Enlarge image

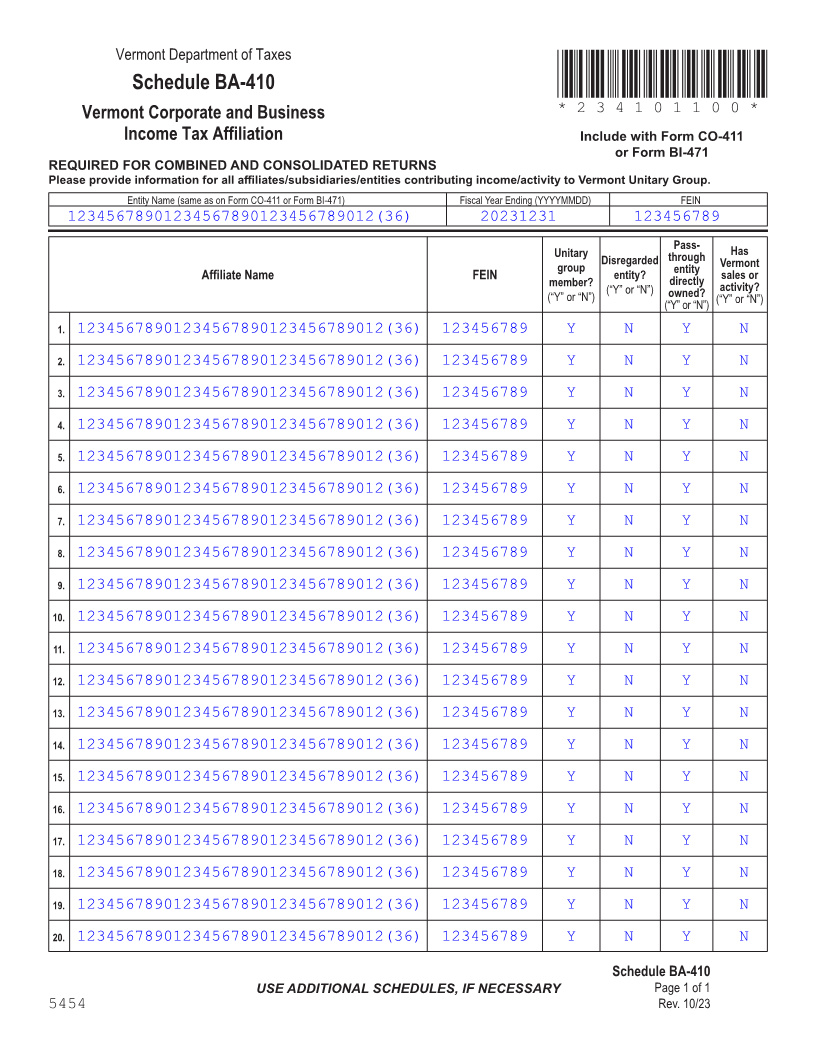

Vermont Department of Taxes

Schedule BA-410 *234101100*

Vermont Corporate and Business *234101100*

Page 2

Income Tax Affiliation Include with Form CO-411

or Form BI-471

REQUIRED FOR COMBINED AND CONSOLIDATED RETURNS

Please provide information for all affiliates/subsidiaries/entities contributing income/activity to Vermont Unitary Group.

Entity Name (same as on Form CO-411 or Form BI-471) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

Pass-

Unitary through Has

Disregarded Vermont

group entity

Affiliate Name FEIN member? entity? directly sales or

(“Y” or “N”) owned? activity?

(“Y” or “N”) (“Y” or “N”)

(“Y” or “N”)

1. 12345678901234567890123456789012(36) 123456789 Y N Y N

2. 12345678901234567890123456789012(36) 123456789 Y N Y N

3. 12345678901234567890123456789012(36) 123456789 Y N Y N FORM (Place atFIRST page)

Form pages

4. 12345678901234567890123456789012(36) 123456789 Y N Y N

5. 12345678901234567890123456789012(36) 123456789 Y N Y N

6. 12345678901234567890123456789012(36) 123456789 Y N Y N 2 - 2

7. 12345678901234567890123456789012(36) 123456789 Y N Y N

8. 12345678901234567890123456789012(36) 123456789 Y N Y N

9. 12345678901234567890123456789012(36) 123456789 Y N Y N

10. 12345678901234567890123456789012(36) 123456789 Y N Y N

11. 12345678901234567890123456789012(36) 123456789 Y N Y N

12. 12345678901234567890123456789012(36) 123456789 Y N Y N

13. 12345678901234567890123456789012(36) 123456789 Y N Y N

14. 12345678901234567890123456789012(36) 123456789 Y N Y N

15. 12345678901234567890123456789012(36) 123456789 Y N Y N

16. 12345678901234567890123456789012(36) 123456789 Y N Y N

FORM (Place at LAST page)

17. 12345678901234567890123456789012(36) 123456789 Y N Y N Form pages

18. 12345678901234567890123456789012(36) 123456789 Y N Y N

19. 12345678901234567890123456789012(36) 123456789 Y N Y N

2 - 2

20. 12345678901234567890123456789012(36) 123456789 Y N Y N

Schedule BA-410

USE ADDITIONAL SCHEDULES, IF NECESSARY Page 1 of 1

5454 Rev. 10/23