Enlarge image

Vermont Department of Taxes

Schedule BA-402 *234021100*

Vermont Apportionment & Allocation *234021100*

Page 5

Include with Form CO-411

Entity Name (same as on Form CO-411) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

PART I Non-Apportionable Income and Foreign Dividends

Enter all amounts in WHOLE DOLLARS.

A. Everywhere B. Vermont

1. Non-Apportionable Income . . . . . . . 1A. ._________________________-123456789012345 .00 1B. _________________________-123456789012345 .00

2. Foreign Dividends . . . . . . . . . . . . . . 2A. ._________________________-123456789012345 .00 2B. _________________________-123456789012345 .00

PART II Sales and Receipts Factor

Section A Sales and Receipts Factor FORM (Place at FIRST page)

A. Everywhere B. Vermont Form pages

123456789012345 3. Sales or gross receipts . . . . . . . . . . . 3A. ._________________________.00

123456789012345 4. Sales of Services received in or delivered to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . .4B. _________________________ .00

5. Sales of tangible personal property delivered or shipped to purchasers in Vermont 5 - 6

123456789012345from outside Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5B. _________________________ .00

6. Sales of tangible personal property delivered or shipped to purchasers in Vermont

123456789012345from within Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6B. _________________________ .00

123456789012345 7. Special Industries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7B. . _________________________.00

8. Apportionable interest and

dividends . . . . . . . . . . . . . . . . . . . . . 8A.._________________________123456789012345 .00 8B. _________________________123456789012345 .00

9. Factors from pass through entities . . 9A.._________________________123456789012345 .00 9B. _________________________123456789012345 .00

10. Royalties . . . . . . . . . . . . . . . . . . . . 10A. ._________________________123456789012345 .00 10B. _________________________123456789012345 .00

11. Gross rents . . . . . . . . . . . . . . . . . . . 11A. ._________________________123456789012345 .00 11B. _________________________123456789012345 .00

12. Other apportionable income (attach

detailed supporting statement) . . . . 12A. ._________________________123456789012345 .00 12B. _________________________123456789012345 .00

13. Total INCOME, SALES, AND

GROSS RECEIPTS

(ADD Lines 3 through 12) . . . . . . 13A. ._________________________123456789012345 .00 13B. _________________________123456789012345 .00

14. Vermont Sales and Receipts factor as percent of Everywhere .

(DIVIDE Line 13B by Line 13A. MULTIPLY the result by 100 and carry the

result out to the sixth decimal place.) Enter this figure on Form CO-411, Line 6 . . . . . . . . 14. . _________. 100 123456____________%

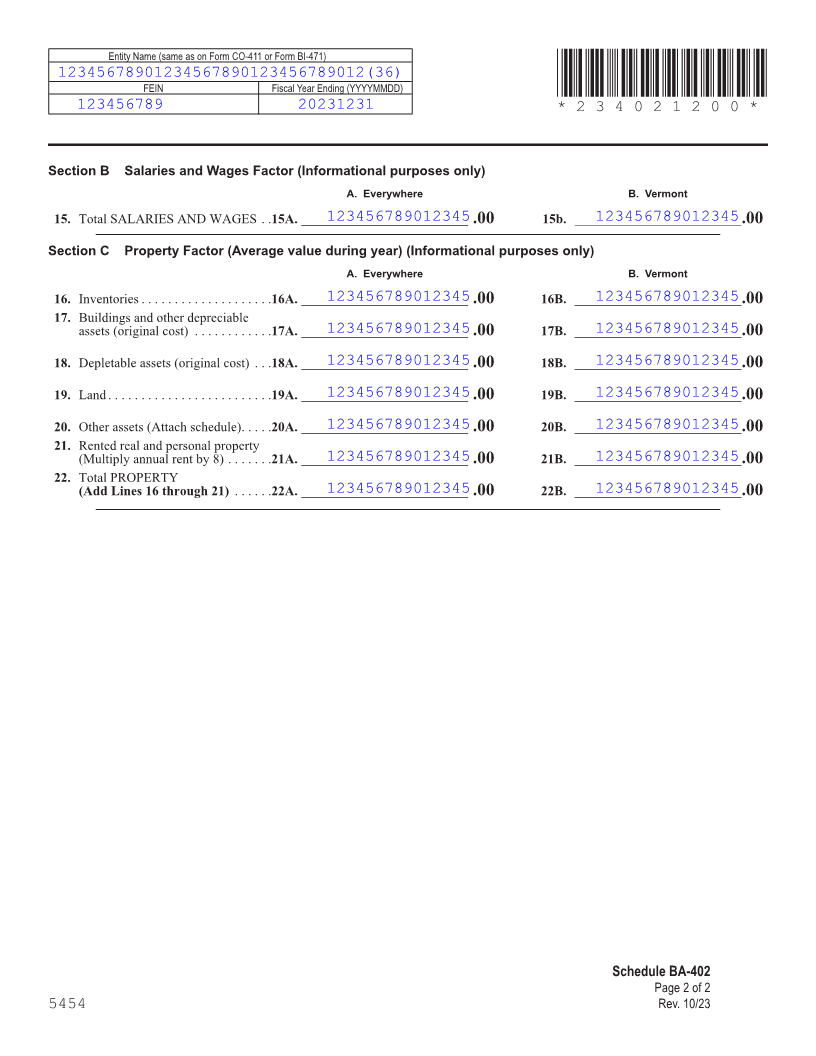

Schedule BA-402

Page 1 of 2

5454 Rev. 10/23