Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

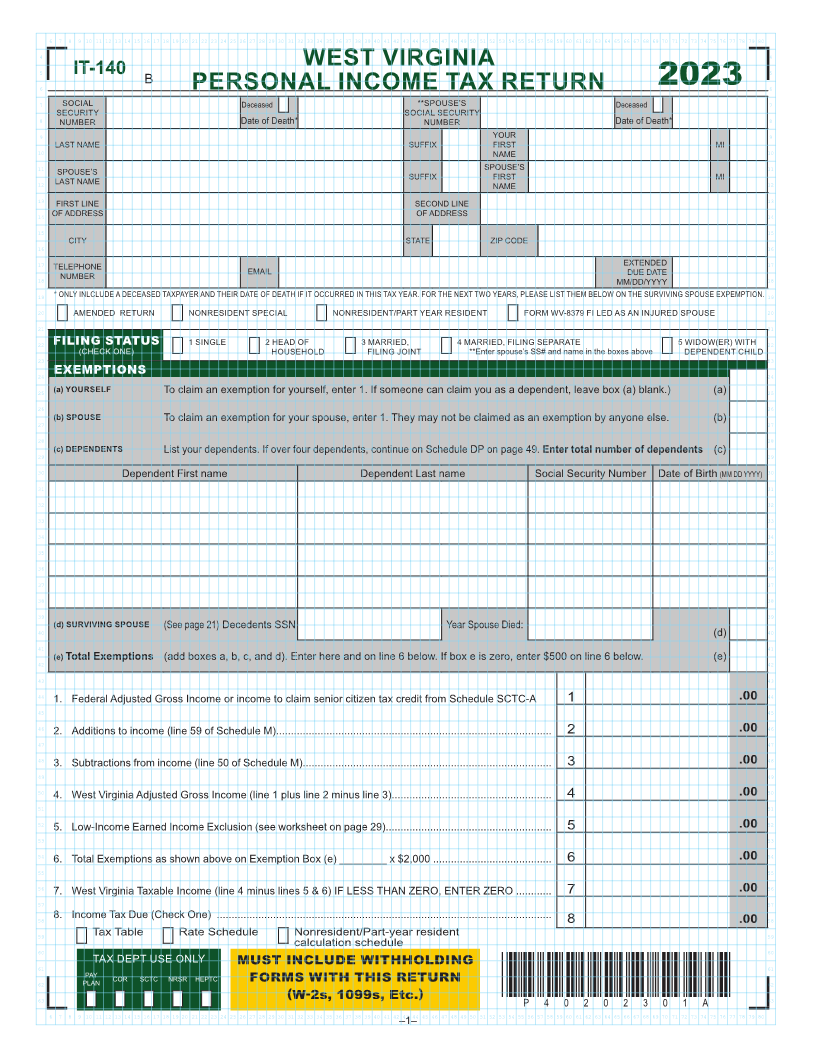

5 IT-140 B WEST VIRGINIA 5

6 PERSONAL INCOME TAX RETURN 2023 6

7 **SPOUSE’S Deceased 7

SOCIAL Deceased SOCIAL SECURITY

8 SECURITY 8

NUMBER Date of Death* NUMBER Date of Death*

9 YOUR 9

10 LAST NAME SUFFIX FIRST MI 10

NAME

11 SPOUSE’S 11

12 SPOUSE’S SUFFIX FIRST MI 12

LAST NAME NAME

13 FIRST LINE SECOND LINE 13

14 OF ADDRESS OF ADDRESS 14

15 15

16 CITY STATE ZIP CODE 16

17 EXTENDED 17

18 TELEPHONE EMAIL DUE DATE 18

NUMBER MM/DD/YYYY

19 * ONLY INLCLUDE A DECEASED TAXPAYER AND THEIR DATE OF DEATH IF IT OCCURRED IN THIS TAX YEAR FOR THE NEXT TWO YEARS, PLEASE LIST THEM BELOW ON THE SURVIVING SPOUSE EXPEMPTION 19

20 AMENDED RETURN NONRESIDENT SPECIAL NONRESIDENT/PART YEAR RESIDENT FORM WV-8379 FI LED AS AN INJURED SPOUSE 20

21 21

22 FILING STATUS 1 SINGLE 2 HEAD OF 3 MARRIED, 4 MARRIED, FILING SEPARATE 5 WIDOW(ER) WITH 22

(CHECK ONE) HOUSEHOLD FILING JOINT **Enter spouse’s SS# and name in the boxes above DEPENDENT CHILD

23 23

24 EXEMPTIONS 24

25 (a) YOURSELF To claim an exemption for yourself, enter 1 If someone can claim you as a dependent, leave box (a) blank) (a) 25

26 26

27 (b) SPOUSE To claim an exemption for your spouse, enter 1 They may not be claimed as an exemption by anyone else (b) 27

28 28

29 (c) DEPENDENTS List your dependents If over four dependents, continue on Schedule DP on page 49 Enter total number of dependents (c) 29

30 Dependent First name Dependent Last name Social Security Number Date of Birth (MM DD YYYY) 30

31 31

32 32

33 33

34 34

35 35

36 36

37 37

38 38

39 39

40 (d) SURVIVING SPOUSE (See page 21) Decedents SSN Year Spouse Died: 40

(d)

41 41

42 (e) Total Exemptions (add boxes a, b, c, and d) Enter here and on line 6 below If box e is zero, enter $500 on line 6 below (e) 42

43 43

44 1 Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule SCTC-A 1 .00 44

45 45

46 2 Additions to income (line 59 of Schedule M) 2 .00 46

47 47

48 3 Subtractions from income (line 50 of Schedule M) 3 .00 48

49 49

50 4 West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3) 4 .00 50

51 51

52 5 Low-Income Earned Income Exclusion (see worksheet on page 29) 5 .00 52

53 53

54 6 Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 6 .00 54

55 55

56 7 West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO 7 .00 56

57 57

58 8 Income Tax Due (Check One) 8 .00 58

59 Tax Table Rate Schedule Nonresident/Part-year resident 59

60 calculation schedule 60

61 TAX DEPT USE ONLY MUST INCLUDE WITHHOLDING 61

PLAN

62 PAY COR SCTC NRSR HEPTC FORMS WITH THIS RETURN 62

(W-2s, 1099s, Etc.) *P40202301A*

63 P40202301A 63

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

–1–