Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

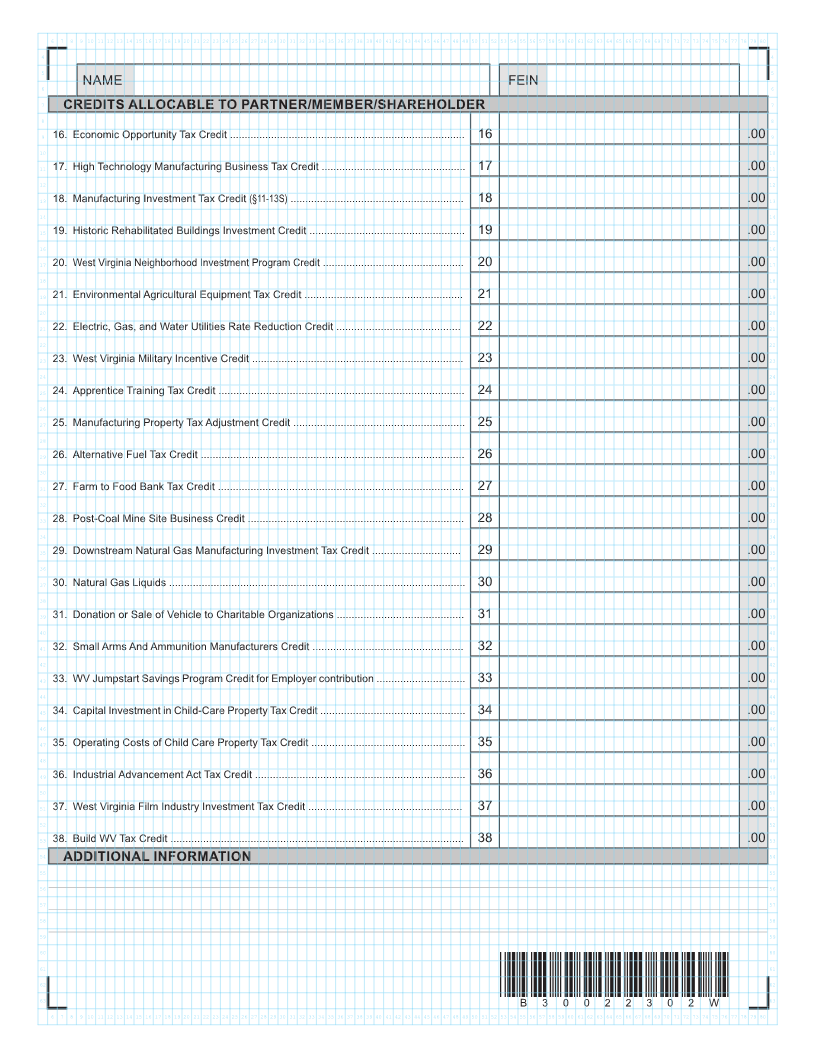

5 K-1C FROM SP Schedule of WV Partner/Shareholder/Member/Beneficiary Information 5

6 6

REV 07-23 for Corporations Subject to Corporate Income Tax 2023

7 TAXABLE YEAR OF ORGANIZATION 7

8 8

BEGINNING ENDING

9 MM/DD/YYYY MM/DD/YYYY 9

10 ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY 10

11 11

12 12

13 STREET or POST OFFICE BOX STREET or POST OFFICE BOX 13

14 14

15 15

16 CITY STATE ZIP CITY STATE ZIP 16

17 17

18 18

19 WV IDENTIFICATION NUMBER FEIN FEIN WV IDENTIFICATION NUMBER 19

20 20

21 21

22 CHECK WITHHOLDING 22

23 ONE: S Corporation 1. Income subject to withholding for nonresident as reported on 23

24 organization’s S Corporation, Partnership or Fiduciary Return $ .00 24

25 Limited Liability Company 25

26 2. Amount of West Virginia tax withheld (see instructions) $ .00 26

27 27

28 Partnership Fiduciary PERCENTAGE OF OWNERSHIP % 28

29 29

DISTRIBUTIVE SHARE

30 INCOME 30

31 31

32 1. Distributive pro rata share of income allocable to West Virginia........................................... 1 .00 32

33 ADDITIONS 33

34 34

2. Interest or dividend income on federal obligations which is exempt from federal tax but

35 subject to state tax............................................................................................................ 2 .00 35

36 36

3. Interest or dividend income on state and local bonds other than bonds from West Virginia

37 sources.............................................................................................................................. 3 .00 37

38 38

4. Interest on money borrowed to purchase bonds earning income exempt from West

39 Virginia tax......................................................................................................................... 4 .00 39

40 40

5. Any amount not included in federal income that was an eligible contribution for the

41 Neighborhood Investment Program Tax Credit................................................................. 5 .00 41

42 42

43 6. Other Income deducted from federal adjusted gross income but subject to state tax...... 6 .00 43

44 44

45 7. Federal depreciation/amortization for WV water/air pollution control facilities ................... 7 .00 45

46 46

47 8. Unrelated business taxable income of a corporation exempt from federal tax................... 8 .00 47

48 48

49 9. Add back expenses for certain REIT’s and RIC’s.............................................................. 9 .00 49

50 SUBTRACTIONS 50

51 51

10. Interest or dividends received on United States or West Virginia obligations included in

52 federal adjusted gross income but exempt from state tax................................................. 10 .00 52

53 53

54 11. Refunds of state and local income taxes received and reported as income to the IRS.... 11 .00 54

55 55

12. Other income included into federal adjusted gross income but excluded from state

56 income tax......................................................................................................................... 12 .00 56

57 57

58 13. Salary expense not allowed on federal return due to claiming the federal jobs credit........ 13 .00 58

59 14. Cost of WV water/air pollution 59

60 control facilities .................... 14 .00 60

61 15.Allowance for governmental 61

62 obligations/obligations secured 15 .00 62

63 *B30022301W* by residential property ........... 63

B30022301W

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980