Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

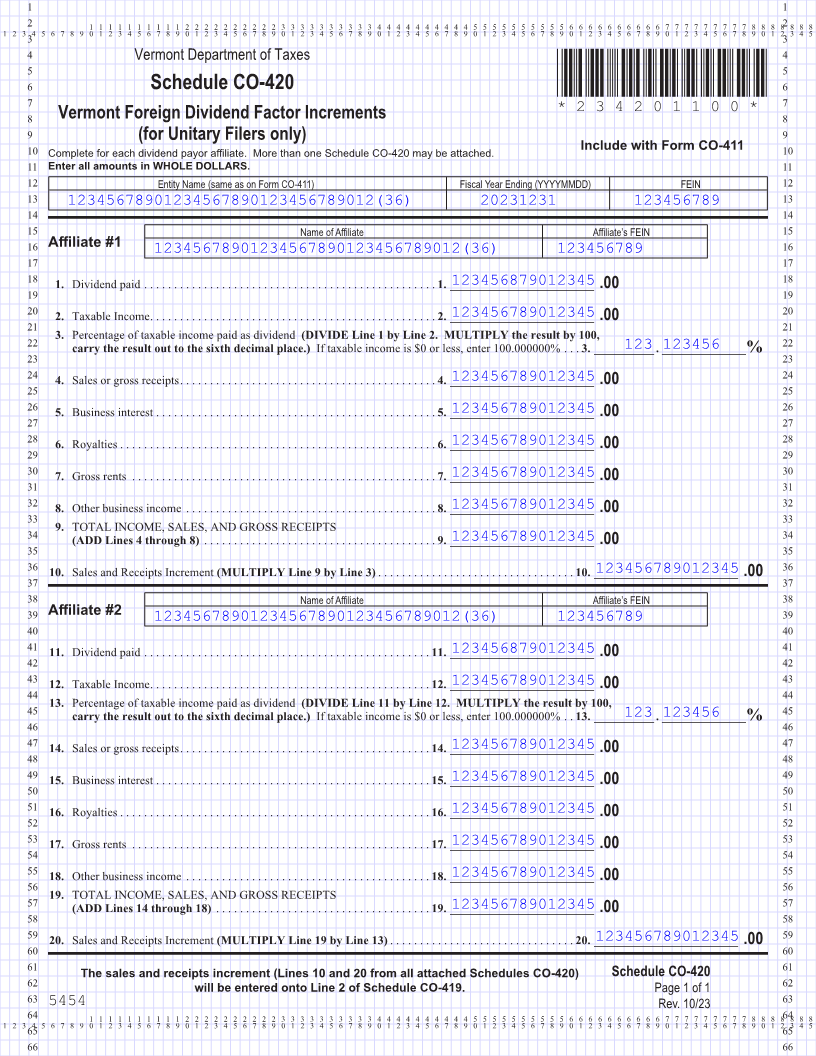

4 Vermont Department of Taxes 4

5 5

6 Schedule CO-420 *234201100* 6

7 7

Vermont Foreign Dividend Factor Increments *234201100*

8 8 Page 3

9 (for Unitary Filers only) 9

10 Complete for each dividend payor affiliate. More than one Schedule CO-420 may be attached. Include with Form CO-411 10

11 Enter all amounts in WHOLE DOLLARS. 11

12 Entity Name (same as on Form CO-411) Fiscal Year Ending (YYYYMMDD) FEIN 12

13 13

12345678901234567890123456789012(36) 20231231 123456789

14 14

15 Name of Affiliate Affiliate’s FEIN 15

16 Affiliate #1 16

17 12345678901234567890123456789012(36) 123456789 17

18 1. 123456879012345Dividend paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ________________________ .00 18

19 19

20 1234567890123452. Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . ________________________ .00 20

21 21

3. Percentage of taxable income paid as dividend (DIVIDE Line 1 by Line 2. MULTIPLY the result by 100,

22 carry the result out to the sixth decimal place.) If taxable income is $0 or less, enter 100 .000000% . . 3. . __________123.123456______________% 22

23 23

24 4. 123456789012345 Sales or gross receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. . ________________________ .00 24

25 25 FORM (Place at FIRST page)

26 5. 123456789012345Business interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. . ________________________ .00 26 Form pages

27 27

28 6. 123456789012345Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. . ________________________ .00 28

29 29

30 7. 123456789012345Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. . ________________________ .00 30

31 31

3 - 3

32 8. 123456789012345 Other business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8. ________________________ .00 32

33 33

9. TOTAL INCOME, SALES, AND GROSS RECEIPTS

34 123456789012345(ADD Lines 4 through 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. . ________________________ .00 34

35 35

36 10. 123456789012345Sales and Receipts Increment(MULTIPLY Line 9 by Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. . ________________________ .00 36

37 37

38 Name of Affiliate Affiliate’s FEIN 38

39 Affiliate #2 39

40 12345678901234567890123456789012(36) 123456789 40

41 11. 123456879012345Dividend paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11. ________________________ .00 41

42 42

43 12. 123456789012345Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. . ________________________ .00 43

44 44

13. Percentage of taxable income paid as dividend (DIVIDE Line 11 by Line 12. MULTIPLY the result by 100,

45 carry the result out to the sixth decimal place.) If taxable income is $0 or less, enter 100 .000000% . 13. . __________123.123456______________% 45

46 46

47 14. 123456789012345 Sales or gross receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. . ________________________ .00 47

48 48

49 15. 123456789012345Business interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. . ________________________ .00 49

50 50

51 16. 123456789012345Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. . ________________________ .00 51

52 52

53 17. 123456789012345Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. . ________________________ .00 53

54 54 FORM (Place at LAST page)

55 55 Form pages

123456789012345 18. Other business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18. ________________________ .00

56 56

19. TOTAL INCOME, SALES, AND GROSS RECEIPTS

57 123456789012345(ADD Lines 14 through 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19. . ________________________ .00 57

58 58

59 20. 123456789012345Sales and Receipts Increment(MULTIPLY Line 19 by Line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20. . ________________________ .00 59

60 60 3 - 3

61 61

The sales and receipts increment (Lines 10 and 20 from all attached Schedules CO-420) Schedule CO-420

62 will be entered onto Line 2 of Schedule CO-419. Page 1 of 1 62

63 5454 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 8 64

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66