Enlarge image

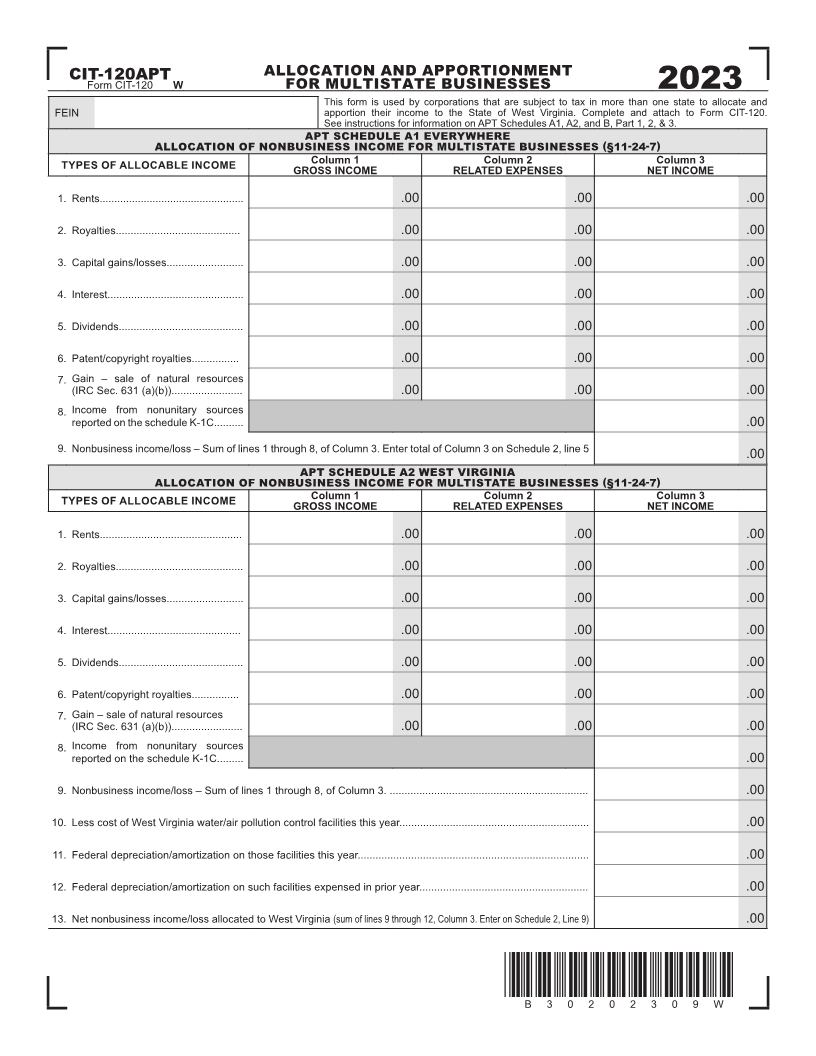

CIT-120APT ALLOCATION AND APPORTIONMENT

Form CIT-120 W FOR MULTISTATE BUSINESSES 2023

This form is used by corporations that are subject to tax in more than one state to allocate and

FEIN apportion their income to the State of West Virginia. Complete and attach to Form CIT-120.

See instructions for information on APT Schedules A1, A2, and B, Part 1, 2, & 3.

APT SCHEDULE A1 EVERYWHERE

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES (§11-24-7)

TYPES OF ALLOCABLE INCOME Column 1 Column 2 Column 3

GROSS INCOME RELATED EXPENSES NET INCOME

1. Rents................................................. .00 .00 .00

2. Royalties.......................................... .00 .00 .00

3. Capital gains/losses.......................... .00 .00 .00

4. Interest.............................................. .00 .00 .00

5. Dividends.......................................... .00 .00 .00

6. Patent/copyright royalties................ .00 .00 .00

7. Gain – sale of natural resources

(IRC Sec. 631 (a)(b))........................ .00 .00 .00

8. Income from nonunitary sources

reported on the schedule K-1C.......... .00

9. Nonbusiness income/loss – Sum of lines 1 through 8, of Column 3. Enter total of Column 3 on Schedule 2, line 5

.00

APT SCHEDULE A2 WEST VIRGINIA

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES (§11-24-7)

TYPES OF ALLOCABLE INCOME Column 1 Column 2 Column 3

GROSS INCOME RELATED EXPENSES NET INCOME

1. Rents................................................ .00 .00 .00

2. Royalties........................................... .00 .00 .00

3. Capital gains/losses.......................... .00 .00 .00

4. Interest............................................. .00 .00 .00

5. Dividends.......................................... .00 .00 .00

6. Patent/copyright royalties................ .00 .00 .00

7. Gain – sale of natural resources

(IRC Sec. 631 (a)(b))........................ .00 .00 .00

8. Income from nonunitary sources

reported on the schedule K-1C......... .00

9. Nonbusiness income/loss – Sum of lines 1 through 8, of Column 3. ................................................................... .00

10. Less cost of West Virginia water/air pollution control facilities this year................................................................ .00

11. Federal depreciation/amortization on those facilities this year.............................................................................. .00

12. Federal depreciation/amortization on such facilities expensed in prior year......................................................... .00

13. Net nonbusiness income/loss allocated to West Virginia (sum of lines 9 through 12, Column 3. Enter on Schedule 2, Line 9) .00

*B30202309W*

B30202309W