Enlarge image

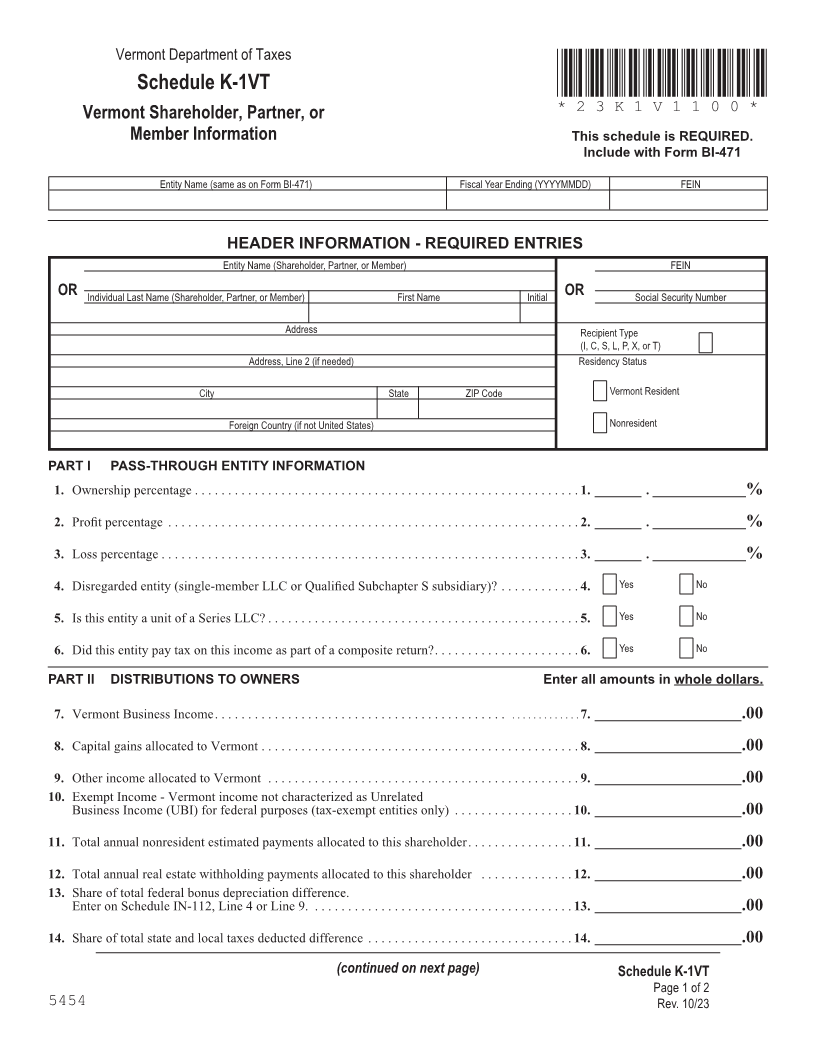

Vermont Department of Taxes

Schedule K-1VT *23K1V1100*

Vermont Shareholder, Partner, or *23K1V1100*

Page 7

Member Information This schedule is REQUIRED.

Include with Form BI-471

Entity Name (same as on Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

HEADER INFORMATION - REQUIRED ENTRIES

Entity Name (Shareholder, Partner, or Member) FEIN

OR Individual Last Name (Shareholder, Partner, or Member) First Name Initial OR Social Security Number

Address Recipient Type

(I, C, S, L, P, X, or T)

Address, Line 2 (if needed) Residency Status

City State ZIP Code Vermont Resident FORM (Place at FIRST page)

Form pages

Foreign Country (if not United States) Nonresident

PART I PASS-THROUGH ENTITY INFORMATION

1. Ownership percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _______ . ______________% 7 - 8

2. Profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . _______ . ______________% percentage

3. Loss percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. _______ . ______________%

4. Disregarded entity (single-member LLC or Qualified Subchapter S subsidiary)? . . . . . . . . . . . . 4. Yes No

5. Is this entity a unit of a Series LLC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. Yes No

6. Did this entity pay tax on this income as part of a composite return? . . . . . . . . . . . . . . . . . . . . . . 6. Yes No

PART II DISTRIBUTIONS TO OWNERS Enter all amounts in whole dollars.

7. Vermont Business Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ______________________.00

8. Capital gains allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ______________________.00

9. Other income allocated to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______________________.00

10. Exempt Income - Vermont income not characterized as Unrelated

Business Income (UBI) for federal purposes (tax-exempt entities only) . . . . . . . . . . . . . . . . . . 10. ______________________.00

11. Total annual nonresident estimated payments allocated to this shareholder . . . . . . . . . . . . . . . . 11. ______________________.00

12. Total annual real estate withholding payments allocated to this shareholder . . . . . . . . . . . . . . 12. ______________________.00

13. Share of total federal bonus depreciation difference.

Enter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. . ______________________.00 on Schedule IN-112, Line 4 or Line 9.

14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. . ______________________.00 Share of total state and local taxes deducted difference

(continued on next page) Schedule K-1VT

Page 1 of 2

5454 Rev. 10/23