Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

5 5

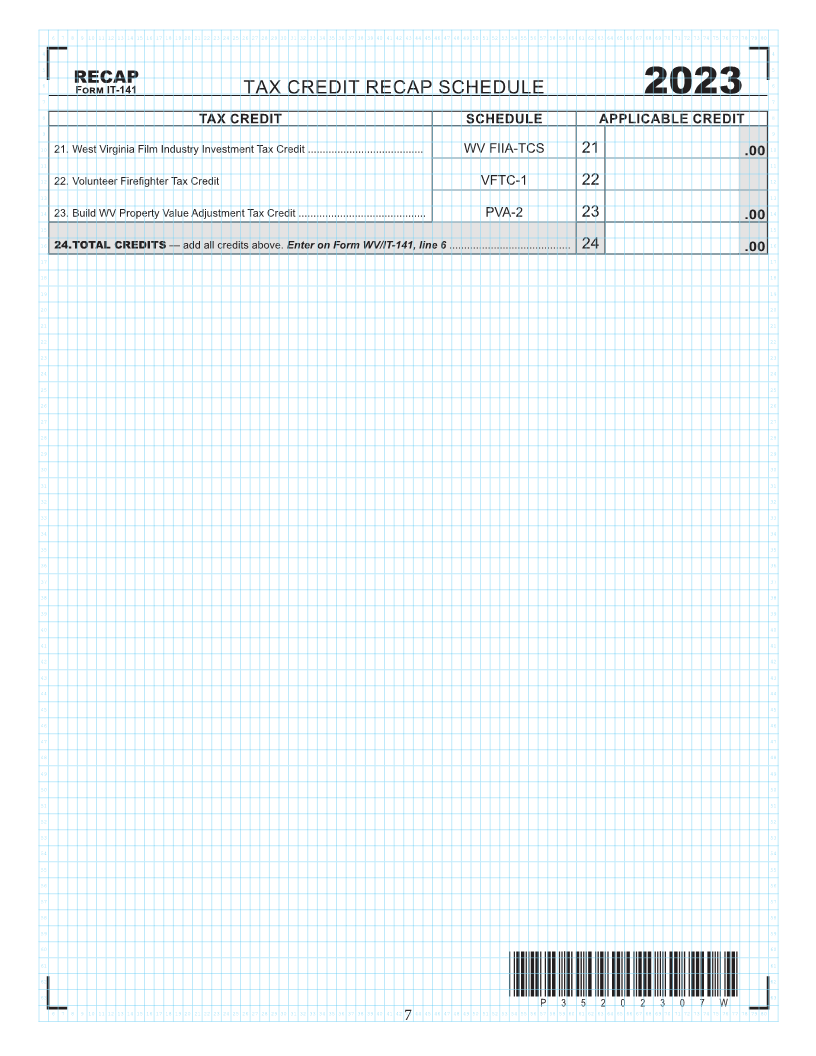

6 RECAP 6

7 Form IT-141 TAX CREDIT RECAP SCHEDULE 2023 7

8 Both this summary form and the appropriate credit calculation schedule(s) or form(s) must be enclosed with your return to claim a tax credit. Information for these tax 8

credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at 1-800-982-8297.

9 9

10 10

TAX CREDIT SCHEDULE APPLICABLE CREDIT

11 11

12 12

1. Credit for Income Tax paid to another state(s)................................................ E 1 .00

13 13

14 ** For what states? 14

15 15

16 16

2. General Economic Opportunity Tax Credit...................................................... EOTC-PIT 2 .00

17 17

18 18

3. High Technology Manufacturing Business ..................................................... EOTC-HTM 3 .00

19 19

20 20

4. WV Environmental Agricultural Equipment Credit.......................................... AG-1 4 .00

21 21

22 22

5. WV Military Incentive Credit........................................................................... J 5 .00

23 23

24 24

6. Neighborhood Investment Program Credit..................................................... NIPA-2 6 .00

25 25

26 26

7. Historic Rehabilitated Buildings Investment Credit (income producing)......... RBIC 7 .00

27 27

28 8. Residential Historic Rehabilitated Buildings Investment Credit 28

(not income producing) .................................................................................. RBIC-A 8 .00

29 29

30 30

9. Apprenticeship Training Tax Credit................................................................ ATTC-1 9 .00

31 31

32 32

10. Alternative-Fuel Tax Credit............................................................................. AFTC-1 10 .00

33 33

34 34

11. Farm to Food Bank Tax Credit...................................................................... 11 .00

35 35

36 36

12. Downstream Natural Gas Manufacturing Investment Tax Credit ................. DNG- 2 12 .00

37 37

38 38

13. Post Coal Mine Site Business Credit ........................................................... PCM-2 13 .00

39 39

40 40

14. Natural Gas Liquids ....................................................................................... NGL-2 14 .00

41 41

42 42

15. Donation or Sale of Vehicle to Qualified Charitable Organizations ............... DSV-1 15 .00

43 43

44 44

16. Small Arms And Ammunition Manufacturers Credit ....................................... SAAM-1 16 .00

45 45

46 46

17. West Virginia Jumpstart Savings Program Credit (Employer Use Only) ....... JSP-1 17 .00

47 47

48 48

18. Capital Investment in Child-Care Property Tax Credit ................................... CIP 18 .00

49 49

50 50

19. Operating Costs of Child Care Property Tax Credit ....................................... OCF 19 .00

51 51

52 52

20. Industrial Advancement Act Tax Credit .......................................................... 20 .00

53 53

Continues on next page

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

63 *P35202306W* 63

P35202306W

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

6