Enlarge image

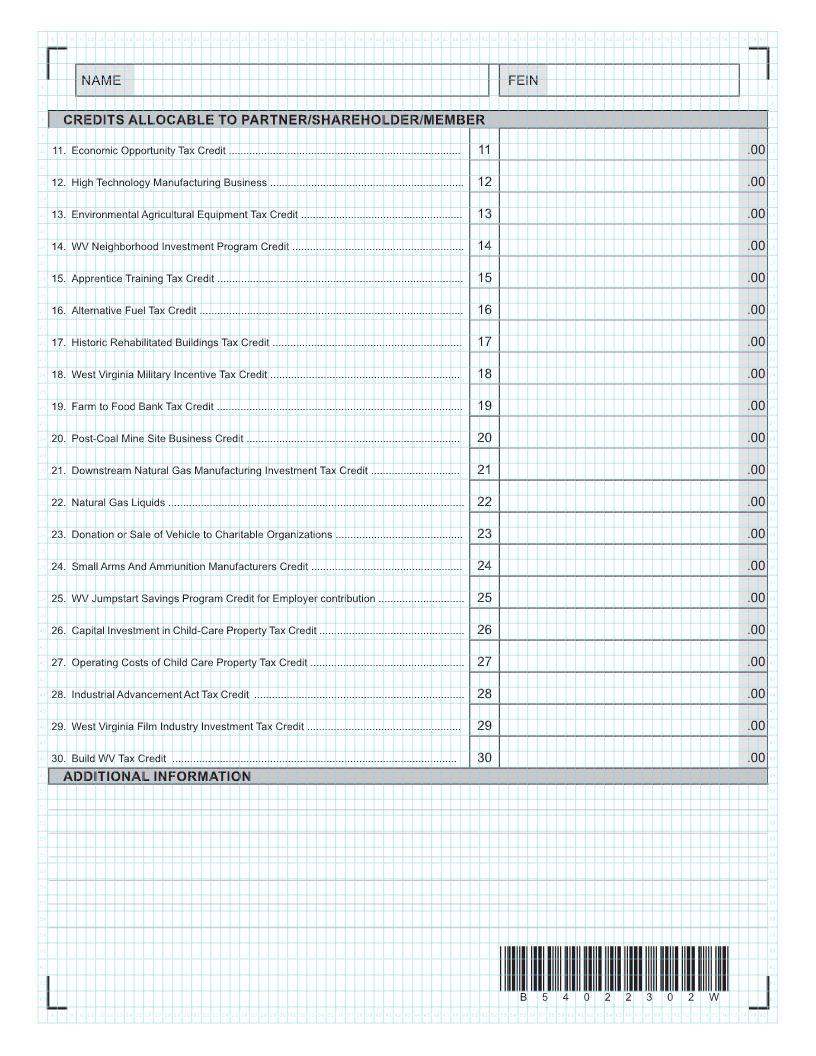

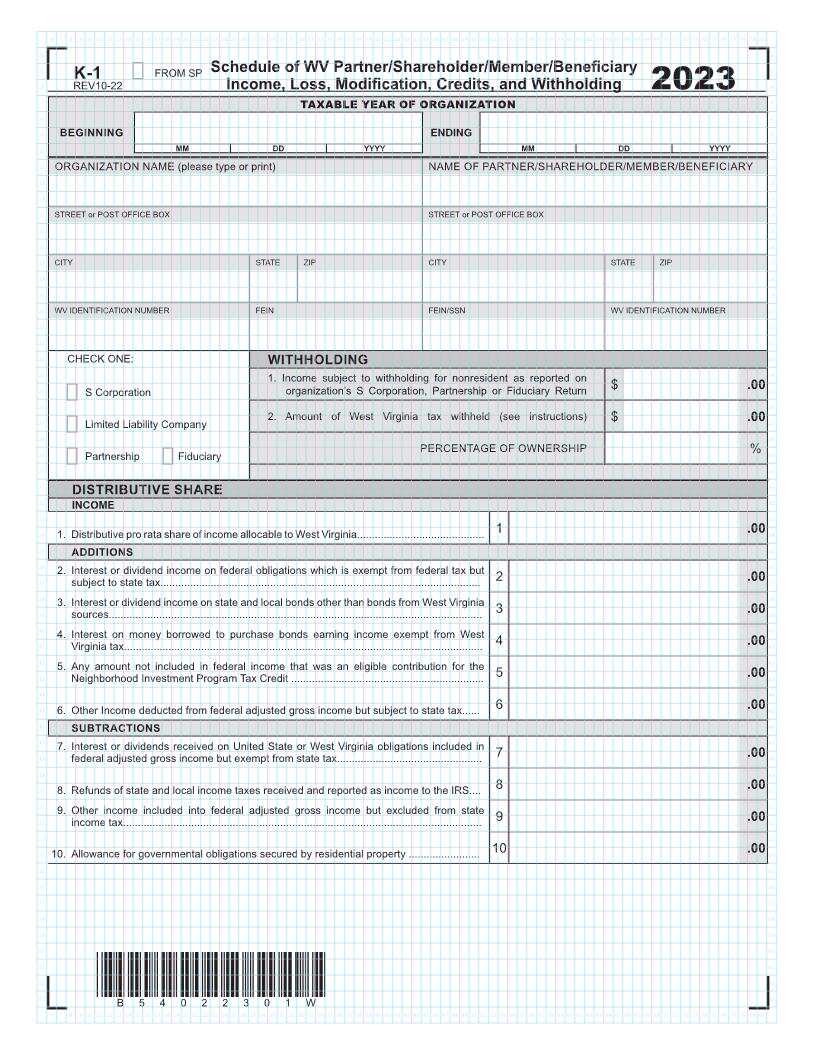

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980 4 4 5 K-1 FROM SP Schedule of WV Partner/Shareholder/Member/Beneficiary 5 6 6 REV10-22 Income,2023 Loss, Modification, Credits, and Withholding 7 TAXABLE YEAR OF ORGANIZATION 7 8 8 9 BEGINNING ENDING 9 10 MM DD YYYY MM DD YYYY 10 11 ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY 11 12 12 13 13 14 STREET or POST OFFICE BOX STREET or POST OFFICE BOX 14 15 15 16 16 17 CITY STATE ZIP CITY STATE ZIP 17 18 18 19 19 20 WV IDENTIFICATION NUMBER FEIN FEIN/SSN WV IDENTIFICATION NUMBER 20 21 21 22 22 23 CHECK ONE: WITHHOLDING 23 24 24 1. Income subject to withholding for nonresident as reported on 25 S Corporation organization’s S Corporation, Partnership or Fiduciary Return $ .00 25 26 26 2. Amount of West Virginia tax withheld (see instructions) 27 Limited Liability Company $ .00 27 28 28 PERCENTAGE OF OWNERSHIP 29 Partnership Fiduciary % 29 30 30 31 31 DISTRIBUTIVE SHARE 32 INCOME 32 33 33 34 1. Distributive pro rata share of income allocable to West Virginia........................................... 1 .00 34 35 ADDITIONS 35 36 36 2. Interest or dividend income on federal obligations which is exempt from federal tax but 37 subject to state tax............................................................................................................ 2 .00 37 38 38 3. Interest or dividend income on state and local bonds other than bonds from West Virginia 39 sources.............................................................................................................................. 3 .00 39 40 40 4. Interest on money borrowed to purchase bonds earning income exempt from West 41 Virginia tax......................................................................................................................... 4 .00 41 42 42 5. Any amount not included in federal income that was an eligible contribution for the 43 Neighborhood Investment Program Tax Credit ................................................................. 5 .00 43 44 44 45 6. Other Income deducted from federal adjusted gross income but subject to state tax...... 6 .00 45 46 SUBTRACTIONS 46 47 47 7. Interest or dividends received on United State or West Virginia obligations included in 48 federal adjusted gross income but exempt from state tax................................................. 7 .00 48 49 49 50 8. Refunds of state and local income taxes received and reported as income to the IRS.... 8 .00 50 51 51 9. Other income included into federal adjusted gross income but excluded from state 52 income tax......................................................................................................................... 9 .00 52 53 53 54 10. Allowance for governmental obligations secured by residential property ........................ 10 .00 54 55 55 56 56 57 57 58 58 59 59 60 60 61 61 62 62 63 *B54022301W* 63 B54022301W 67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980