Enlarge image

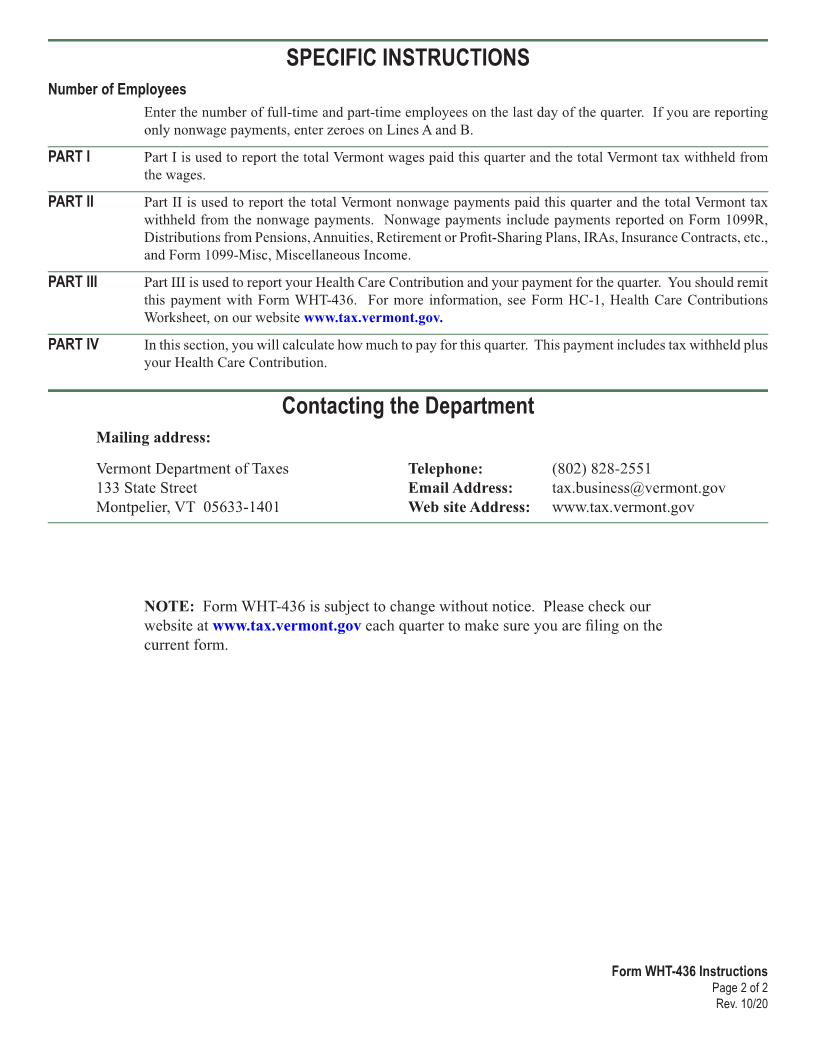

FORM WHT-436 Instructions

Quarterly Withholding Reconciliation

Page 1

GENERAL INFORMATION

Please print in BLUE or BLACK ink only.

IMPORTANT INFORMATION

Quarter Form WHT-436 Due Dates*

January 1 – March 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . April 25

April 1 – June 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . July 25

July 1 – September 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . October 25

October 1 – December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . January 25

*If the due date falls on a weekend or holiday, the return is due the next business day .

All taxpayers (Quarterly, Monthly, and Semi-Weekly) are required to file Form WHT-436 at the close of each

quarter. Returns must be filed every quarter even if no tax is due. Visit our secure online filing site at INSTR (Place at FIRST page)

www.myVTax.vermont.gov to file this form electronically. Please only file one WHT-436 return each Instr . pages

quarter, per account.

Quarterly Payments – You are required to file Form WHT-436 on the quarterly filing date. You may file a return and remit

your payment at the same time. If you are unable to file your return electronically, you may find a copy of

our fillable form at www.tax.vermont.gov.

1 - 2

Monthly Payments – You are required to file Form WHT-436 on the quarterly filing date. You must remit payments every

month by the 25th. You may submit payments electronically via ACH Debit or ACH Credit. If you are

unable to submit payments electronically, you may submit payments for the first two months of the quarter

using Form WHT-430, Withholding Tax Payment Voucher. Submit your final payment for the quarter with

Form WHT-436.

Semi-Weekly Payments – You are required to file Form WHT-436 on the quarterly filing date. You must remit your payments

electronically via ACH Debit or ACH Credit.

See our website at www.tax.vermont.gov for detailed instructions regarding Vermont Income Tax Withholding.

Form WHT-436 Instructions

Page 1 of 2

Rev. 10/20