Enlarge image

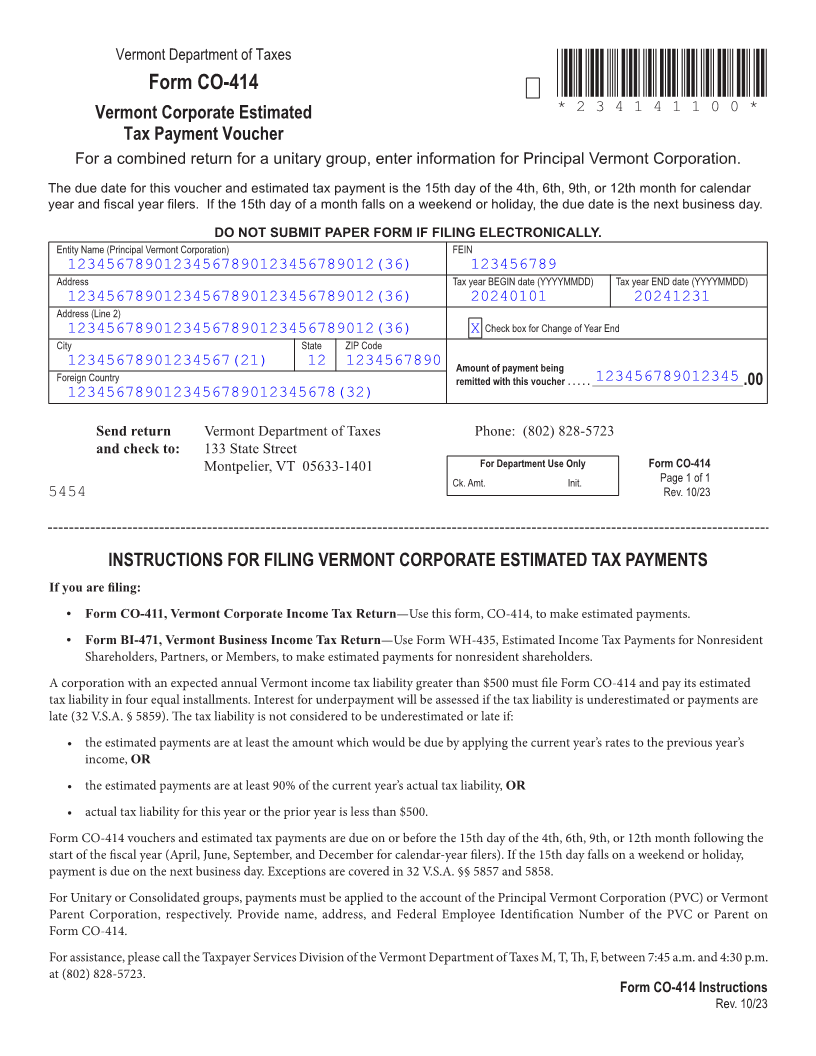

Vermont Department of Taxes

Form CO-414 *234141100*

Vermont Corporate Estimated *234141100*

Page 1

Tax Payment Voucher

For a combined return for a unitary group, enter information for Principal Vermont Corporation.

The due date for this voucher and estimated tax payment is the 15th day of the 4th, 6th, 9th, or 12th month for calendar

year and fiscal year filers. If the 15th day of a month falls on a weekend or holiday, the due date is the next business day.

DO NOT SUBMIT PAPER FORM IF FILING ELECTRONICALLY.

Entity Name (Principal Vermont Corporation) FEIN

12345678901234567890123456789012(36) 123456789

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

12345678901234567890123456789012(36) 20240101 20241231

Address (Line 2)

12345678901234567890123456789012(36) X Check box for Change of Year End

City State ZIP Code

12345678901234567(21) 12 1234567890 Amount of payment being

123456789012345Foreign Country remitted with this voucher . . . . . _______________________________ .00

1234567890123456789012345678(32) FORM (Place at FIRST page)

Form pages

Send return Vermont Department of Taxes Phone: (802) 828-5723

and check to: 133 State Street

Montpelier, VT 05633-1401 For Department Use Only Form CO-414

Ck. Amt. Init. Page 1 of 1

5454 Rev. 10/23 1 - 1

INSTRUCTIONS FOR FILING VERMONT CORPORATE ESTIMATED TAX PAYMENTS

If you are filing:

• Form CO-411, Vermont Corporate Income Tax Return—Use this form, CO-414, to make estimated payments.

• Form BI-471, Vermont Business Income Tax Return—Use Form WH-435, Estimated Income Tax Payments for Nonresident

Shareholders, Partners, or Members, to make estimated payments for nonresident shareholders.

A corporation with an expected annual Vermont income tax liability greater than $500 must file Form CO-414 and pay its estimated

tax liability in four equal installments. Interest for underpayment will be assessed if the tax liability is underestimated or payments are

late (32 V.S.A. § 5859). The tax liability is not considered to be underestimated or late if:

• the estimated payments are at least the amount which would be due by applying the current year’s rates to the previous year’s

income, OR

• the estimated payments are at least 90% of the current year’s actual tax liability, OR

• actual tax liability for this year or the prior year is less than $500.

Form CO-414 vouchers and estimated tax payments are due on or before the 15th day of the 4th, 6th, 9th, or 12th month following the

start of the fiscal year (April, June, September, and December for calendar-year filers). If the 15th day falls on a weekend or holiday,

payment is due on the next business day. Exceptions are covered in 32 V.S.A. §§ 5857 and 5858.

For Unitary or Consolidated groups, payments must be applied to the account of the Principal Vermont Corporation (PVC) or Vermont

Parent Corporation, respectively. Provide name, address, and Federal Employee Identification Number of the PVC or Parent on FORM (Place at LAST page)

Form CO-414. Form pages

For assistance, please call the Taxpayer Services Division of the Vermont Department of Taxes M, T, Th, F, between 7:45 a.m. and 4:30 p.m.

at (802) 828-5723.

Form CO-414 Instructions

Rev. 10/23

1 - 1