S.A. § 5930ii) 123456789012 123456789012 123456789012 123456789012 24

25 25 FORM (Place at FIRST page)

26 2. Charitable Housing 26 Form pages

27 (32 V.S.A. § 5830c) 123456789012 123456789012 123456789012 123456789012 27

28 28

29 3. Affordable Housing 29

30 (32 V.S.A. § 5930u) 123456789012 123456789012 123456789012 123456789012 30

31 31

5 - 5

32 4. Qualified Sale of Mobile 32

33 Home Park 33

(32 V.S.A. § 5828) 123456789012 123456789012 123456789012 123456789012

34 34

35 5. Vermont Entrepreneurs’ 35

36 Seed Capital Fund 36

(32 V.S.A. § 5830b) 123456789012 123456789012 123456789012 123456789012

37 37

38 6. Code Improvement 38

39 (32 V.S.A. § 5930cc(c)) 123456789012 123456789012 123456789012 123456789012 39

40 40

41 7. Historic Rehabilitation 41

42 (32 V.S.A. § 5930cc(a)) 123456789012 123456789012 123456789012 123456789012 42

43 43

44 8. Facade Improvement 44

45 (32 V.S.A. § 5930cc(b)) 123456789012 123456789012 123456789012 123456789012 45

46 46

47 9. Investment Tax Credit - 47

48 Solar Energy 48

(32 V.S.A. § 5822(d)) 123456789012 123456789012 123456789012 123456789012

49 49

50 10. Investment Tax Credit - 50

51 Other 51

(32 V.S.A. § 5822(d)) 123456789012 123456789012 123456789012 123456789012

52 52 FORM (Place at LAST page)

53 11. TOTAL FOR ALL 53 Form pages

54 CREDITS (ADD 54

Lines 1 through 10) 123456789012 123456789012 123456789012 123456789012

55 55

56 56

57 57

58 58 5 - 5

59 59

60 60

61 61

Schedule BA-404

62 Page 1 of 1 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66