Enlarge image

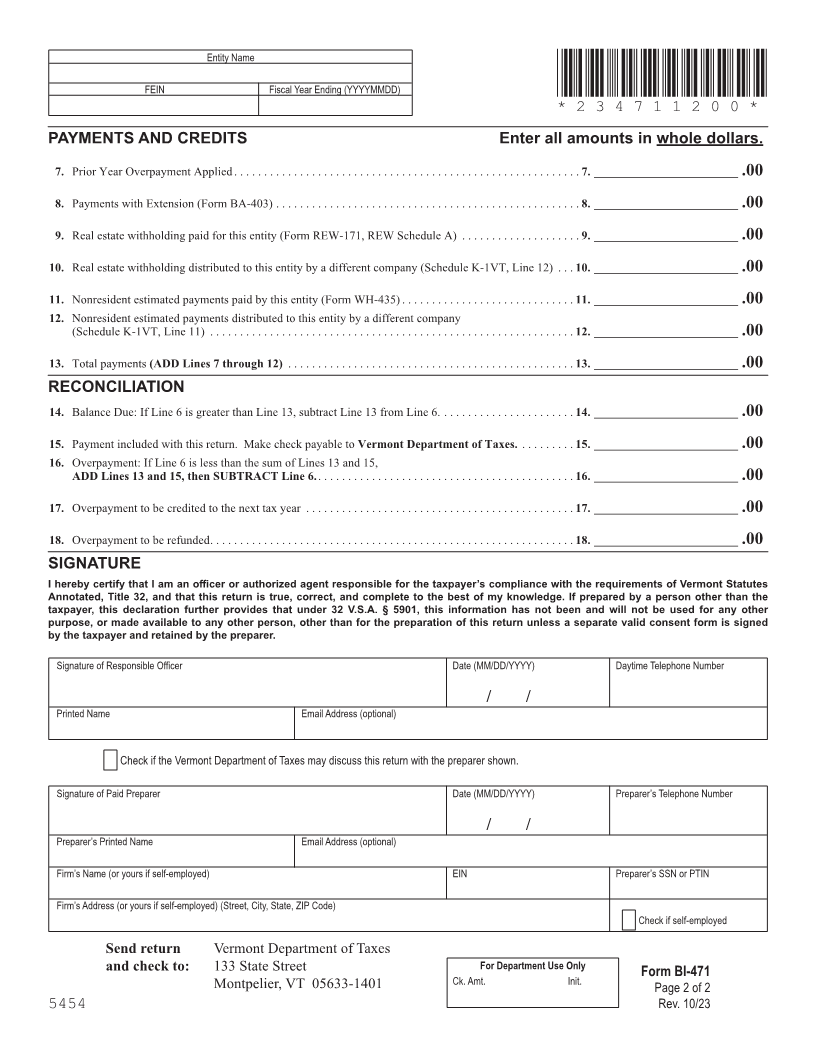

Vermont Department of Taxes

Form BI-471 *234711100*

Vermont Business Income Tax Return *234711100*

for Partnerships, Subchapter S Corporations, and LLCs Page 11

Check Name Composite Accounting Initial Public Law Pro Forma -

Change Return Period Change Return 86-272 Applies Cannabis

Appropriate

Box(es) Address Amended Extended Federal Final Return

Change Return Return Extension Requested (Cancels Account)

Entity Name FEIN Primary 6-digit NAICS number

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

Address (Line 2)

Federal tax

City State ZIP Code return filed

(Check one 1120S 1065 Other

Foreign Country (if not United States) box)

FORM (Place at FIRST page)

A. Were any shareholders, partners, or members nonresidents of Vermont during this tax year? . . . . . . . . . . A. Yes No Form pages

B. Did this entity have income or losses derived from at least one state other than Vermont? . . . . . . . . . . . . . B. Yes No

If Yes, complete and attach Schedule BI-477 .

C. Net adjustment to income resulting from Vermont’s disallowance of

“bonus depreciation” (IRC 168(k)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C. ________________________ .00 11 - 12

D. Total number of Shareholders, Partners, or Members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. ____________________________

E. How many are Vermont Residents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .E. ____________________________

F. How many are Nonresidents? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .F. ____________________________

G. Check box if 32 V .S .A . § 5920(f), (g), or (h) applies (regarding nonresident estimated payments for affordable housing projects,

federal new market tax credit projects, or publicly traded partnerships) . Attach authorization or documentation . . . . . . . . . . . . . . . . . . . . G.

TAX COMPUTATION (see instructions): Enter all amounts in whole dollars.

Check box if exception NO VERMONT ACTIVITY / INVESTMENT CLUB § 5921 IRC § 761

INACTIVE ($0) ($0) ($0)

to minimum tax applies:

1. Vermont minimum entity tax ($250) or above exception (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 1. ________________________ .00

2. For non-composite entities

2a. Nonresident estimated payment requirement

(Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. ________________________ .00

2b. Overpayment distributed to owners (ADD Schedule K-1VT,

Lines 11 and 12 from all schedules, then SUBTRACT

amount from Schedule BI-472, Line 6) . . . . . . . . . . . . . . . . . . 2b. ________________________ .00

2c. ADD Lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c. ________________________.00

3. For composite entities, Vermont composite tax due (Schedule BI-473, Line 11) . . . . . . . . . . . . . . . . . . . . . 3. ________________________ .00

4. Vermont apportionment of entity level taxes (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________ .00

5. Use Tax for taxable items on which no sales tax was charged, including online purchases . . . . . . . . . . . . . 5. ________________________ .00

6. Total tax due (ADD Lines 1, 2c, 3, 4, and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ________________________ .00

Form BI-471

5454 Page 1 of 2, Rev. 10/23