Enlarge image

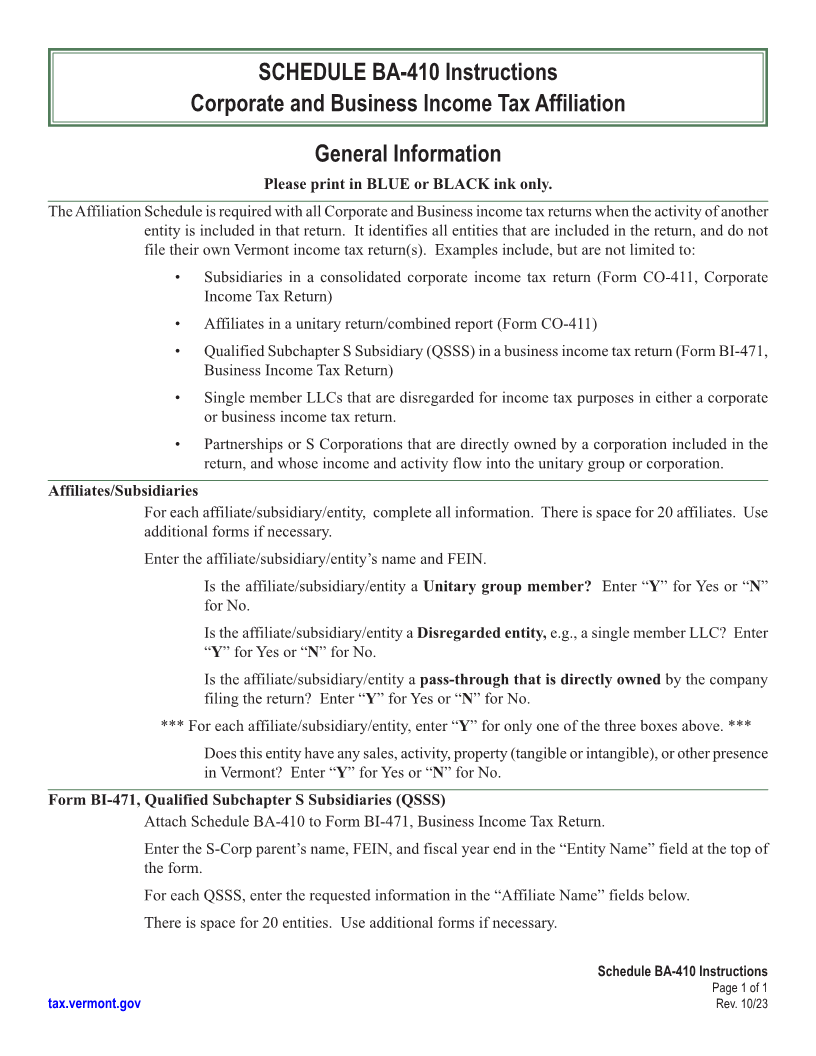

SCHEDULE BA-410 Instructions

Corporate and Business Income Tax Affiliation

Page 1

General Information

Please print in BLUE or BLACK ink only.

The Affiliation Schedule is required with all Corporate and Business income tax returns when the activity of another

entity is included in that return. It identifies all entities that are included in the return, and do not

file their own Vermont income tax return(s). Examples include, but are not limited to:

• Subsidiaries in a consolidated corporate income tax return (Form CO-411, Corporate

Income Tax Return)

• Affiliates in a unitary return/combined report (Form CO-411)

• Qualified Subchapter S Subsidiary (QSSS) in a business income tax return (Form BI-471,

Business Income Tax Return)

INSTR (Place at FIRST page)

• Single member LLCs that are disregarded for income tax purposes in either a corporate

Instr. pages

or business income tax return.

• Partnerships or S Corporations that are directly owned by a corporation included in the

return, and whose income and activity flow into the unitary group or corporation.

Affiliates/Subsidiaries 1 - 1

For each affiliate/subsidiary/entity, complete all information. There is space for 20 affiliates. Use

additional forms if necessary.

Enter the affiliate/subsidiary/entity’s name and FEIN.

Is the affiliate/subsidiary/entity a Unitary group member? Enter “Y” for Yes or “ ”N

for No.

Is the affiliate/subsidiary/entity a Disregarded entity, e.g., a single member LLC? Enter

“Y” for Yes or “ ”Nfor No.

Is the affiliate/subsidiary/entity a pass-through that is directly owned by the company

filing the return? Enter “Y” for Yes or “ ”Nfor No.

*** For each affiliate/subsidiary/entity, enter “Y” for only one of the three boxes above. ***

Does this entity have any sales, activity, property (tangible or intangible), or other presence

in Vermont? Enter “Y” for Yes or “N” for No.

Form BI-471, Qualified Subchapter S Subsidiaries (QSSS)

Attach Schedule BA-410 to Form BI-471, Business Income Tax Return.

Enter the S-Corp parent’s name, FEIN, and fiscal year end in the “Entity Name” field at the top of

INSTR (Place at LAST page)

the form.

Instr. pages

For each QSSS, enter the requested information in the “Affiliate Name” fields below.

There is space for 20 entities. Use additional forms if necessary.

1 - 1

Schedule BA-410 Instructions

Page 1 of 1

tax.vermont.gov Rev. 10/23