Enlarge image

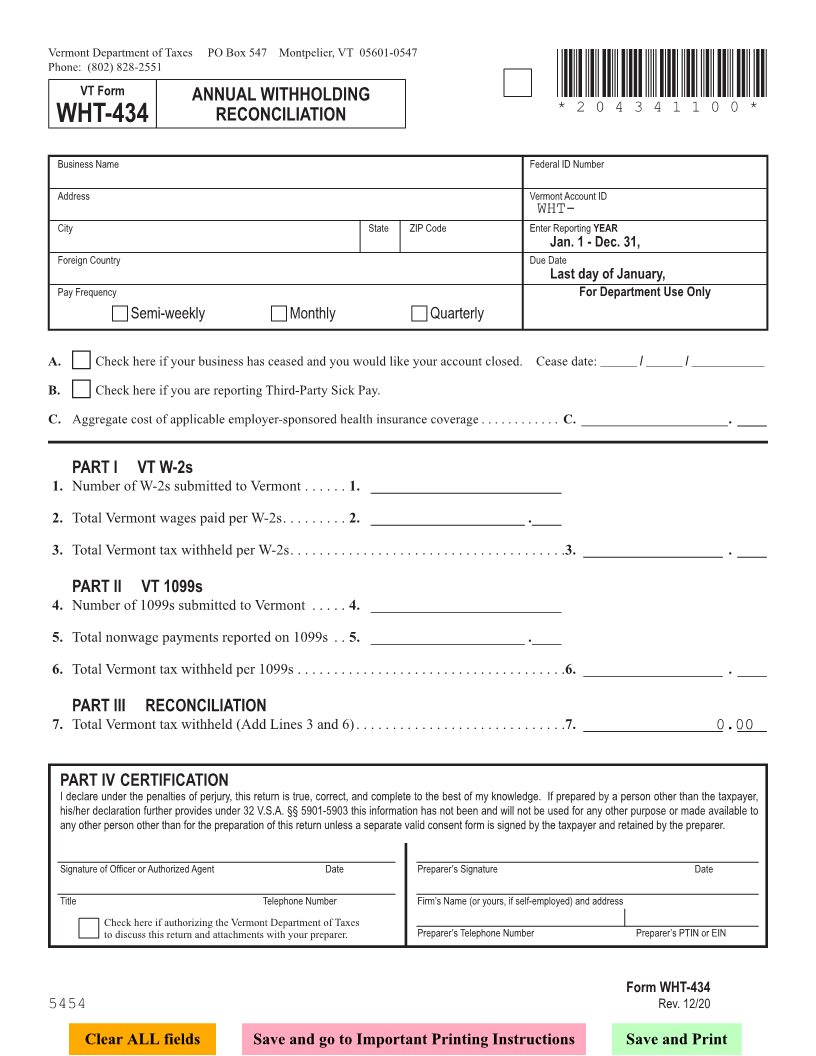

Vermont Department of Taxes PO Box 547 Montpelier, VT 05601-0547

Phone: (802) 828-2551

VT Form *204341100*

ANNUAL WITHHOLDING

*204341100*

WHT-434 RECONCILIATION Page 2

Business Name Federal ID Number

Address Vermont Account ID

WHT-

City State ZIP Code Enter Reporting YEAR

Jan. 1 - Dec. 31,

Foreign Country Due Date

Last day of January,

PayFor Department Use Only Frequency

c Semi-weekly c Monthly c Quarterly

A. c Check here if your business has ceased and you would like your account closed . Cease date: ______ / ______ / ____________

B. c Check here if you are reporting Third-Party Sick Pay . FORM (Place at FIRST page)

Form pages

C. Aggregate cost of applicable employer-sponsored health insurance coverage . . . . . . . . . . . . C. ______________________ . ____

PART I VT W-2s

1. Number of W-2s submitted to Vermont . . . . . . 1. __________________________

2 - 2

2. Total Vermont wages paid per W-2s . . . . . . . . . 2. _____________________ . ____

3. Total Vermont tax withheld per W-2s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. ___________________ . ____

PART II VT 1099s

4. Number of 1099s submitted to Vermont . . . . . 4. __________________________

5. Total nonwage payments reported on 1099s . . 5. _____________________ . ____

6. Total Vermont tax withheld per 1099s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. ___________________ . ____

PART III RECONCILIATION

7. Total Vermont tax withheld (Add Lines 3 and 6) . . . . . . . . . . . . . . . . . . . 7. . ___________________. . . . . . . . . 0.00. ____

PART IV CERTIFICATION

I declare under the penalties of perjury, this return is true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer,

his/her declaration further provides under 32 V.S.A. §§ 5901-5903 this information has not been and will not be used for any other purpose or made available to

any other person other than for the preparation of this return unless a separate valid consent form is signed by the taxpayer and retained by the preparer. FORM (Place at LAST page)

Form pages

Signature of Officer or Authorized Agent Date Preparer’s Signature Date

Title Telephone Number Firm’s Name (or yours, if self-employed) and address

Check here if authorizing the Vermont Department of Taxes Preparer’sPreparer’s2 - 2 TelephonePTINNumberor EIN

to discuss this return and attachments with your preparer .

Form WHT-434

5454 Rev. 12/20

Clear ALL fields Save and go to Important Printing Instructions Save and Print