Enlarge image

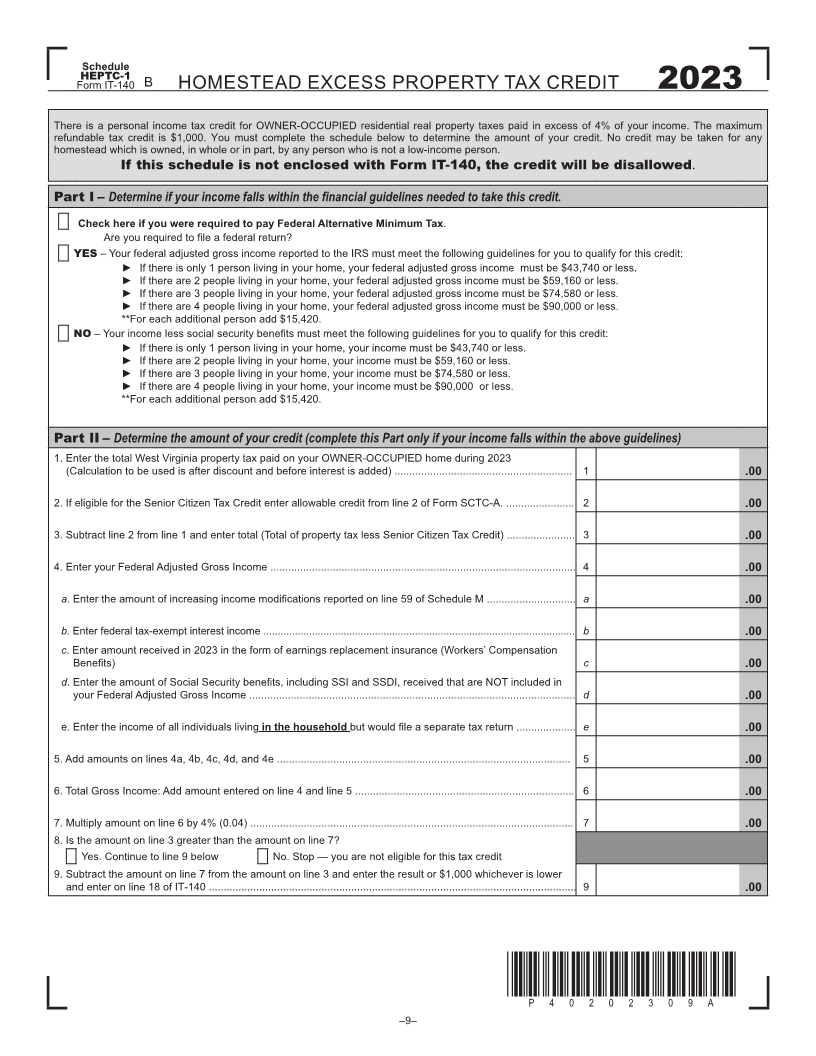

Schedule

HEPTC-1

Form IT-140 B HOMESTEAD EXCESS PROPERTY TAX CREDIT 2023

There is a personal income tax credit for OWNER-OCCUPIED residential real property taxes paid in excess of 4% of your income The maximum

refundable tax credit is $1,000 You must complete the schedule below to determine the amount of your credit No credit may be taken for any

homestead which is owned, in whole or in part, by any person who is not a low-income person

If this schedule is not enclosed with Form IT-140, the credit will be disallowed

Part I – Determine if your income falls within the financial guidelines needed to take this credit.

Check here if you were required to pay Federal Alternative Minimum Tax

Are you required to file a federal return?

YES – Your federal adjusted gross income reported to the IRS must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your federal adjusted gross income must be $43,740 or less

► If there are 2 people living in your home, your federal adjusted gross income must be $59,160 or less

► If there are 3 people living in your home, your federal adjusted gross income must be $74,580 or less

► If there are 4 people living in your home, your federal adjusted gross income must be $90,000 or less

**For each additional person add $15,420

NO – Your income less social security benefits must meet the following guidelines for you to qualify for this credit:

► If there is only 1 person living in your home, your income must be $43,740 or less

► If there are 2 people living in your home, your income must be $59,160 or less

► If there are 3 people living in your home, your income must be $74,580 or less

► If there are 4 people living in your home, your income must be $90,000 or less

**For each additional person add $15,420

Part II – Determine the amount of your credit (complete this Part only if your income falls within the above guidelines)

1 Enter the total West Virginia property tax paid on your OWNER-OCCUPIED home during 2023

(Calculation to be used is after discount and before interest is added) 1 .00

2 If eligible for the Senior Citizen Tax Credit enter allowable credit from line 2 of Form SCTC-A 2 .00

3 Subtract line 2 from line 1 and enter total (Total of property tax less Senior Citizen Tax Credit) 3 .00

4 Enter your Federal Adjusted Gross Income 4 .00

a. Enter the amount of increasing income modifications reported on line 59 of Schedule M .............................. a .00

b Enter federal tax-exempt interest income b .00

c Enter amount received in 2023 in the form of earnings replacement insurance (Workers’ Compensation

Benefits) c .00

d. Enter the amount of Social Security benefits, including SSI and SSDI, received that are NOT included in

your Federal Adjusted Gross Income d .00

e Enter the income of all individuals living in the household but would file a separate tax return .................... e .00

5 Add amounts on lines 4a, 4b, 4c, 4d, and 4e 5 .00

6 Total Gross Income: Add amount entered on line 4 and line 5 6 .00

7 Multiply amount on line 6 by 4% (004) 7 .00

8 Is the amount on line 3 greater than the amount on line 7?

Yes Continue to line 9 below No Stop — you are not eligible for this tax credit

9 Subtract the amount on line 7 from the amount on line 3 and enter the result or $1,000 whichever is lower

and enter on line 1 8of IT-140 9 .00

*P40202309A*

P40202309A

–9–