Enlarge image

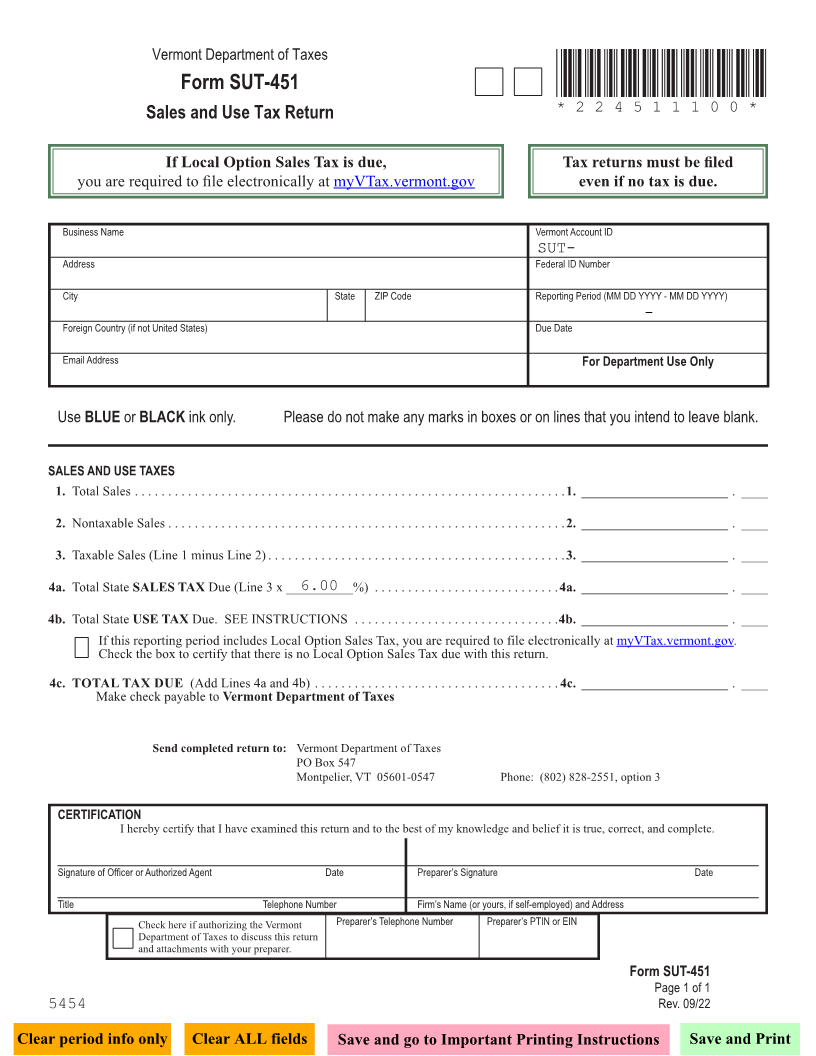

Vermont Department of Taxes

Sales and Use Tax Return

Page 3

For faster processing, file and pay Sales and Use Tax online at myVTax.vermont.gov.

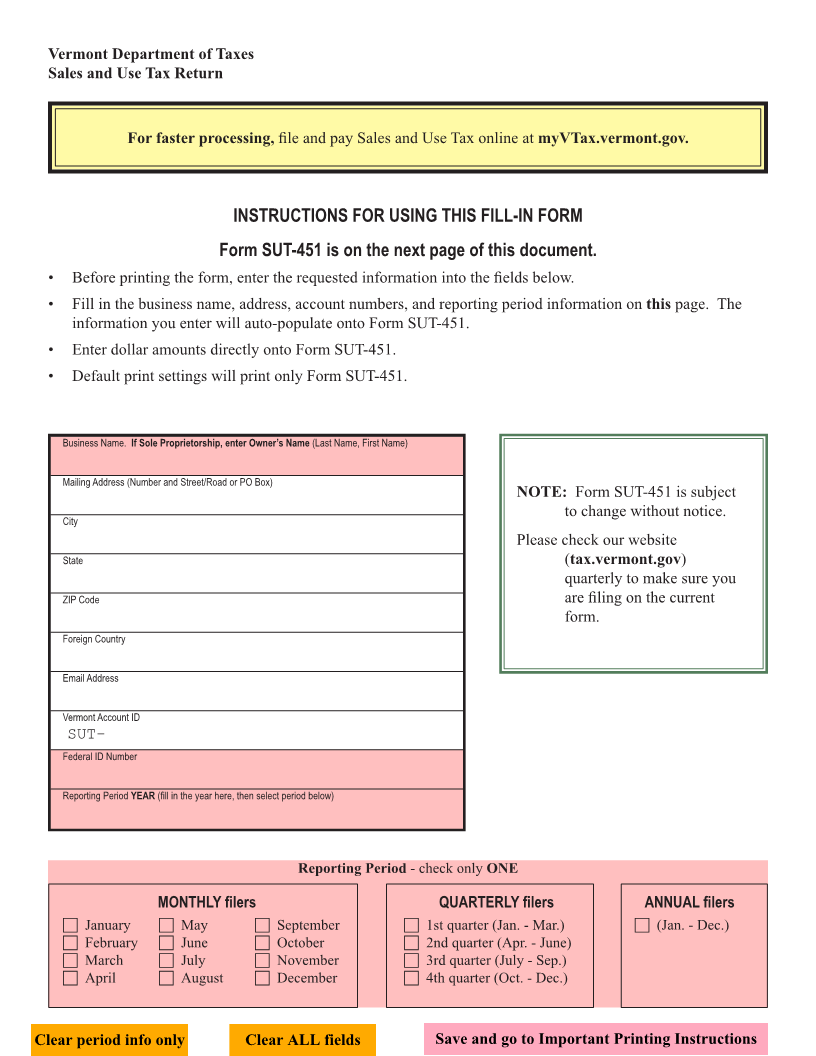

INSTRUCTIONS FOR USING THIS FILL-IN FORM

Form SUT-451 is on the next page of this document.

• Before printing the form, enter the requested information into the fields below.

• Fill in the business name, address, account numbers, and reporting period information on this page. The

information you enter will auto-populate onto Form SUT-451.

• Enter dollar amounts directly onto Form SUT-451.

• Default print settings will print only Form SUT-451.

FORM (Place at FIRST page)

Form pages

Business Name. If Sole Proprietorship, enter Owner’s Name (Last Name, First Name)

Mailing Address (Number and Street/Road or PO Box)

NOTE: Form SUT-451 is subject 3 - 4

to change without notice.

City

Please check our website

State (tax.vermont.gov)

quarterly to make sure you

ZIP Code are filing on the current

form.

Foreign Country

Email Address

Vermont Account ID

SUT-

Federal ID Number

Reporting Period YEAR (fill in the year here, then select period below)

Reporting Period - check only ONE

MONTHLYQUARTERLYANNUALfilersfilersfilers

c January c May c September c 1st quarter (Jan. - Mar.) c (Jan. - Dec.)

c February c June c October c 2nd quarter (Apr. - June)

c March c July c November c 3rd quarter (July - Sep.)

c April c August c December c 4th quarter (Oct. - Dec.)

Clear period info only Clear ALL fields Save and go to Important Printing Instructions