Enlarge image

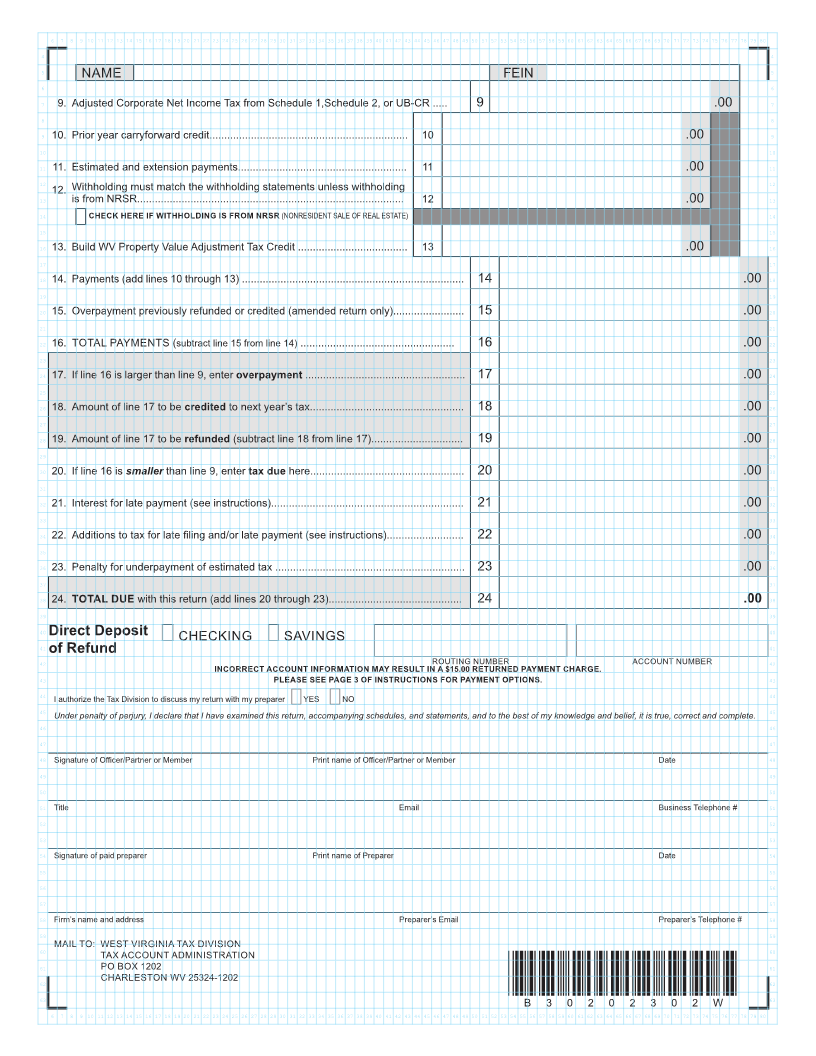

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

5 WEST VIRGINIA 5

6 6

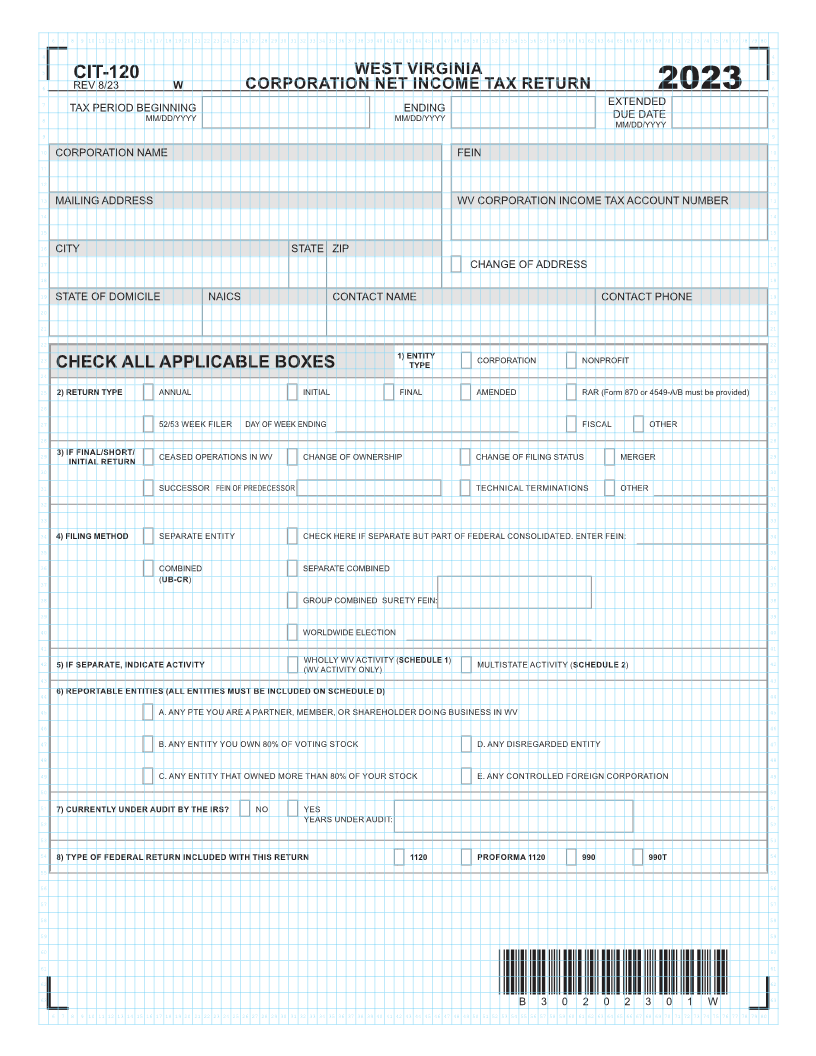

REVCIT-1208/23 W CORPORATION NET INCOME TAX RETURN 2023

7 TAX PERIOD BEGINNING ENDING EXTENDED 7

8 MM/DD/YYYY MM/DD/YYYY DUE DATE 8

MM/DD/YYYY

9 9

10 CORPORATION NAME FEIN 10

11 11

12 12

13 MAILING ADDRESS WV CORPORATION INCOME TAX ACCOUNT NUMBER 13

14 14

15 15

16 CITY STATE ZIP 16

17 CHANGE OF ADDRESS 17

18 18

19 STATE OF DOMICILE NAICS CONTACT NAME CONTACT PHONE 19

20 20

21 21

22 22

1) ENTITY

23 CHECK ALL APPLICABLE BOXES TYPE CORPORATION NONPROFIT 23

24 24

25 2) RETURN TYPE ANNUAL INITIAL FINAL AMENDED RAR (Form 870 or 4549-A/B must be provided) 25

26 26

27 52/53 WEEK FILER DAY OF WEEK ENDING FISCAL OTHER 27

28 28

29 3) IF FINAL/SHORT/ CEASED OPERATIONS IN WV CHANGE OF OWNERSHIP CHANGE OF FILING STATUS MERGER 29

INITIAL RETURN

30 30

31 SUCCESSOR FEIN OF PREDECESSOR TECHNICAL TERMINATIONS OTHER 31

32 32

33 33

