Enlarge image

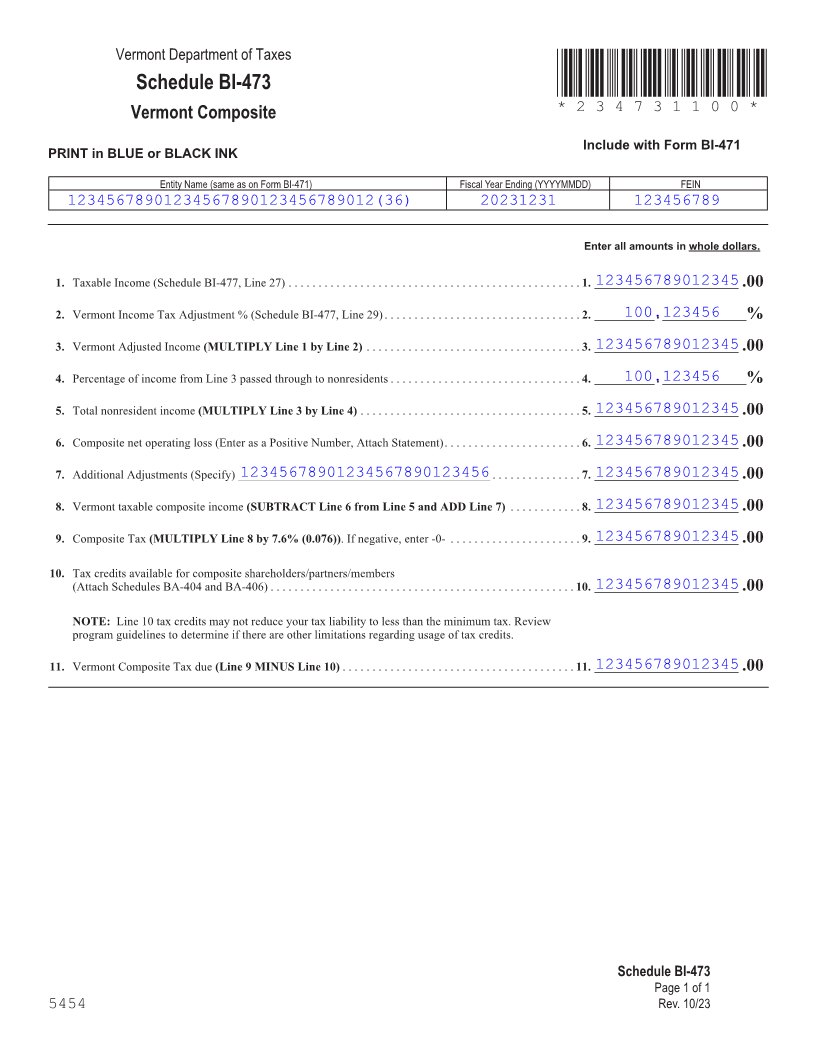

Vermont Department of Taxes

Schedule BI-473 *234731100*

Vermont Composite *234731100*

Page 5

Include with Form BI-471

PRINT in BLUE or BLACK INK

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

Enter all amounts in whole dollars.

123456789012345 1. Taxable Income (Schedule BI-477, Line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . ________________________.00

100.123456 2. Vermont Income Tax Adjustment % (Schedule BI-477, Line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . __________ . ______________%

123456789012345 3. Vermont Adjusted Income(MULTIPLY Line 1 by Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . ________________________.00

100.123456 4. Percentage of income from Line 3 passed through to nonresidents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________ . ______________%

FORM (Place at FIRST page)

123456789012345 5. Total nonresident income (MULTIPLY Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. . ________________________.00 Form pages

123456789012345 6. Composite net operating loss (Enter as a Positive Number, Attach Statement) . . . . . . . . . . . . . . . . . . . . . . 6. . ________________________.00

7. Additional Adjustments (Specify) __________________________________________ 12345678901234567890123456 . . . . . . . . . . . . . . 7. . 123456789012345________________________.00

5 - 5

123456789012345 8. Vermont taxable composite income (SUBTRACT Line 6 from Line 5 and ADD Line 7) . . . . . . . . . . . 8. . ________________________.00

123456789012345 9. Composite Tax (MULTIPLY Line 8 by 7.6% (0.076)) . If negative, enter -0- . . . . . . . . . . . . . . . . . . . . . 9. . ________________________.00

10. Tax credits available for composite shareholders/partners/members

123456789012345(Attach Schedules BA-404 and BA-406) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. . ________________________.00

NOTE: Line 10 tax credits may not reduce your tax liability to less than the minimum tax . Review

program guidelines to determine if there are other limitations regarding usage of tax credits .

123456789012345 11. Vermont Composite Tax due(Line 9 MINUS Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. . ________________________.00

FORM (Place at LAST page)

Form pages

Schedule BI-473 5 - 5

Page 1 of 1

5454 Rev. 10/23