Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

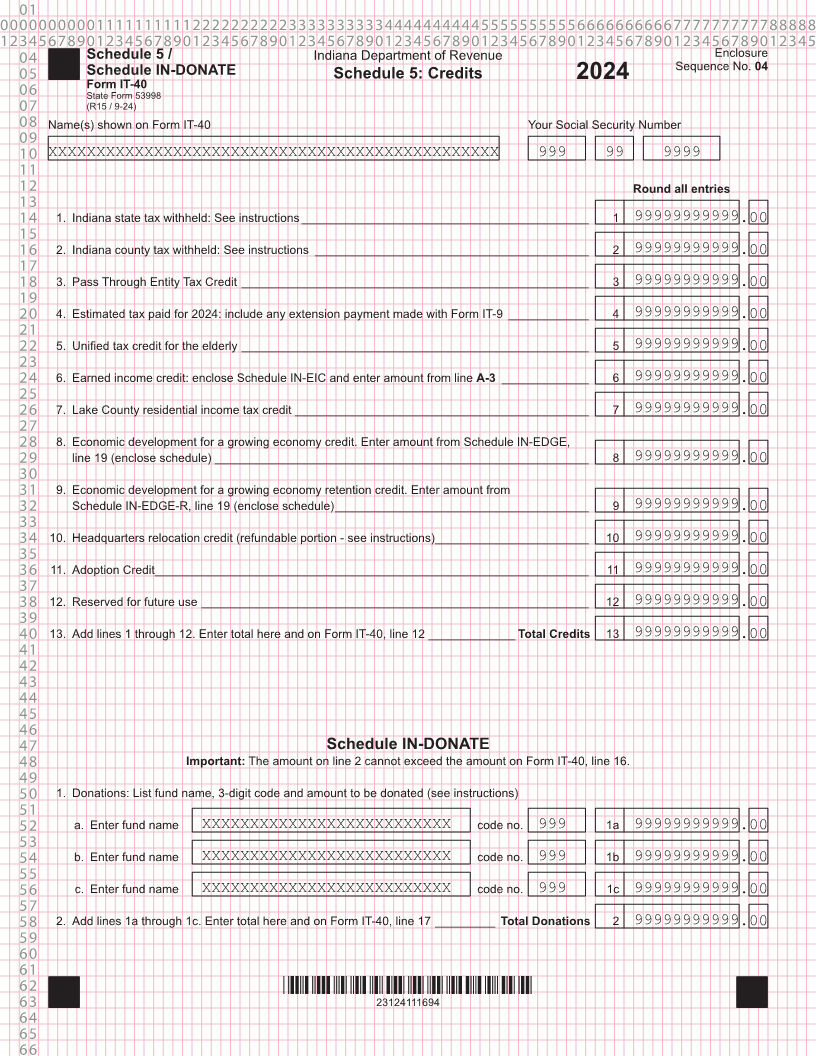

04 Schedule 5 / Indiana Department of Revenue Enclosure

05 Schedule IN-DONATE Schedule 5: Credits Sequence No. 04

06 Form IT-40 2024

State Form 53998

07 (R15 / 9-24)

08 Name(s) shown on Form IT-40 Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 Round all entries

13

14 1. Indiana state tax withheld: See instructions ___________________________________________ 1 99999999999.00

15

16 2. Indiana county tax withheld: See instructions _________________________________________ 2 99999999999.00

17

18 3. Pass Through Entity Tax Credit ____________________________________________________ 3 99999999999.00

19

20 4. Estimated tax paid for 2024: include any extension payment made with Form IT-9 ____________ 4 99999999999.00

21

22 5. Unified tax credit for the elderly ____________________________________________________ 5 99999999999.00

23

24 6. Earned income credit: enclose Schedule IN-EIC and enter amount from line A-3 _____________ 6 99999999999.00

25

26 7. Lake County residential income tax credit ____________________________________________ 7 99999999999.00

27

28 8. Economic development for a growing economy credit. Enter amount from Schedule IN-EDGE,

29 line 19 (enclose schedule) ________________________________________________________ 8 99999999999.00

30

31 9. Economic development for a growing economy retention credit. Enter amount from

32 Schedule IN-EDGE-R, line 19 (enclose schedule) ______________________________________ 9 99999999999.00

33

34 10. Headquarters relocation credit (refundable portion - see instructions) _______________________ 10 99999999999.00

35

36 11. Adoption Credit _________________________________________________________________ 11 99999999999.00

37

38 12. Reserved for future use __________________________________________________________ 12 99999999999.00

39

40 13. Add lines 1 through 12. Enter total here and on Form IT-40, line 12 _____________ Total Credits 13 99999999999.00

41

42

43

44

45

46

47 Schedule IN-DONATE

48 Important: The amount on line 2 cannot exceed the amount on Form IT-40, line 16.

49

50 1. Donations: List fund name, 3-digit code and amount to be donated (see instructions)

51

52 a. Enter fund name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 1a 99999999999.00

53

54 b. Enter fund name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 1b 99999999999.00

55

56 c. Enter fund name XXXXXXXXXXXXXXXXXXXXXXXXXX code no. 999 1c 99999999999.00

57

58 2. Add lines 1a through 1c. Enter total here and on Form IT-40, line 17 _________ Total Donations 2 99999999999.00

59

60

61

62 *23124111694*

63 23124111694

64

65

66