Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

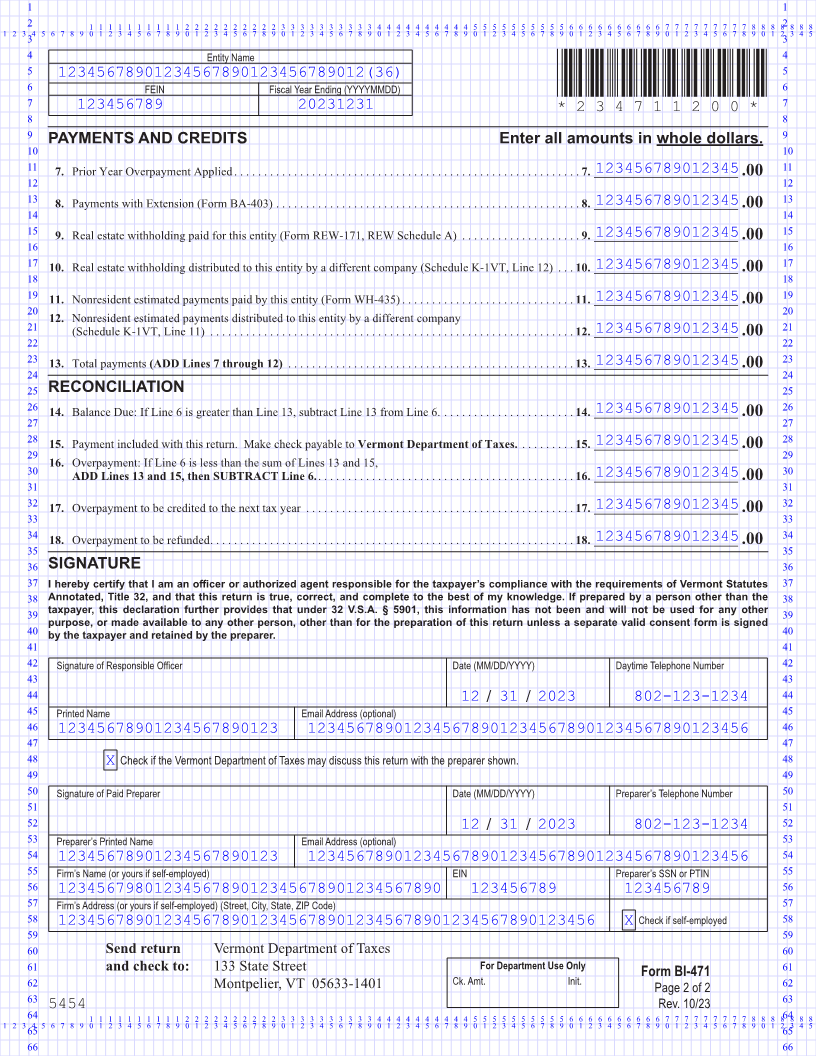

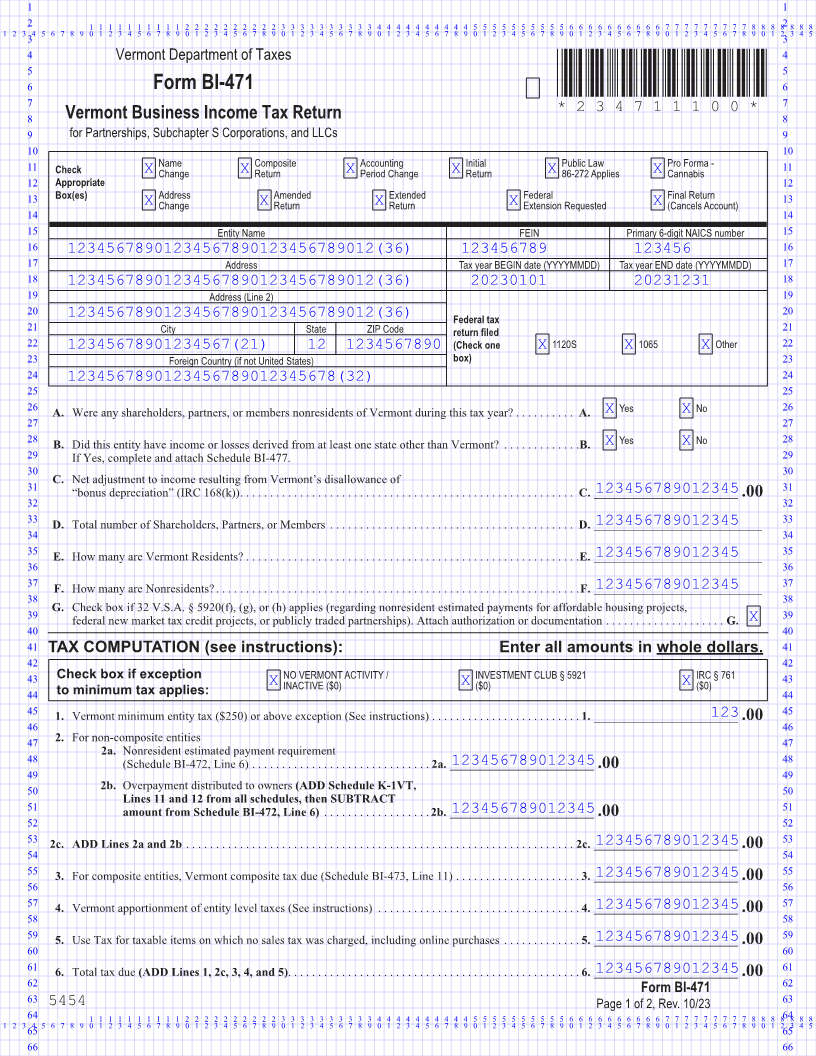

4 Vermont Department of Taxes 4

5 5

6 Form BI-471 *234711100* 6

7 7

Vermont Business Income Tax Return *234711100*

8 for Partnerships, Subchapter S Corporations, and LLCs 8 Page 11

9 9

10 10

11 Check Name Composite Accounting Initial Public Law Pro Forma - 11

X Change X Return X Period Change X Return X 86-272 Applies X Cannabis

12 Appropriate 12

13 Box(es) Address Amended Extended Federal Final Return 13

X Change X Return X Return X Extension Requested X (Cancels Account)

14 14

15 Entity Name FEIN Primary 6-digit NAICS number 15

16 16

12345678901234567890123456789012(36) 123456789 123456

17 Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD) 17

18 18

12345678901234567890123456789012(36) 20230101 20231231

19 Address (Line 2) 19

20 20

12345678901234567890123456789012(36) Federal tax

21 City State ZIP Code return filed 21

22 12345678901234567(21) 12 1234567890 (Check one X 1120S X 1065 X Other 22

23 Foreign Country (if not United States) box) 23

24 24

1234567890123456789012345678(32)

25 25 FORM (Place at FIRST page)

26 A. Were any shareholders, partners, or members nonresidents of Vermont during this tax year? . . . . . . . . . .A. X Yes X No 26 Form pages

27 27

28 B. Did this entity have income or losses derived from at least one state other than Vermont? . . . . . . . . . . . . B.. X Yes X No 28

29 If Yes, complete and attach Schedule BI-477 . 29

30 30

31 C. Net adjustment to income resulting from Vermont’s disallowance of 31

123456789012345“bonus depreciation” (IRC 168(k)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .C. ________________________.00 11 - 12

32 32

D.

33 123456789012345Total number of Shareholders, Partners, or Members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. ____________________________ 33

34 34

E.

35 123456789012345How many are Vermont Residents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E.. ____________________________ 35

36 36

F.