34 4) FILING METHOD SEPARATE ENTITY CHECK HERE IF SEPARATE BUT PART OF FEDERAL CONSOLIDATED. ENTER FEIN: 34

35 35

36 COMBINED SEPARATE COMBINED 36

37 (UB-CR) 37

38 GROUP COMBINED SURETY FEIN: 38

39 39

40 WORLDWIDE ELECTION 40

41 41

42 5) IF SEPARATE, INDICATE ACTIVITY WHOLLY WV ACTIVITY (SCHEDULE 1) MULTISTATE ACTIVITY (SCHEDULE 2) 42

(WV ACTIVITY ONLY)

43 43

44 6) REPORTABLE ENTITIES (ALL ENTITIES MUST BE INCLUDED ON SCHEDULE D) 44

45 A. ANY PTE YOU ARE A PARTNER, MEMBER, OR SHAREHOLDER DOING BUSINESS IN WV 45

46 46

47 B. ANY ENTITY YOU OWN 80% OF VOTING STOCK D. ANY DISREGARDED ENTITY 47

48 48

49 C. ANY ENTITY THAT OWNED MORE THAN 80% OF YOUR STOCK E. ANY CONTROLLED FOREIGN CORPORATION 49

50 50

51 7) CURRENTLY UNDER AUDIT BY THE IRS? NO YES 51

52 YEARS UNDER AUDIT: 52

53 53

54 8) TYPE OF FEDERAL RETURN INCLUDED WITH THIS RETURN 1120 PROFORMA 1120 990 990T 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

*B30202301W*

63 B30202301W 63

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980