Enlarge image

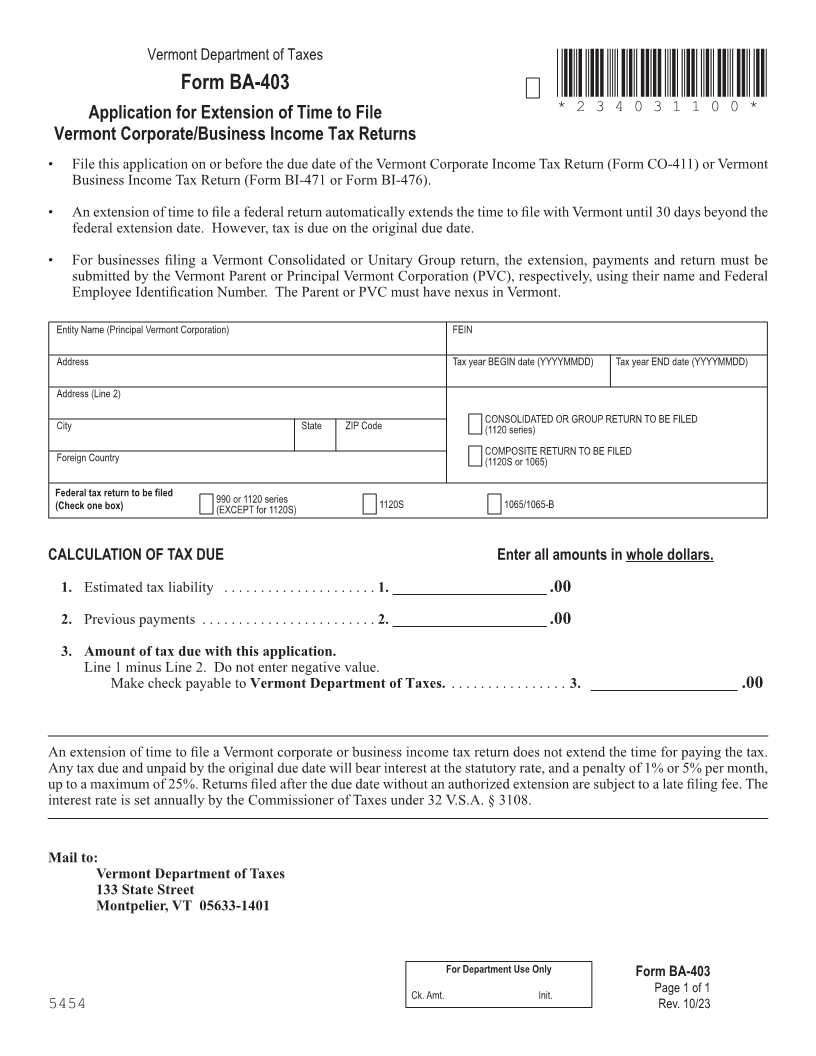

Vermont Department of Taxes

Form BA-403 *234031100*

Application for Extension of Time to File *234031100*

Vermont Corporate/Business Income Tax Returns

• File this application on or before the due date of the Vermont Corporate Income Tax Return (Form CO-411) or Vermont

Business Income Tax Return (Form BI-471 or Form BI-476).

• An extension of time to file a federal return automatically extends the time to file with Vermont until 30 days beyond the

federal extension date . However, tax is due on the original due date .

• For businesses filing a Vermont Consolidated or Unitary Group return, the extension, payments and return must be

submitted by the Vermont Parent or Principal Vermont Corporation (PVC), respectively, using their name and Federal

Employee Identification Number. The Parent or PVC must have nexus in Vermont.

Entity Name (Principal Vermont Corporation) FEIN

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

Address (Line 2)

City State ZIP Code CONSOLIDATED OR GROUP RETURN TO BE FILED

(1120 series)

Foreign Country COMPOSITE RETURN TO BE FILED

(1120S or 1065)

Federal tax return to be filed

(Check one box) 990 or 1120 series 1120S 1065/1065-B

(EXCEPT for 1120S)

CALCULATION OF TAX DUE Enter all amounts in whole dollars.

1. Estimated tax liability . . . . . . . . . . . . . . . . . . . . . 1. _____________________ .00

2. Previous payments . . . . . . . . . . . . . . . . . . . . . . . . 2. _____________________ .00

3. Amount of tax due with this application.

Line 1 minus Line 2 . Do not enter negative value .

Make check payable to Vermont Department of Taxes. . . . . . . . . . . . . . . . . 3. ____________________ .00

An extension of time to file a Vermont corporate or business income tax return does not extend the time for paying the tax.

Any tax due and unpaid by the original due date will bear interest at the statutory rate, and a penalty of 1% or 5% per month,

up to a maximum of 25%. Returns filed after the due date without an authorized extension are subject to a late filing fee. The

interest rate is set annually by the Commissioner of Taxes under 32 V.S.A. § 3108.

Mail to:

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

For Department Use Only Form BA-403

Ck. Amt. Init. Page 1 of 1

5454 Rev. 10/23