Enlarge image

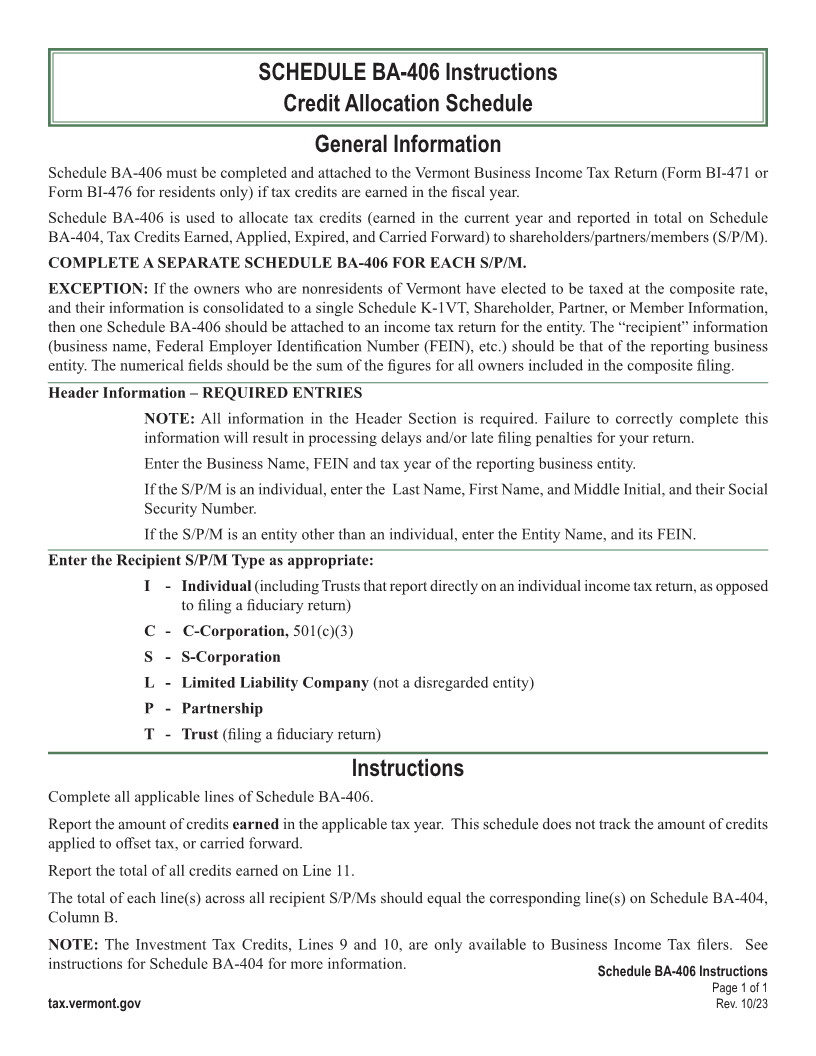

SCHEDULE BA-406 Instructions

Credit Allocation Schedule

Page 1

General Information

Schedule BA-406 must be completed and attached to the Vermont Business Income Tax Return (Form BI-471 or

Form BI-476 for residents only) if tax credits are earned in the fiscal year.

Schedule BA-406 is used to allocate tax credits (earned in the current year and reported in total on Schedule

BA-404, Tax Credits Earned, Applied, Expired, and Carried Forward) to shareholders/partners/members (S/P/M).

COMPLETE A SEPARATE SCHEDULE BA-406 FOR EACH S/P/M.

EXCEPTION: If the owners who are nonresidents of Vermont have elected to be taxed at the composite rate,

and their information is consolidated to a single Schedule K-1VT, Shareholder, Partner, or Member Information,

then one Schedule BA-406 should be attached to an income tax return for the entity. The “recipient” information

(business name, Federal Employer Identification Number (FEIN), etc.) should be that of the reporting business

entity. The numerical fields should be the sum of the figures for all owners included in the composite filing.

Header Information – REQUIRED ENTRIES INSTR (Place at FIRST page)

Instr. pages

NOTE: All information in the Header Section is required. Failure to correctly complete this

information will result in processing delays and/or late filing penalties for your return.

Enter the Business Name, FEIN and tax year of the reporting business entity.

If the S/P/M is an individual, enter the Last Name, First Name, and Middle Initial, and their Social 1 - 1

Security Number.

If the S/P/M is an entity other than an individual, enter the Entity Name, and its FEIN.

Enter the Recipient S/P/M Type as appropriate:

I - Individual (including Trusts that report directly on an individual income tax return, as opposed

to filing a fiduciary return)

C - C-Corporation, 501(c)(3)

S - S-Corporation

L - Limited Liability Company (not a disregarded entity)

P - Partnership

T - Trust (filing a fiduciary return)

Instructions

Complete all applicable lines of Schedule BA-406.

Report the amount of credits earned in the applicable tax year. This schedule does not track the amount of credits

INSTR (Place at LAST page)

applied to offset tax, or carried forward. Instr. pages

Report the total of all credits earned on Line 11.

The total of each line(s) across all recipient S/P/Ms should equal the corresponding line(s) on Schedule BA-404,

Column B.

1 - 1

NOTE: The Investment Tax Credits, Lines 9 and 10, are only available to Business Income Tax filers. See

instructions for Schedule BA-404 for more information.

Schedule BA-406 Instructions

Page 1 of 1

tax.vermont.gov Rev. 10/23