Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

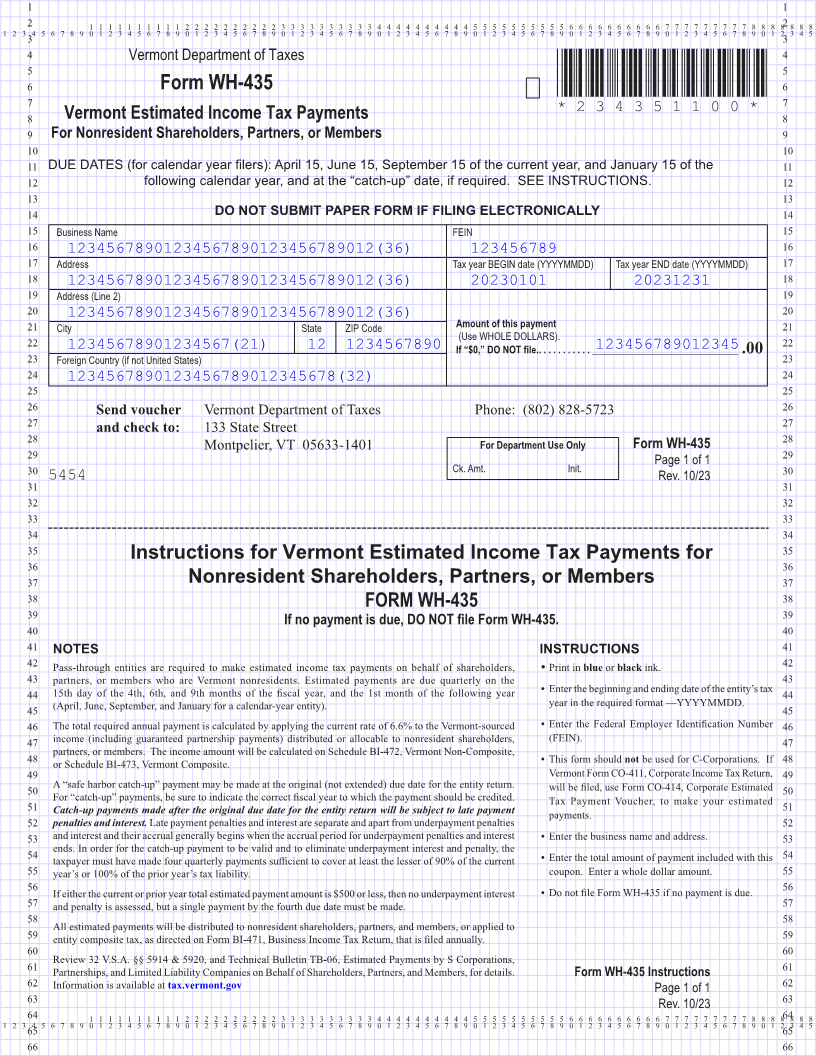

4 Vermont Department of Taxes 4

5 5

6 Form WH-435 *234351100* 6

7 7

Vermont Estimated Income Tax Payments *234351100*

8 8 Page

9 For Nonresident Shareholders, Partners, or Members 9 Page 11

10 10

11 DUE DATES (for calendar year filers): April 15, June 15, September 15 of the current year, and January 15 of the 11

12 following12 calendar year, and at the “catch-up” date, if required. SEE INSTRUCTIONS.

13 13

14 DO NOT SUBMIT PAPER FORM IF FILING ELECTRONICALLY 14

15 Business Name FEIN 15

16 16

12345678901234567890123456789012(36) 123456789

17 Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD) 17

18 18

12345678901234567890123456789012(36) 20230101 20231231

19 Address (Line 2) 19

20 20

21 12345678901234567890123456789012(36) City State ZIP Code Amount of this payment 21

22 (Use WHOLE DOLLARS). 22

12345678901234567(21) 12 1234567890 If “$0,” DO NOT file. ........... ______________________________123456789012345.00

23 Foreign Country (if not United States) 23

24 24

1234567890123456789012345678(32)

25 25 FORM (Place at FIRST page)

26 Send voucher Vermont Department of Taxes Phone: (802) 828-5723 26 Form pages

27 27

and check to: 133 State Street

28 For Department Use Only 28

Montpelier, VT 05633-1401 Form WH-435

29 Page 1 of 1 29

Ck. Amt. Init.

30 5454 Rev. 10/23 30

31 31

1 - 1

32 32

33 33

34 34

35 35

Instructions for Vermont Estimated Income Tax Payments for

36 36

37 Nonresident Shareholders, Partners, or Members 37

38 38

FORM WH-435

39 39

If no payment is due, DO NOT file Form WH-435.

40 40

41 NOTES INSTRUCTIONS 41

42 Pass-through entities are required to make estimated income tax payments on behalf of shareholders, • Print in blue or black ink. 42

43 partners, or members who are Vermont nonresidents. Estimated payments are due quarterly on the 43

44 15th day of the 4th, 6th, and 9th months of the fiscal year, and the 1st month of the following year • Enter the beginning and ending date of the entity’s tax 44

45 (April, June, September, and January for a calendar-year entity). year in the required format —YYYYMMDD. 45

46 The total required annual payment is calculated by applying the current rate of 6.6% to the Vermont-sourced • Enter the Federal Employer Identification Number 46

47 income (including guaranteed partnership payments) distributed or allocable to nonresident shareholders, (FEIN). 47

partners, or members. The income amount will be calculated on Schedule BI-472, Vermont Non-Composite,

48 or Schedule BI-473, Vermont Composite. • This form should not be used for C-Corporations. If 48

49 Vermont Form CO-411, Corporate Income Tax Return, 49

A “safe harbor catch-up” payment may be made at the original (not extended) due date for the entity return. will be filed, use Form CO-414, Corporate Estimated

50 For “catch-up” payments, be sure to indicate the correct fiscal year to which the payment should be credited. Tax Payment Voucher, to make your estimated 50

51 Catch-up payments made after the original due date for the entity return will be subject to late payment payments. 51

52 penalties and interest. Late payment penalties and interest are separate and apart from underpayment penalties 52

53 and interest and their accrual generally begins when the accrual period for underpayment penalties and interest • Enter the business name and address. 53

ends. In order for the catch-up payment to be valid and to eliminate underpayment interest and penalty, the

54 taxpayer must have made four quarterly payments sufficient to cover at least the lesser of 90% of the current • Enter the total amount of payment included with this 54

55 year’s or 100% of the prior year’s tax liability. coupon. Enter a whole dollar amount. 55

56 • Do not file Form WH-435 if no payment is due. 56 FORM (Place at LAST page)

If either the current or prior year total estimated payment amount is $500 or less, then no underpayment interest

57 and penalty is assessed, but a single payment by the fourth due date must be made. 57 Form pages

58 58

All estimated payments will be distributed to nonresident shareholders, partners, and members, or applied to

59 entity composite tax, as directed on Form BI-471, Business Income Tax Return, that is filed annually. 59

60 60

Review 32 V.S.A. §§ 5914 & 5920, and Technical Bulletin TB-06, Estimated Payments by S Corporations,

61 Partnerships, and Limited Liability Companies on Behalf of Shareholders, Partners, and Members, for details. Form WH-435 Instructions 61

62 Information is available at tax.vermont.gov Page 1 of 1 62 1 - 1

63 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66