Enlarge image

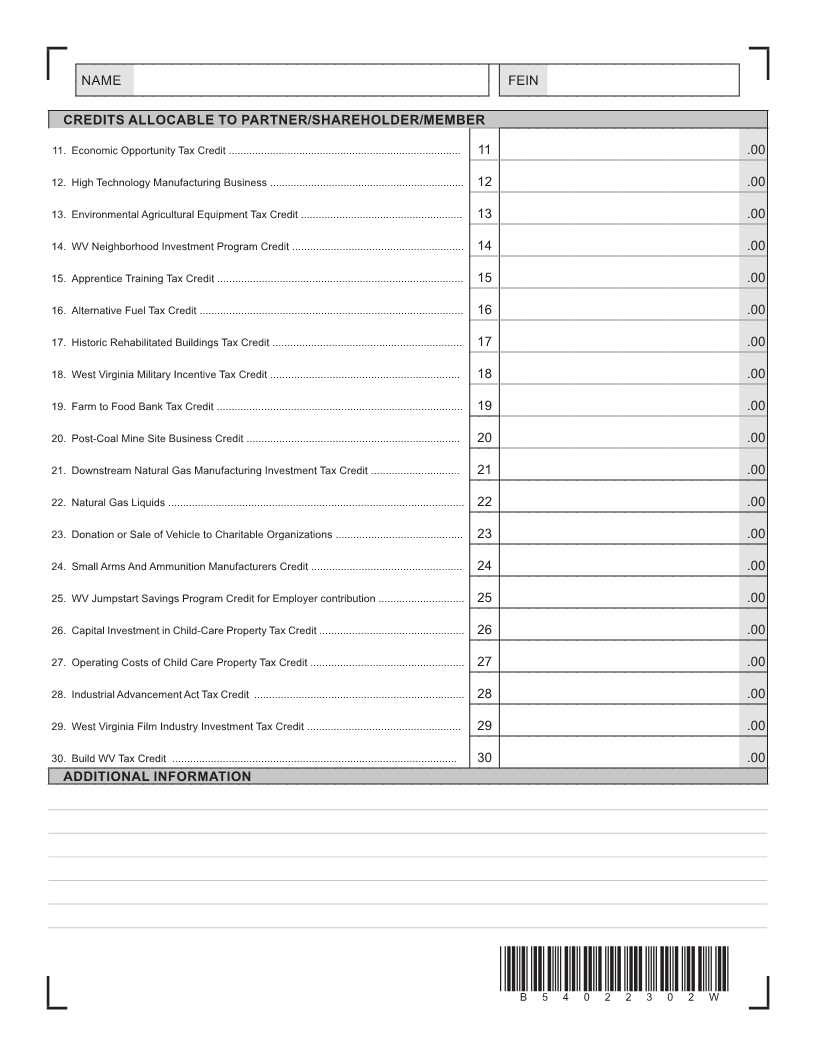

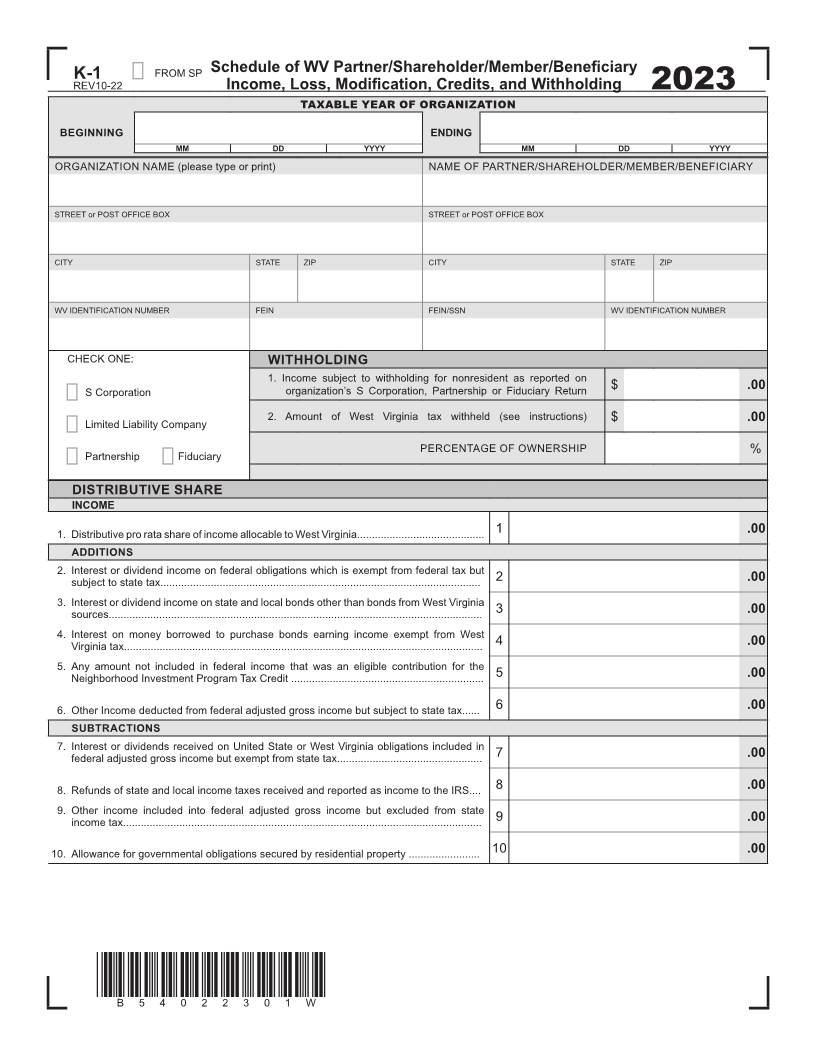

K-1 FROM SP Schedule of WV Partner/Shareholder/Member/Beneficiary REV10-22 Income, Loss, Modification, Credits, and Withholding 2023 TAXABLE YEAR OF ORGANIZATION BEGINNING ENDING MM DD YYYY MM DD YYYY ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY STREET or POST OFFICE BOX STREET or POST OFFICE BOX CITY STATE ZIP CITY STATE ZIP WV IDENTIFICATION NUMBER FEIN FEIN/SSN WV IDENTIFICATION NUMBER CHECK ONE: WITHHOLDING 1. Income subject to withholding for nonresident as reported on S Corporation organization’s S Corporation, Partnership or Fiduciary Return $ .00 2. Amount of West Virginia tax withheld (see instructions) Limited Liability Company $ .00 PERCENTAGE OF OWNERSHIP Partnership Fiduciary % DISTRIBUTIVE SHARE INCOME 1. Distributive pro rata share of income allocable to West Virginia........................................... 1 .00 ADDITIONS 2. Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax............................................................................................................ 2 .00 3. Interest or dividend income on state and local bonds other than bonds from West Virginia sources.............................................................................................................................. 3 .00 4. Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax......................................................................................................................... 4 .00 5. Any amount not included in federal income that was an eligible contribution for the Neighborhood Investment Program Tax Credit ................................................................. 5 .00 6. Other Income deducted from federal adjusted gross income but subject to state tax...... 6 .00 SUBTRACTIONS 7. Interest or dividends received on United State or West Virginia obligations included in federal adjusted gross income but exempt from state tax................................................. 7 .00 8. Refunds of state and local income taxes received and reported as income to the IRS.... 8 .00 9. Other income included into federal adjusted gross income but excluded from state income tax......................................................................................................................... 9 .00 10. Allowance for governmental obligations secured by residential property ........................ 10 .00 *B54022301W* B54022301W