Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

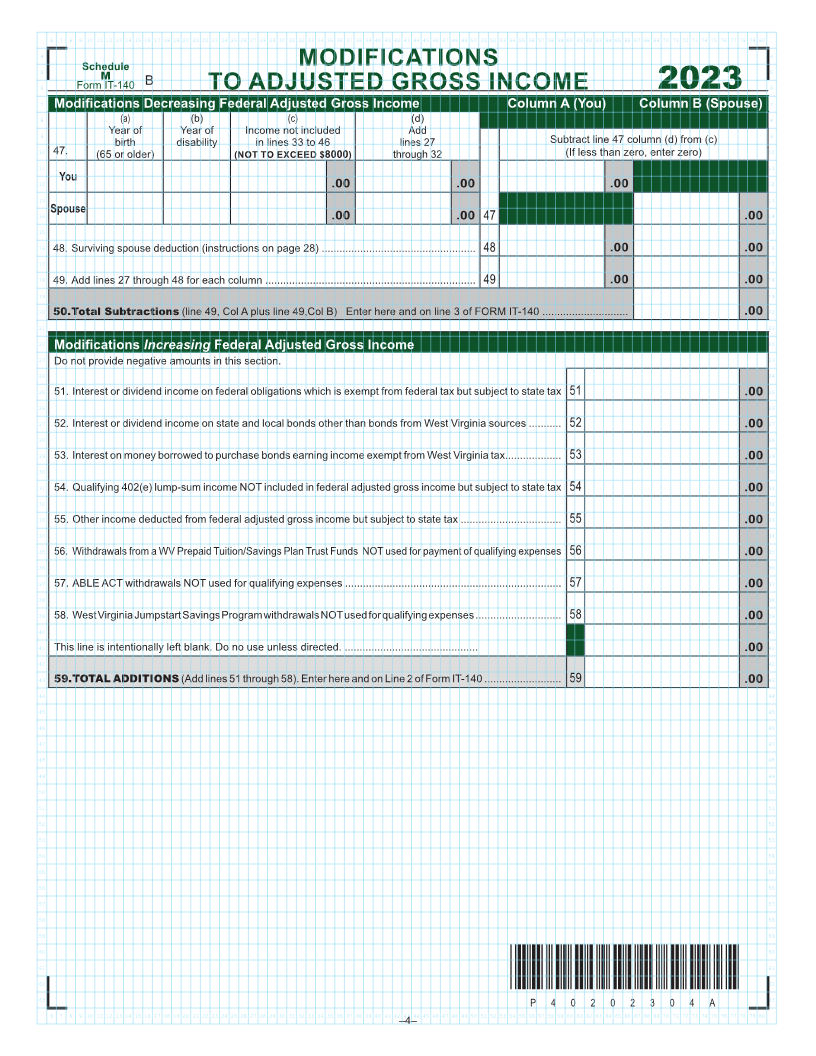

5 Schedule MODIFICATIONS TO 5

M

6 6

Form IT-140 B ADJUSTED GROSS INCOME 2023

7 Modifications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse) 7

8 27 Interest or dividends received on United States or West Virginia obligations, or 8

9 allowance for government obligation income, included in federal adjusted gross income 9

but exempt from state tax 27 .00 .00

10 10

28 Total amount of any benefit (including survivorship annuities) received from certain

11 federal retirement systems by retired federal law enforcement officers ........................ 28 .00 .00 11

12 29 Total amount of any benefit (including survivorship annuities) received from WV 12

13 state or local police, deputy sheriffs’ or firemen’s retirement system, Excluding PERS 13

– see page 26 29 .00 .00

14 14

15 30 Military Retirement Modification ..................................................................................... 15

30 .00 .00

16 31 Other Retirement Modification Column A (You) Column B (Spouse) 16

17 17

(a) West Virginia Teachers’ and

18 Public Employees’ Retirement .00 .00 Add lines 31 (a) and (b). If that sum is greater than $2000, enter $200018

19 (b)Federal Retirement Systems 19

20 (Title 4 USC §111) .00 .00 31 .00 .00 20

21 32 Social Security Benefits You cannot claim this modification if 21

22 (a) TOTAL Social Security Benefits. .00 .00 your Federal AGI exceeds 22

$ 50,000 for SINGLE or MARRIED SEPARATE filers

23 (b) Benefits exempt for Federal tax $100,000 for MARRIED JOINT filers 23

24 purposes .00 .00 24

25 (c) Benefits taxable for Federal tax purposes (line a minus line b) ..................................... 32 .00 .00 25

26 26

27 33 Certain assets held by subchapter S Corporation bank 33 .00 .00 27

28 28

29 34 Certain Active Duty Military pay (See instructions on page 20) 29

If not domiciled in WV, complete Part II of Schedule A instead 34 .00 .00

30 30

31 35 Active Military Separation (see instructions on page 20) 31

Must enclose military orders and discharge papers 35 .00 .00

32 32

33 36 Refunds of state and local income taxes received and reported as income to the IRS 36 .00 .00 33

34 34

35 37 Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds 35

Annual Statement must be included ............................................................................... 37 .00 .00

36 36

37 38 Railroad Retirement Board Income received 38 .00 .00 37

38 38

39 39 Long-Term Care Insurance 39 .00 .00 39

40 40

41 40 IRC 1341 Repayments 40 .00 .00 41

42 42

43 41 Autism Modification (instructions on page 21) ................................................................ 41 .00 .00 43

44 44

45 42 ABLE Act 45

Annual Statement must be included 42 .00 .00

46 46

43 West Virginia Jumpstart Savings Program deposits made (not to exceed $25000)

47 Annual Statement must be included 43 .00 .00 47

48 44 PBGC Modification ..................... 48

49 (a) retirement benefits that would have been .00 .00 Subtract line 44 (b) from (a) 49

50 paid from your employer-provided plan 50

(b) retirement benefits actually received

51 from PBGC .00 .00 44 .00 .00 51

52 52

53 45 Qualified Opportunity Zone business income ................................................................. 45 .00 .00 53

54 54

55 46 Gambling losses (cannot be greater than your gambling winnings) 46 .00 .00 55

56 56

57 This line is intentionally left blank Do no use unless directed .00 .00 57

58 Continues on next page 58

59 59

60 60

61 61

62 *P40202303A* 62

63 P40202303A 63

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

–3–