Enlarge image

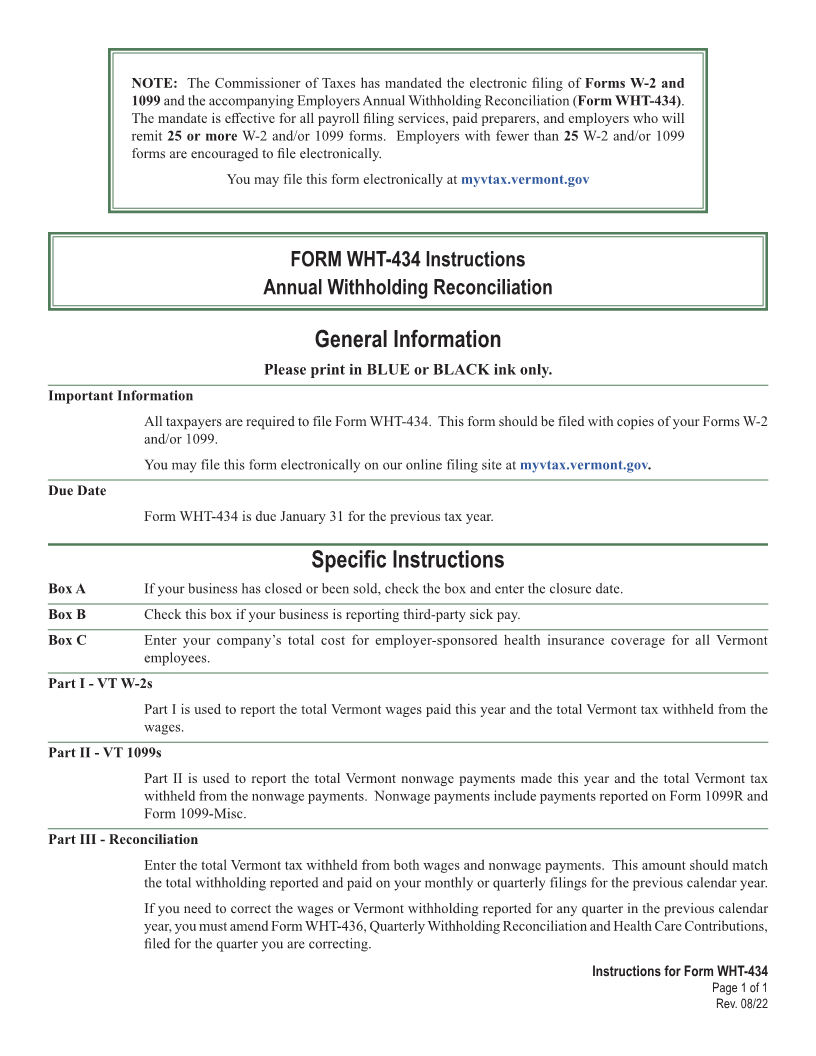

NOTE: The Commissioner of Taxes has mandated the electronic filing of Forms W-2 and

1099 and the accompanying Employers Annual Withholding Reconciliation (Form WHT-434).

The mandate is effective for all payroll filing services, paid preparers, and employers who will Page 1

remit 25 or more W-2 and/or 1099 forms. Employers with fewer than 25 W-2 and/or 1099

forms are encouraged to file electronically.

You may file this form electronically at myvtax.vermont.gov

FORM WHT-434 Instructions

Annual Withholding Reconciliation

General Information

Please print in BLUE or BLACK ink only.

Important Information INSTR (Place at FIRST page)

Instr. pages

All taxpayers are required to file Form WHT-434. This form should be filed with copies of your Forms W-2

and/or 1099.

You may file this form electronically on our online filing site at myvtax.vermont.gov.

Due Date 1 - 1

Form WHT-434 is due January 31 for the previous tax year.

Specific Instructions

Box A If your business has closed or been sold, check the box and enter the closure date.

Box B Check this box if your business is reporting third-party sick pay.

Box C Enter your company’s total cost for employer-sponsored health insurance coverage for all Vermont

employees.

Part I - VT W-2s

Part I is used to report the total Vermont wages paid this year and the total Vermont tax withheld from the

wages.

Part II - VT 1099s

Part II is used to report the total Vermont nonwage payments made this year and the total Vermont tax

INSTR (Place at LAST page)

withheld from the nonwage payments. Nonwage payments include payments reported on Form 1099R and

Instr. pages

Form 1099-Misc.

Part III - Reconciliation

Enter the total Vermont tax withheld from both wages and nonwage payments. This amount should match

the total withholding reported and paid on your monthly or quarterly filings for the previous calendar year.

1 - 1

If you need to correct the wages or Vermont withholding reported for any quarter in the previous calendar

year, you must amend Form WHT-436, Quarterly Withholding Reconciliation and Health Care Contributions,

filed for the quarter you are correcting.

Instructions for Form WHT-434

Page 1 of 1

Rev. 08/22