Enlarge image

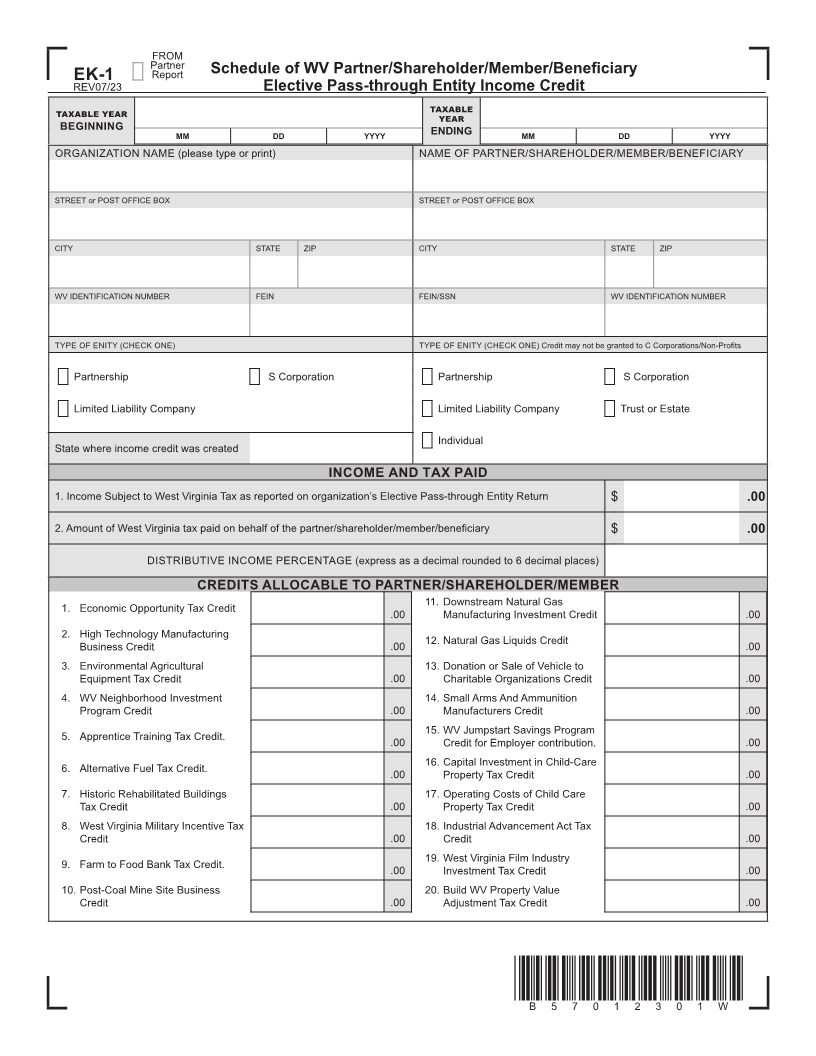

FROM

Partner

EK-1 Report Schedule of WV Partner/Shareholder/Member/Bene fi ciary

REV07/23 Elective Pass-through Entity Income Credit

TAXABLE YEAR TAXABLE

YEAR

BEGINNING MM DD YYYY ENDING MM DD YYYY

ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY

STREET or POST OFFICE BOX STREET or POST OFFICE BOX

CITY STATE ZIP CITY STATE ZIP

WV IDENTIFICATION NUMBER FEIN FEIN/SSN WV IDENTIFICATION NUMBER

TYPE OF ENITY (CHECK ONE) TYPE OF ENITY (CHECK ONE) Credit may not be granted to C Corporations/Non-Pro tsfi

Partnership S Corporation Partnership S Corporation

Limited Liability Company Limited Liability Company Trust or Estate

Individual

State where income credit was created

INCOME AND TAX PAID

1. Income Subject to West Virginia Tax as reported on organization’s Elective Pass-through Entity Return $ .00

2. Amount of West Virginia tax paid on behalf of the partner/shareholder/member/bene ficiary $ .00

DISTRIBUTIVE INCOME PERCENTAGE (express as a decimal rounded to 6 decimal places)

CREDITS ALLOCABLE TO PARTNER/SHAREHOLDER/MEMBER

11. Downstream Natural Gas

1. Economic Opportunity Tax Credit .00 Manufacturing Investment Credit .00

Business Credit .00

2. High Technology Manufacturing 12. Natural Gas Liquids Credit .00

3. Environmental Agricultural 13. Donation or Sale of Vehicle to

Equipment Tax Credit .00 Charitable Organizations Credit .00

4. WV Neighborhood Investment 14. Small Arms And Ammunition

Program Credit .00 Manufacturers Credit .00

15. WV Jumpstart Savings Program

5. Apprentice Training Tax Credit. .00 Credit for Employer contribution. .00

16. Capital Investment in Child-Care

6. Alternative Fuel Tax Credit. .00 Property Tax Credit .00

7. Historic Rehabilitated Buildings 17. Operating Costs of Child Care

Tax Credit .00 Property Tax Credit .00

8. West Virginia Military Incentive Tax 18. Industrial Advancement Act Tax

Credit .00 Credit .00

19. West Virginia Film Industry

9. Farm to Food Bank Tax Credit. .00 Investment Tax Credit .00

10. Post-Coal Mine Site Business 20. Build WV Property Value

Credit .00 Adjustment Tax Credit .00

*B57012301W*

B57012301W