Enlarge image

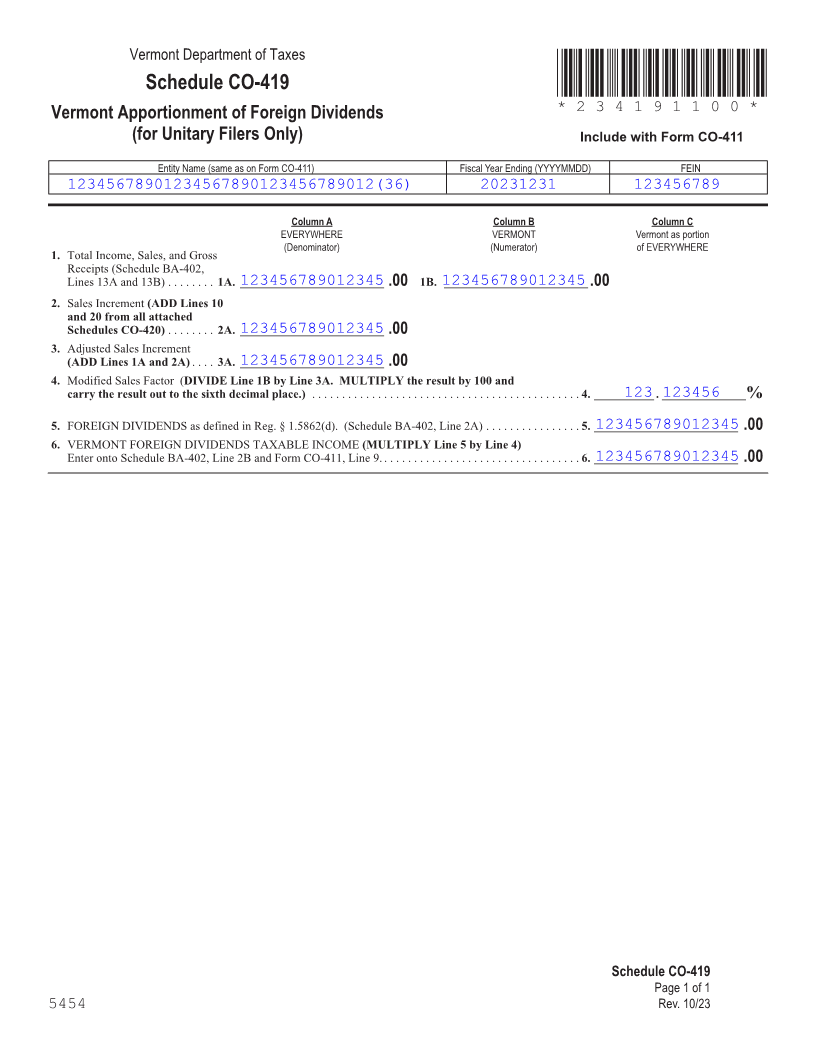

Vermont Department of Taxes

Schedule CO-419 *234191100*

Vermont Apportionment of Foreign Dividends *234191100*

Page 3

(for Unitary Filers Only) Include with Form CO-411

Entity Name (same as on Form CO-411) Fiscal Year Ending (YYYYMMDD) FEIN

12345678901234567890123456789012(36) 20231231 123456789

Column A Column B Column C

EVERYWHERE VERMONT Vermont as portion

(Denominator) (Numerator) of EVERYWHERE

1. Total Income, Sales, and Gross

Receipts (Schedule BA-402,

Lines 13A and 13B) . . . . . . . .1A. 123456789012345 ________________________ .00 1B. ________________________123456789012345 .00

2. Sales Increment (ADD Lines 10

and 20 from all attached

123456789012345Schedules CO-420) . . . . . . . .2A. ________________________ .00

3. Adjusted Sales Increment

123456789012345(ADD Lines 1A and 2A) . . . .3A. ________________________ .00

4. Modified Sales Factor (DIVIDE Line 1B by Line 3A. MULTIPLY the result by 100 and

carry the result out to the sixth decimal place.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . __________123.123456______________% FORM (Place atFIRST page)

Form pages

123456789012345 5. FOREIGN DIVIDENDS as defined in Reg . § 1 .5862(d) . (Schedule BA-402, Line 2A) . . . . . . . . . . . . . .5. . .________________________ .00

6. VERMONT FOREIGN DIVIDENDS TAXABLE INCOME (MULTIPLY Line 5 by Line 4)

123456789012345Enter onto Schedule BA-402, Line 2B and Form CO-411, Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. . ________________________ .00

3 - 3

FORM (Place at LAST page)

Form pages

3 - 3

Schedule CO-419

Page 1 of 1

5454 Rev. 10/23