Enlarge image

Extension of Time to File Fiduciary and

IT-141EXT

REV 07/2022 Information Returns

NOTE: This form is to be used for requesting an extension of time to lefi the duciaryfireturn and for

making tentative payments. This form is not a substitute for filing the annual tax returns.

WHO MAY FILE: Any Estate or Trust needing an extension of time to file the West Virginia Fiduciary

Income Tax Return (Form IT-141) and expects to owe tax must file the voucher below. Any taxpayer

granted an extension of time to file a federal return is granted the same extension of time to lefitheir

West Virginia return. An extension of time for lingfidoes not extend the time for payment. To avoid

interest and additions to tax for late payment, use this return to make a tentative payment pending the

fi ling of your annual return.

WHEN TO FILE: All returns must be filed on or before the 15th day of the fourth month following the

close of the taxable year or, if the due date falls on a Saturday, Sunday, or legal holiday, the next

business day. The taxable year of the estate or trust for West Virginia income tax purposes is the same

as the one used for federal tax purposes.

HOW AND WHERE TO FILE: Payment of any tax balance due may be made by completing the voucher

below, detaching and mailing to:

West Virginia Tax Division

Tax Account Administration

P.O. Box 2585

Charleston, WV 25329-2585

Make check payable to West Virginia Tax Division.

CLAIMING OF TENTATIVE PAYMENT: A tentative payment made by lingfithis voucher must be

claimed on line 12 of your West Virginia Fiduciary Income Tax Return (Form IT-141).

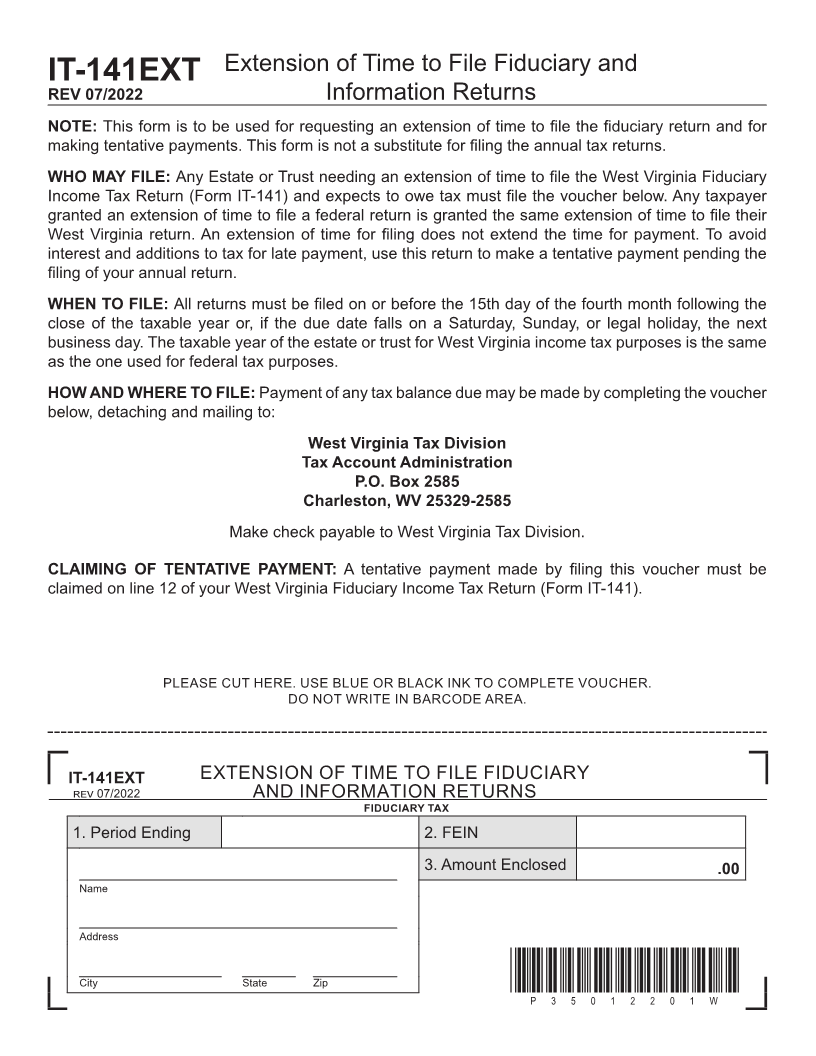

PLEASE CUT HERE. USE BLUE OR BLACK INK TO COMPLETE VOUCHER.

DO NOT WRITE IN BARCODE AREA.

IT-141EXT EXTENSION OF TIME TO FILE FIDUCIARY

07/2022 AND INFORMATION RETURNS

FIDUCIARY TAX

1. Period Ending 2. FEIN

3. Amount Enclosed .00

Name

Address

City State Zip *P35012201W*

P35012201W