Enlarge image

Clear ALL fields

Vermont Department of Taxes

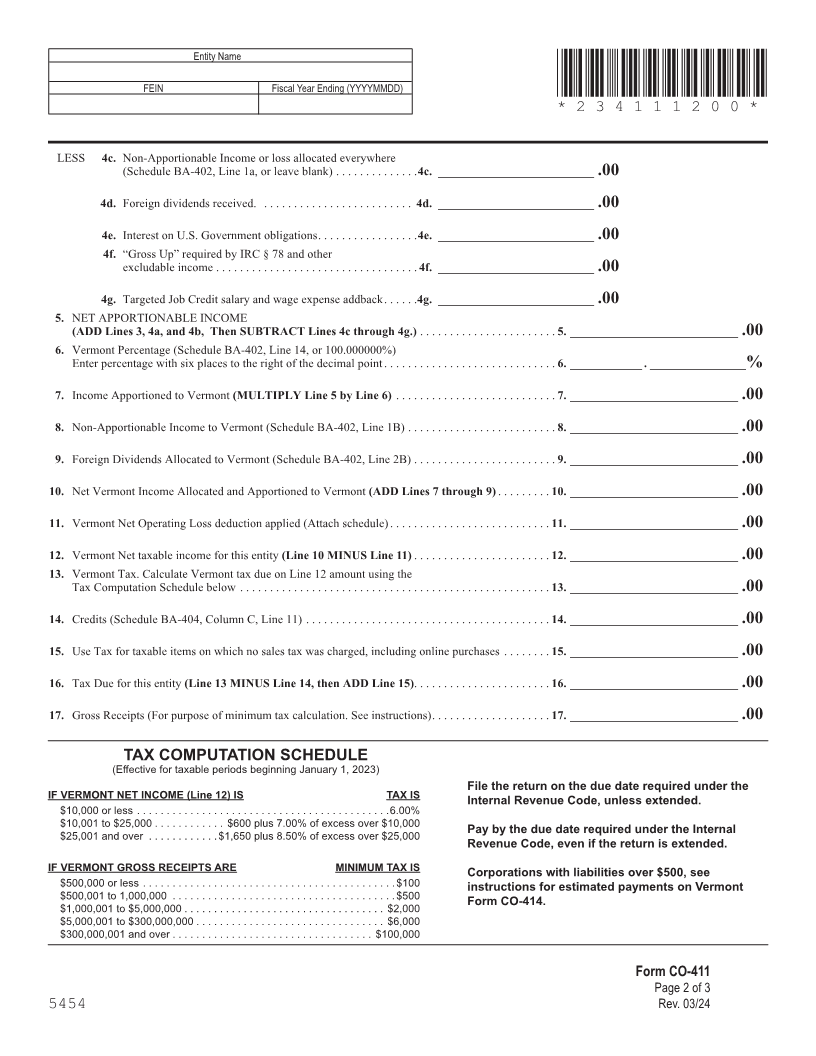

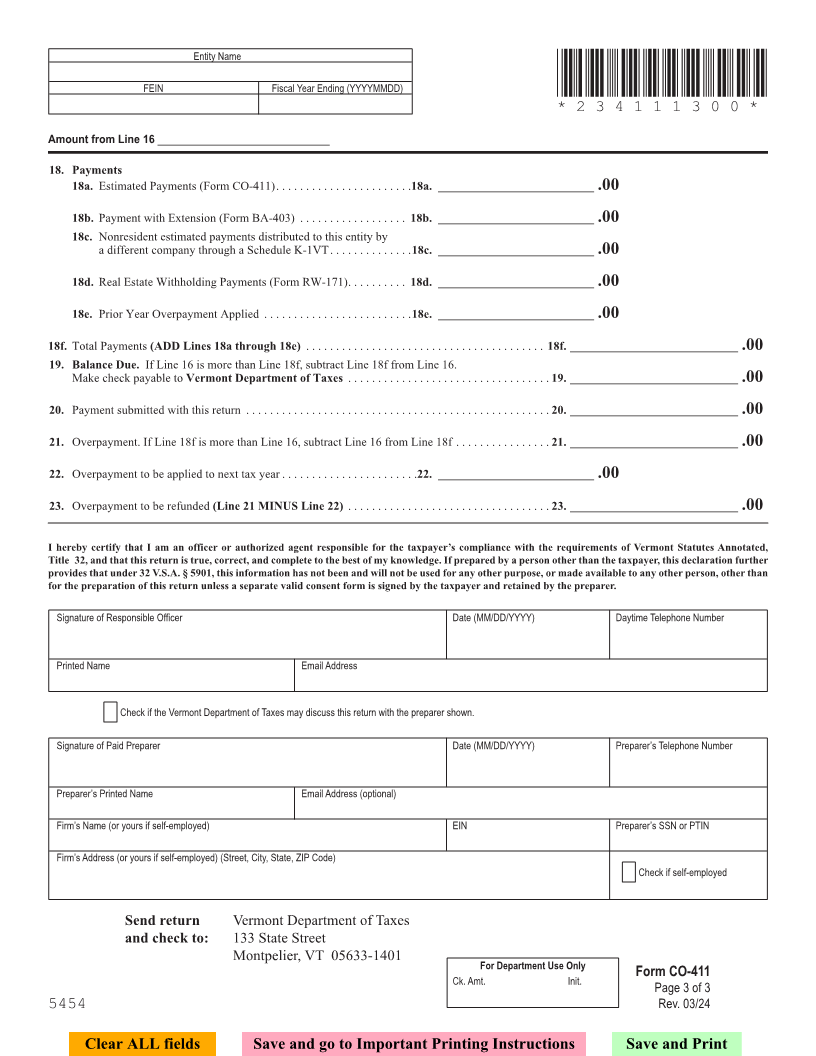

Form CO-411 *234111100*

Vermont Corporate Income Tax Return *234111100*

Page 17

Name Accounting Extended Unitary PL 86-272 is

Check Change Period Change Return Applicable

Appropriate

Box(es) Address Amended Federal Extension RAR Pro Forma - Final Return

Change Return Requested Amended Cannabis (Cancels Account)

Entity Name (Principal Vermont Corporation) FEIN Primary 6-digit NAICS number

Address Tax year BEGIN date (YYYYMMDD) Tax year END date (YYYYMMDD)

Address (Line 2) Number of companies in Number of companies

Vermont Unitary Group with Vermont Nexus

City State ZIP Code

Federal tax 1120 1120-F 990-T

Foreign Country return filed

(Check one box)

1120-H Other

FORM (Place at FIRST page)

Enter all amounts in whole dollars. Form pages

1. FEDERAL TAXABLE INCOME (federal Form 1120, Line 28, as filed) . . . . . . . . . . . . . . . . . . . . . . . 1. ____________________________ .00

1a. Special Deductions as filed with IRS

(federal Form 1120, Line 29b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1a. __________________________ .00

1b. Income/Loss from unitary members included in

Vermont combined group . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b. __________________________ .00 17 - 19

1c. Income/Loss from affiliated entities filed in the above federal

consolidated returns but excluded from Vermont combined group . 1c. __________________________ .00

1d. Special Deductions: Vermont adjustments to federal

special deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1d. __________________________ .00

1e. Eliminations: Vermont adjustments to federal eliminations . . . . . . 1e. __________________________ .00

1f. Other: Other Vermont adjustments to Combined Net Income

(charitable expenses, etc .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1f. __________________________ .00

1g. Federal Taxable Income as Adjusted for Combined Net Income (ADD Lines 1 through 1f) . . . . . . 1g. ____________________________ .00

2. Bonus Depreciation Adjustment (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. ____________________________ .00

3. Federal Taxable Income as Adjusted for Combined Net Income and Bonus Depreciation

(ADD Lines 1g and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ____________________________ .00

4. ADD 4a. Interest on non-Vermont state and local obligations . . . . . . . .4a. __________________________ .00

4b. State and local income or franchise taxes . . . . . . . . . . . . . . . 4b. __________________________ .00

Check box if exception SMALL FARM CORPORATION NO VERMONT ACTIVITY HOMEOWNER’S / CONDO ASSOC.

($75 minimum) ($0) (Federal Form 1120-H only) ($0)

to minimum tax applies:

Form CO-411

Page 1 of 3

5454 Rev. 03/24