Enlarge image

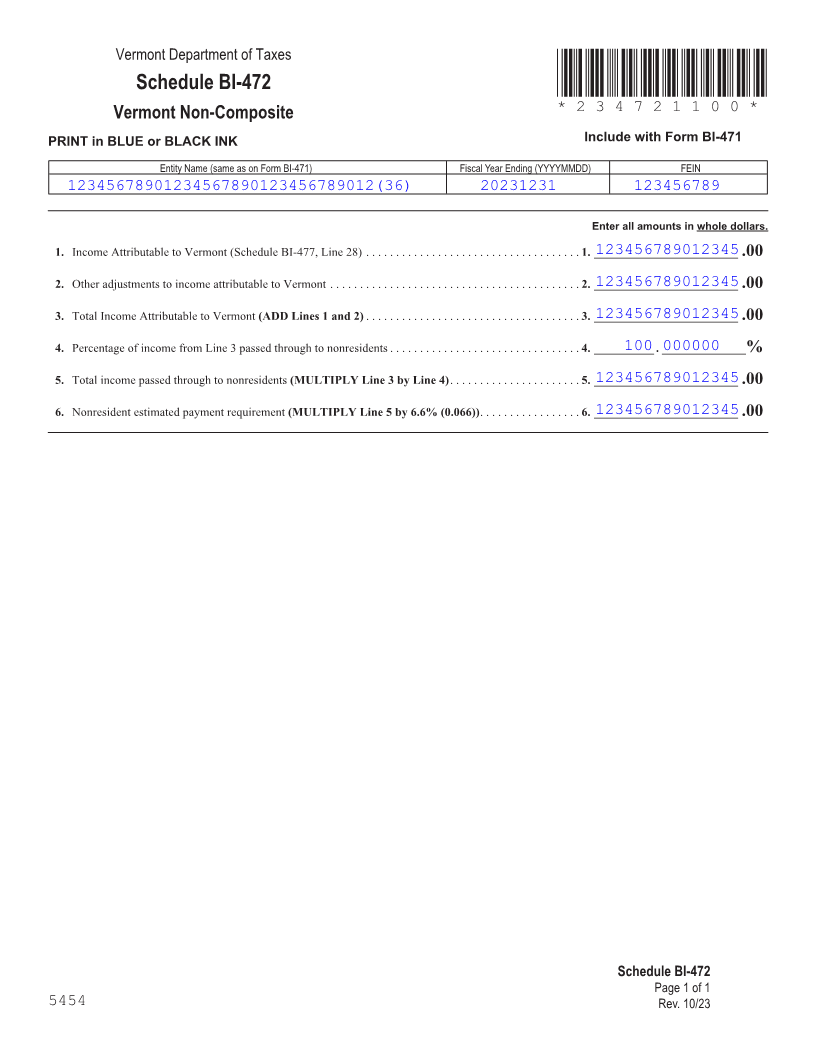

Vermont Department of Taxes

Schedule BI-472 *234721100*

Vermont Non-Composite *234721100*

Page 5

PRINT in BLUE or BLACK INK Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

Enter all amounts in whole dollars.

123456789012345 1. Income Attributable to Vermont (Schedule BI-477, Line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ________________________.00

123456789012345 2. Other adjustments to income attributable to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. ________________________.00

123456789012345 3. Total Income Attributable to Vermont(ADD Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . ________________________.00

4. Percentage of income from Line 3 passed through to nonresidents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________100.000000______________%

123456789012345 5. Total income passed through to nonresidents(MULTIPLY Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . 5. . ________________________.00

FORM (Place at FIRST page)

123456789012345 6. Nonresident estimated payment requirement(MULTIPLY Line 5 by 6.6% (0.066)) . . . . . . . . . . . . . . . . 6. . ________________________.00 Form pages

5 - 5

FORM (Place at LAST page)

Form pages

5 - 5

Schedule BI-472

Page 1 of 1

5454 Rev. 10/23