Enlarge image

Vermont Department of Taxes

Form CO-411 *234111100*

Vermont Corporate Income Tax Return *234111100*

Page 15

Name Accounting Extended Unitary PL 86-272 is

Check X Change X Period Change X Return X X Applicable

Appropriate

Box(es) Address Amended Federal Extension RAR Pro Forma - Final Return

X Change X Return X Requested X Amended X Cannabis X (Cancels Account)

Entity Name (Principal Vermont Corporation) FEIN Primary 6-digit NAICS number

12345678901234567890123456789012(36) 123456789 123456

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

12345678901234567890123456789012(36) 20230101 20231231

Address (Line 2) Number of companies in Number of companies

12345678901234567890123456789012(36) Vermont Unitary Group 123 with Vermont Nexus 123

City State ZIP Code

Federal tax 1120 1120-F 990-T

12345678901234567(21) Foreign Country 12 1234567890 return filed X X X

(Check one box)

1234567890123456789012345678(32) X 1120-H XOther

FORM (Place at FIRST page)

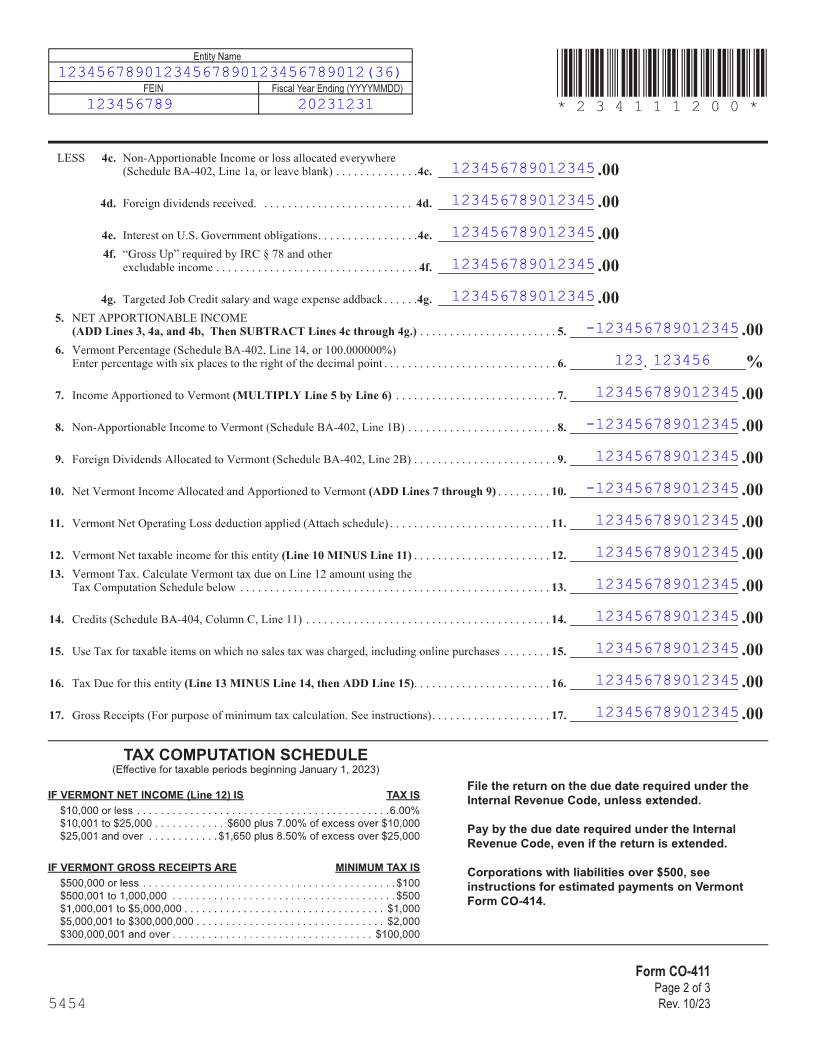

Enter all amounts in whole dollars. Form pages

-123456789012345 1. FEDERAL TAXABLE INCOME (federal Form 1120, Line 28, as filed) . . . . . . . . . . . . . . . . . . . . . . 1. . ____________________________.00

1a. Special Deductions as filed with IRS

-123456789012345(federal Form 1120, Line 29b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a. .__________________________ .00

1b. Income/Loss from unitary members included in

-123456789012345Vermont combined group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1b. __________________________ .00 15 - 17

1c. Income/Loss from affiliated entities filed in the above federal

123456789012345consolidated returns butexcluded from Vermont combined group 1c. .__________________________ .00

1d. Special Deductions: Vermont adjustments to federal

123456789012345special deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1d. __________________________ .00

123456789012345 1e. Eliminations: Vermont adjustments to federal eliminations . . . . . 1e. .__________________________ .00

1f. Other: Other Vermont adjustments to Combined Net Income

123456789012345(charitable expenses, etc .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1f. . __________________________ .00

-123456789012345 1g. Federal Taxable Income as Adjusted for Combined Net Income(ADD Lines 1 through 1f) . . . . . 1g. . ____________________________.00

123456789012345 2. Bonus Depreciation Adjustment (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . ____________________________.00

3. Federal Taxable Income as Adjusted for Combined Net Income and Bonus Depreciation

123456789012345(ADD Lines 1g and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . ____________________________.00

123456789012345 4. ADD 4a. Interest on non-Vermont state and local obligations . . . . . . . 4a. .__________________________ .00

123456789012345 4b. State and local income or franchise taxes . . . . . . . . . . . . . . . 4b. __________________________ .00

Check box if exception SMALL FARM CORPORATION NO VERMONT ACTIVITY HOMEOWNER’S / CONDO ASSOC.

($75 minimum) ($0) (Federal Form 1120-H only) ($0)

to minimum tax applies:X X X

Form CO-411

Page 1 of 3

5454 Rev. 10/23