Enlarge image

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

4 4

5 Schedule 5

UT

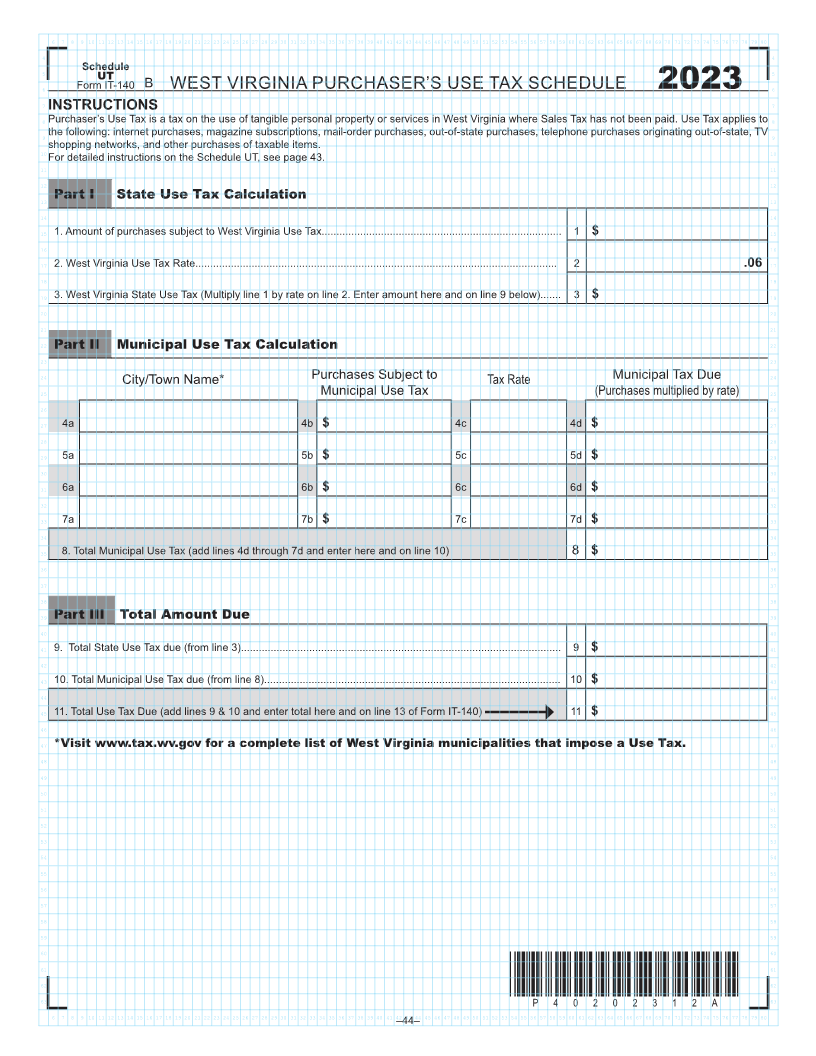

6 Form IT-140 B WEST VIRGINIA PURCHASER’S USE TAX SCHEDULE 2023 6

7 INSTRUCTIONS 7

8 Purchaser’s Use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not been paid Use Tax applies to 8

9 the following: internet purchases, magazine subscriptions, mail-order purchases, out-of-state purchases, telephone purchases originating out-of-state, TV 9

10shopping networks, and other purchases of taxable items 10

For detailed instructions on the Schedule UT, see page 43

11 11

12 12

13 Part I State Use Tax Calculation 13

14 14

15 1 Amount of purchases subject to West Virginia Use Tax 1 $ 15

16 16

17 2 West Virginia Use Tax Rate 2 .06 17

18 18

19 3 West Virginia State Use Tax (Multiply line 1 by rate on line 2 Enter amount here and on line 9 below) 3 $ 19

20 20

21 21

22 Part II Municipal Use Tax Calculation 22

23 23

24 City/Town Name* Purchases Subject to Tax Rate Municipal Tax Due 24

25 Municipal Use Tax (Purchases multiplied by rate) 25

26 26

27 4a 4b $ 4c 4d $ 27

28 28

29 5a 5b $ 5c 5d $ 29

30 30

31 6a 6b $ 6c 6d $ 31

32 32

33 7a 7b $ 7c 7d $ 33

34 34

35 8 Total Municipal Use Tax (add lines 4d through 7d and enter here and on line 10) 8 $ 35

36 36

37 37

38 38

39 Part III Total Amount Due 39

40 40

41 9 Total State Use Tax due (from line 3) 9 $ 41

42 42

43 10 Total Municipal Use Tax due (from line 8) 10 $ 43

44 44

45 11 Total Use Tax Due (add lines 9 & 10 and enter total here and on line 13 of Form IT-140) 11 $ 45

46 46

47 *Visit www.tax.wv.gov for a complete list of West Virginia municipalities that impose a Use Tax. 47

48 48

49 49

50 50

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

*P40202312A*

63 P40202312A 63

67891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071 727374757677787980

–44–