Enlarge image

1 1

0 0 0 0 20 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 82

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

3 3

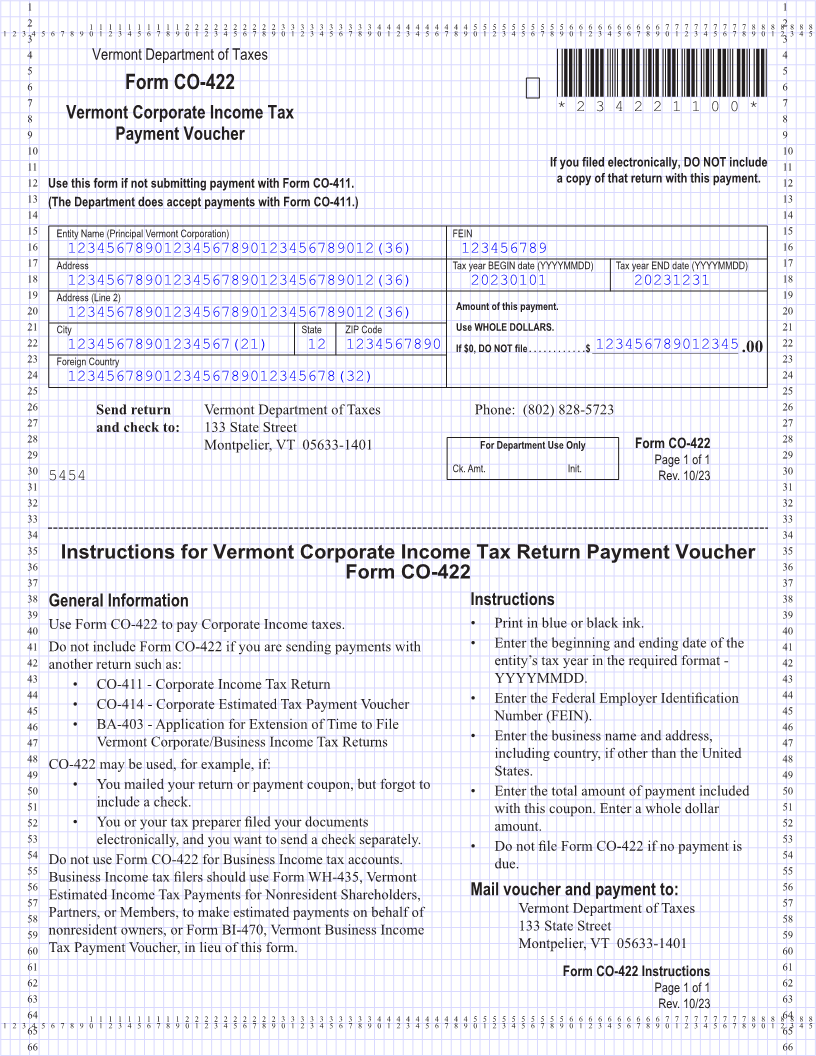

4 Vermont Department of Taxes 4

5 5

6 Form CO-422 *234221100* 6

7 7

Vermont Corporate Income Tax *234221100*

8 8 Page 1

9 Payment Voucher 9

10 10

11 If you filed electronically, DO NOT include 11

12 Use this form if not submitting payment with Form CO-411. a copy of that return with this payment. 12

13 (The Department does accept payments with Form CO-411.) 13

14 14

15 Entity Name (Principal Vermont Corporation) FEIN 15

16 16

12345678901234567890123456789012(36) 123456789

17 Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD) 17

18 18

12345678901234567890123456789012(36) 20230101 20231231

19 Address (Line 2) 19

20 Amount of this payment. 20

12345678901234567890123456789012(36)

21 City State ZIP Code Use WHOLE DOLLARS. 21

22 12345678901234567(21) 12 1234567890 If $0, DO NOT file ............$ ______________________________123456789012345.00 22

23 Foreign Country 23

24 24

1234567890123456789012345678(32)

25 25 FORM (Place at FIRST page)

26 Send return Vermont Department of Taxes Phone: (802) 828-5723 26 Form pages

27 27

and check to: 133 State Street

28 For Department Use Only 28

Montpelier, VT 05633-1401 Form CO-422

29 Page 1 of 1 29

Ck. Amt. Init.

30 5454 Rev. 10/23 30

31 31

1 - 1

32 32

33 33

34 34

35 35

Instructions for Vermont Corporate Income Tax Return Payment Voucher

36 36

37 Form CO-422 37

38 General Information Instructions 38

39 39

40 Use Form CO-422 to pay Corporate Income taxes. • Print in blue or black ink. 40

41 Do not include Form CO-422 if you are sending payments with • Enter the beginning and ending date of the 41

42 another return such as: entity’s tax year in the required format - 42

43 YYYYMMDD. 43

• CO-411 - Corporate Income Tax Return

44 • Enter the Federal Employer Identification 44

45 • CO-414 - Corporate Estimated Tax Payment Voucher 45

Number (FEIN).

46 • BA-403 - Application for Extension of Time to File 46

47 Vermont Corporate/Business Income Tax Returns • Enter the business name and address, 47

48 including country, if other than the United 48

CO-422 may be used, for example, if:

49 States. 49

50 • You mailed your return or payment coupon, but forgot to 50

• Enter the total amount of payment included

51 include a check. 51

with this coupon. Enter a whole dollar

52 • You or your tax preparer filed your documents amount. 52

53 electronically, and you want to send a check separately. 53

54 • Do not file Form CO-422 if no payment is 54

Do not use Form CO-422 for Business Income tax accounts.

55 due. 55

Business Income tax filers should use Form WH-435, Vermont FORM (Place at LAST page)

56 56 Form pages

57 Estimated Income Tax Payments for Nonresident Shareholders, Mail voucher and payment to: 57

58 Partners, or Members, to make estimated payments on behalf of Vermont Department of Taxes 58

59 nonresident owners, or Form BI-470, Vermont Business Income 133 State Street 59

60 Tax Payment Voucher, in lieu of this form. Montpelier, VT 05633-1401 60

61 61

Form CO-422 Instructions 1 - 1

62 Page 1 of 1 62

63 Rev. 10/23 63

0 0 0 0 640 0 0 0 0 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 6 6 6 6 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 8 8 8 8 8 8 864

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

65 65

66 66