37 123456789012345 How many are Nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F.. ____________________________ 37

38 38

39 G. Check box if 32 V .S .A . § 5920(f), (g), or (h) applies (regarding nonresident estimated payments for affordable housing projects, 39

Xfederal new market tax credit projects, or publicly traded partnerships) . Attach authorization or documentation . . . . . . . . . . . . . . . . . . . .G.

40 40

41 TAX COMPUTATION (see instructions): Enter all amounts in whole dollars. 41

42 42

43 Check box if exception NO VERMONT ACTIVITY / INVESTMENT CLUB § 5921 IRC § 761 43

INACTIVE ($0) ($0) ($0)

44 to minimum tax applies: X X X 44

45 1. 123Vermont minimum entity tax ($250) or above exception (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . 1.. ________________________.00 45

46 46

47 2. For non-composite entities 47

2a. Nonresident estimated payment requirement

48 123456789012345 (Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2a. ________________________.00 48

49 49

50 2b. Overpayment distributed to owners (ADD Schedule K-1VT, 50

Lines 11 and 12 from all schedules, then SUBTRACT

51 123456789012345 amount from Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . 2b. . ________________________.00 51

52 52

53 1234567890123452c. ADD Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c. ________________________.00 53

54 54

55 1234567890123453. For composite entities, Vermont composite tax due (Schedule BI-473, Line 11) . . . . . . . . . . . . . . . . . . . . 3. . ________________________.00 55

56 56

57 4. 123456789012345Vermont apportionment of entity level taxes (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . ________________________.00 57

58 58

59 5. 123456789012345 Use Tax for taxable items on which no sales tax was charged, including online purchases . . . . . . . . . . . . .5. ________________________.00 59

60 60

61 6. 123456789012345Total tax due (ADD Lines 1, 2c, 3, 4, and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. . ________________________.00 61

62 62

Form BI-471

63 5454 Page 1 of 2, Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66