Enlarge image

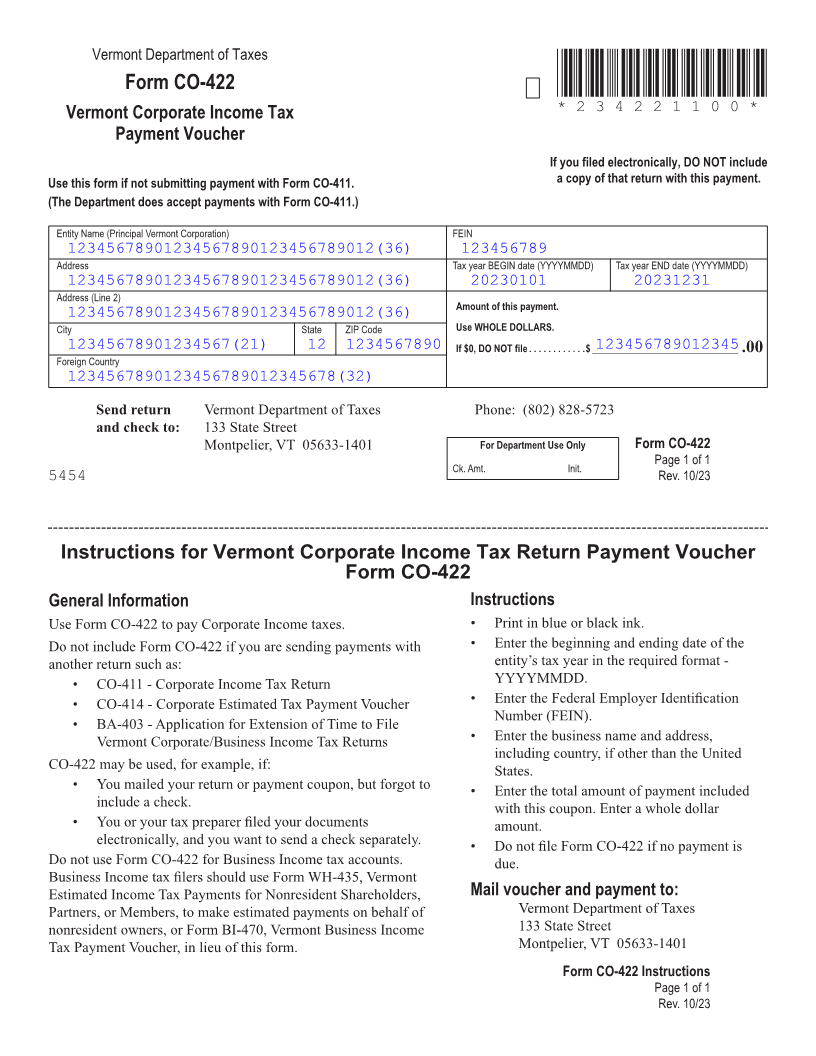

Vermont Department of Taxes

Form CO-422 *234221100*

Vermont Corporate Income Tax *234221100*

Page 1

Payment Voucher

If you filed electronically, DO NOT include

Use this form if not submitting payment with Form CO-411. a copy of that return with this payment.

(The Department does accept payments with Form CO-411.)

Entity Name (Principal Vermont Corporation) FEIN

12345678901234567890123456789012(36) 123456789

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

12345678901234567890123456789012(36) 20230101 20231231

Address (Line 2)

Amount of this payment.

12345678901234567890123456789012(36)

City State ZIP Code Use WHOLE DOLLARS.

12345678901234567(21) 12 1234567890 If $0, DO NOT file ............$ ______________________________123456789012345.00

Foreign Country

1234567890123456789012345678(32)

FORM (Place at FIRST page)

Send return Vermont Department of Taxes Phone: (802) 828-5723 Form pages

and check to: 133 State Street

Montpelier, VT 05633-1401 For Department Use Only Form CO-422

Page 1 of 1

Ck. Amt. Init.

5454 Rev. 10/23

1 - 1

Instructions for Vermont Corporate Income Tax Return Payment Voucher

Form CO-422

General Information Instructions

Use Form CO-422 to pay Corporate Income taxes. • Print in blue or black ink.

Do not include Form CO-422 if you are sending payments with • Enter the beginning and ending date of the

another return such as: entity’s tax year in the required format -

• CO-411 - Corporate Income Tax Return YYYYMMDD.

• CO-414 - Corporate Estimated Tax Payment Voucher • Enter the Federal Employer Identification

Number (FEIN).

• BA-403 - Application for Extension of Time to File

Vermont Corporate/Business Income Tax Returns • Enter the business name and address,

including country, if other than the United

CO-422 may be used, for example, if:

States.

• You mailed your return or payment coupon, but forgot to

• Enter the total amount of payment included

include a check.

with this coupon. Enter a whole dollar

• You or your tax preparer filed your documents amount.

electronically, and you want to send a check separately.

• Do not file Form CO-422 if no payment is

Do not use Form CO-422 for Business Income tax accounts. due.

Business Income tax filers should use Form WH-435, Vermont FORM (Place at LAST page)

Estimated Income Tax Payments for Nonresident Shareholders, Mail voucher and payment to: Form pages

Partners, or Members, to make estimated payments on behalf of Vermont Department of Taxes

nonresident owners, or Form BI-470, Vermont Business Income 133 State Street

Tax Payment Voucher, in lieu of this form. Montpelier, VT 05633-1401

Form CO-422 Instructions 1 - 1

Page 1 of 1

Rev. 10/23